[ad_1]

Brad Garlinghouse, the CEO of Ripple, appears to have reeled in some of his criticism of bitcoin (BTC) after a backlash on social media, while Ripple itself last week scored a legal victory of sorts.

As reported last week, the Ripple chief, who is currently fighting a battle with the American regulatory Securities and Exchange Commission (SEC) over the nature of the Ripple-affiliated XRP token, took aim at BTC’s energy credentials.

Last week, he opined that BTC was “not ideal as a payments mechanism” due to its high energy usage – while the Ripple Chief Technology Officer claimed that BTC’s Proof-of-Work consensus mechanism had been touted as a “secret sauce” but showed “cracks” right from its inception.

However, in a series of tweets, Garlinghouse conceded that he had “hit a nerve” and clarified that he was not in favor of a “ban” on BTC. Instead, he added that “we, collectively, can and should understand Proof-of-Work’s carbon footprint.”

He also posted his sources for his calculations on BTC’s energy usage and ended with a call-to-arms and final plea to the BTC community, writing,

“We have the tools to make crypto 100% renewable and reach its full potential. Let’s focus on the solutions to change the opinion of [US Treasury Secretary] Janet Yellen, Bill Gates, and countless others who have pointed out concerns about energy usage instead of accusing me of [spreading] FUD [fear, uncertainty, and doubt].”

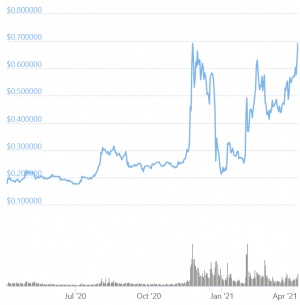

Garlinghouse was tweeting as XRP prices surged once again, peaking at just over USD 0.7 in the early hours of Monday morning (UTC). At the time of writing (08:13 UTC), XRP trades at USD 0.69 and is up by 17% in a day and 26% in a week.

XRP price chart:

On an XRP forum, token advocates welcomed the “return of the 70s” and price highs not seen since 2018 – although the token did experience a period of sudden growth in November last year.

“I believe when we break through USD 0.80 (hopefully in the coming weeks) then we will really see some fireworks. If that breakthrough is accompanied by some positive news in the SEC case (summary judgment on the current XRP status, relisting, settlement etc) then it is the perfect setup. […] Until then I will just hodl and wait,” one commenter wrote.

XRP reached its all-time high of USD 3.40 in January of 2018.

Ripple last week scored a legal victory of sorts, with a judge in New York agreeing to redact the contents of an email exchange between Garlinghouse and an unnamed individual about Ripple’s venture capital operations, as well as two unnamed parties debating how XRP is conceived by the general public – per Tweets released by the company’s lawyers.

Ripple had hoped to force redactions of two further emails, one of which reveals financial data about the Ripple co-founder Chris Larsen. The other is an exchange with private investors. The SEC is determined to ensure that these two documents be allowed as evidence in the trial.

The token’s recent surge upwards has taken it far beyond the levels it was trading at prior to the SEC’s intervention back in December 2020, when – in its own words – it stated that it was “alleging that [Ripple’s chiefs] raised over USD 1.3bn through an unregistered, ongoing digital asset securities offering.”

____

Learn more:

– Ripple Goes For M&A in Asia Amid Legal Battle In US

– Unconfirmed Report From Court Hearing May Have Sparked XRP Rally

– SEC Lists 3 Reasons for Seeking Ripple Execs’ Financial Info on XRP Deals

– Fact-checking Ripple’s Claim that ‘Many G20 Gov’ts’ Call XRP a ‘Currency’

[ad_2]