[ad_1]

- XRP price on pace to gain 30% in March, despite broader market weakness.

- Tranglo deal strengthens growing footprint in Southeast Asia.

- Ascending trendline continues to limit downside volatility.

XRP price chart is a colorful reminder of the perils associated with trading a cryptocurrency amid a legal stand-off with the Securities and Exchange Commission (SEC). Despite the incomparable headline volatility, technical traders need to be mindful that Ripple is on pace to close March with a 30% gain and is only a few percent away from the critically important $0.600 level.

XRP price may need a catalyst to overcome heavy resistance

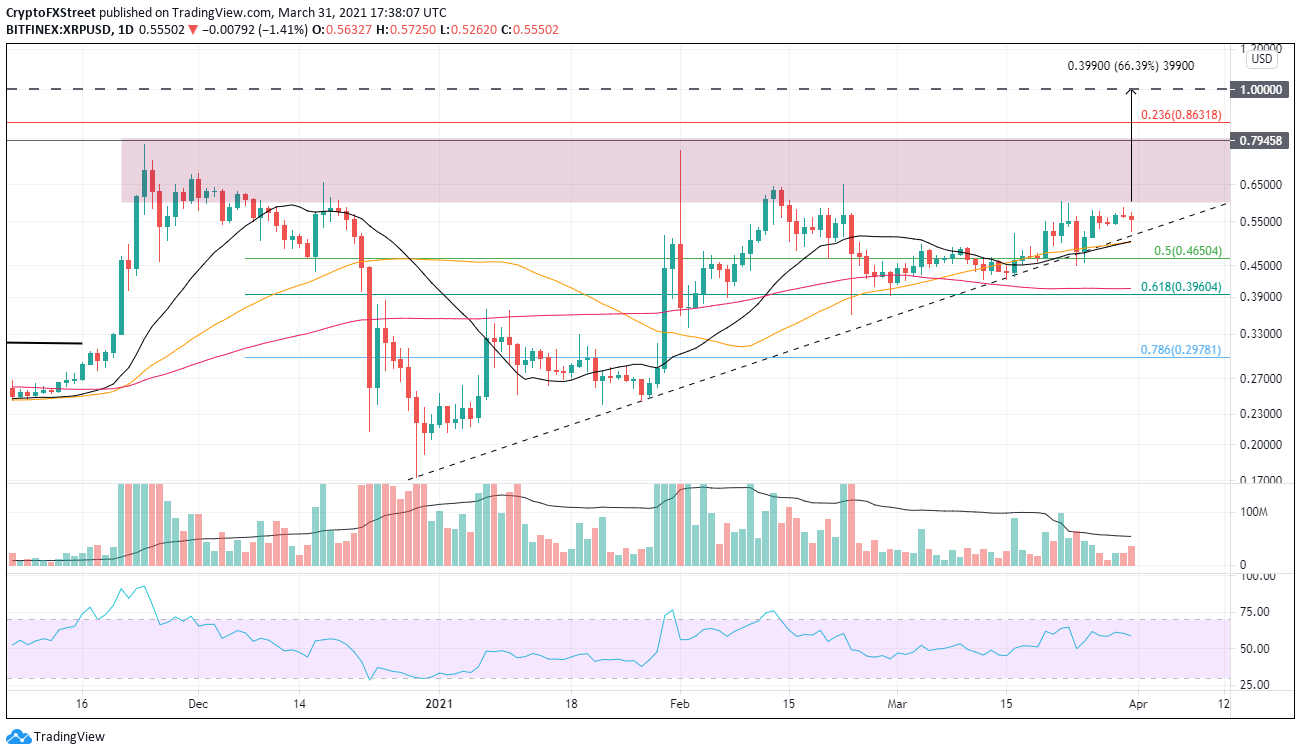

A series of wicks in the price range between $0.600-$0.800 are standing in front of a new retracement high for the 2018-2020 bear market. It has been a brutal resistance level that may require a significant catalyst to finally drive Ripple above the top of the range.

As mentioned above, Ripple needs to puncture the $0.600 price level on a weekly close before traders can turn their sights on much higher prices. Next, the digital token needs to close above the $0.800 level on a weekly basis, which is slightly above November 2020 high at $0.780.

If traders are successful in breaking through, attention will shift to the 0.236 Fibonacci retracement level at $0.863, followed by the psychologically important $1.000 level, which would yield a gain of 66%.

XRP/USD daily chart

A resumption of bearish legal news may target XRP price support at the union of the 21-day and 50-day SMAs at $0.500. Still, the legitimate support is at the 0.618 Fibonacci retracement level of the early 2021 advance at $0.396. Lower support levels include the February 23 low at $0.361 and the 0.786 retracement level at $0.298.

For now, traders are focusing on the bullish Ripple expansion outside of the United States, which should bode well for XRP price in the coming weeks.

[ad_2]