[ad_1]

|

Russian President Vladimir Putin delivers his annual address to the Federal Assembly on April 21, 2021, in Moscow. Days earlier, the U.S. government issued sanctions limiting financial transactions with Russian banks and expelling Russian diplomats from the U.S. |

The Russian metals sector may be a target for future U.S. sanctions if President Vladimir Putin escalates a growing battle with the West through military action, former U.S. government officials told S&P Global Market Intelligence.

The Biden administration on April 15 expelled 10 Russian diplomats from the U.S. and banned U.S. banks from buying sovereign bonds issued by Russian institutions, part of a swath of sanctions in response to Russia’s attempts to influence the 2020 U.S. presidential election, its decision to gather troops on its border with Ukraine, and an alleged global cyber espionage campaign.

Following the sanctions, Russia declared it would pull troops back from the Ukraine border and attended a global summit on climate change hosted by the White House. Afterward, Russia sent warships to the Black Sea for a military maneuver and said sections of the area would be temporarily closed to foreign warships.

“Russia is likely to remain a disruptive power for much or all of the next two decades even as its material capabilities decline relative to other major players,” according to a report the U.S. Office of the Director of National Intelligence release in April. Among Russia’s advantages on the world stage, the report noted its energy and mineral resources.

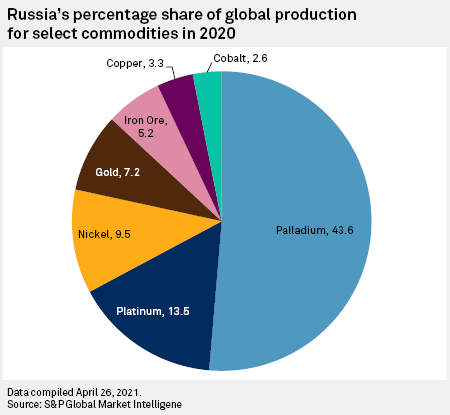

If tensions should escalate to military conflict between the two nations, experts said Russian mining companies could be one of the first subjects of new U.S. sanctions. Russia is the world’s leading source for diamonds and a leading exporter of battery metals, gold, steel, coal and other minerals.

|

|

“It’s the next largest sector that has yet to be targeted with sanctions,” Brian O’Toole, a former senior Treasury official under the Obama administration, said in an interview.

O’Toole believes that the likeliest targets for sanctions would be the diamond giant PJSC Alrosa, one of the largest diamond producers in the world, and steelmaker Evraz PLC. Putin appointed the former head of the Kremlin state intelligence hub, Sergey Ivanov Jr., as head of Alrosa in 2017. Evraz is partially owned by Roman Abramovich, a wealthy Russian magnate who has denied he has close ties to Putin.

The last major attempt to penalize a Russian miner came under the Trump administration in 2018, when the U.S. sanctioned United Co. RUSAL International PJSC and En+ Group International public joint-stock company over their ties to Russian billionaire Oleg Deripaska. Those sanctions were lifted after both entities agreed to corporate restructuring and Deripaska reportedly sold his ownership in them.

the U.S. also faced pressure to lift the sanctions on Rusal and En+ due to the ways each miner is integrated into global supply chains, Heather Conley, a former State Department official under the Bush administration, told S&P Global Market Intelligence. Conley said the experience taught government staff supervising the sanctions about the “oligarchic tentacles” of major Russian industries such as mining and may have created “some hesitancy for future sanctions against individual targets that end up unwittingly causing some ripple effects on the global markets.”

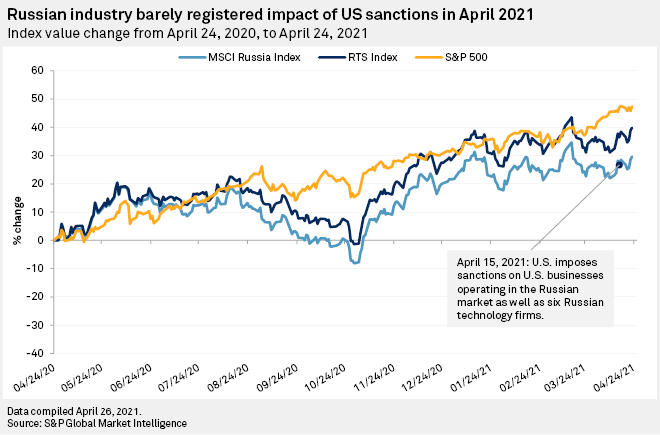

However, if tensions escalate further through actions by the Russian military, then energy, minerals and financial markets will likely be the next targets. The sanctions issued by the Biden administration did little to move market indexes indicative of Russian economic performance, such as the MSCI Russia Index.

“We are now at a threshold where further sanctions mean we are going after key sectors of the Russian economy or the Russian financial sector. The next steps are pretty punishing,” Conley said.

O’Toole said the Biden administration is probably considering the supply chain impacts of penalizing Russian miners, especially given their supply relationships with electric vehicle manufacturers key to the global energy transition.

“I think it’s a bit of a new calculation. The Trump administration probably wouldn’t have cared, [but] John Kerry, the White House climate czar, sits on the National Security Council,” O’Toole said. “That doesn’t mean [the concerns] are going to win out. It just means they are understood and thought through.”

[ad_2]