[ad_1]

- Bitcoin price favors bulls reaching $60,000 by the end of this week and onwards to new all-time highs by the end of next week.

- Ethereum price broke a bearish top line and could hit new all-time highs by next week in tandem with Bitcoin.

- Ripple price sees puzzled bulls not knowing what to do. A break below $1 could help.

Bitcoin price jumped this week after a shift in sentiment on Thursday when global equities went back in the green and investors favored riskier assets like cryptocurrencies. Ethereum and Bitcoin broke through a few critical bearish elements, while XRP seems not to be enjoying the favorable tailwind in global markets.

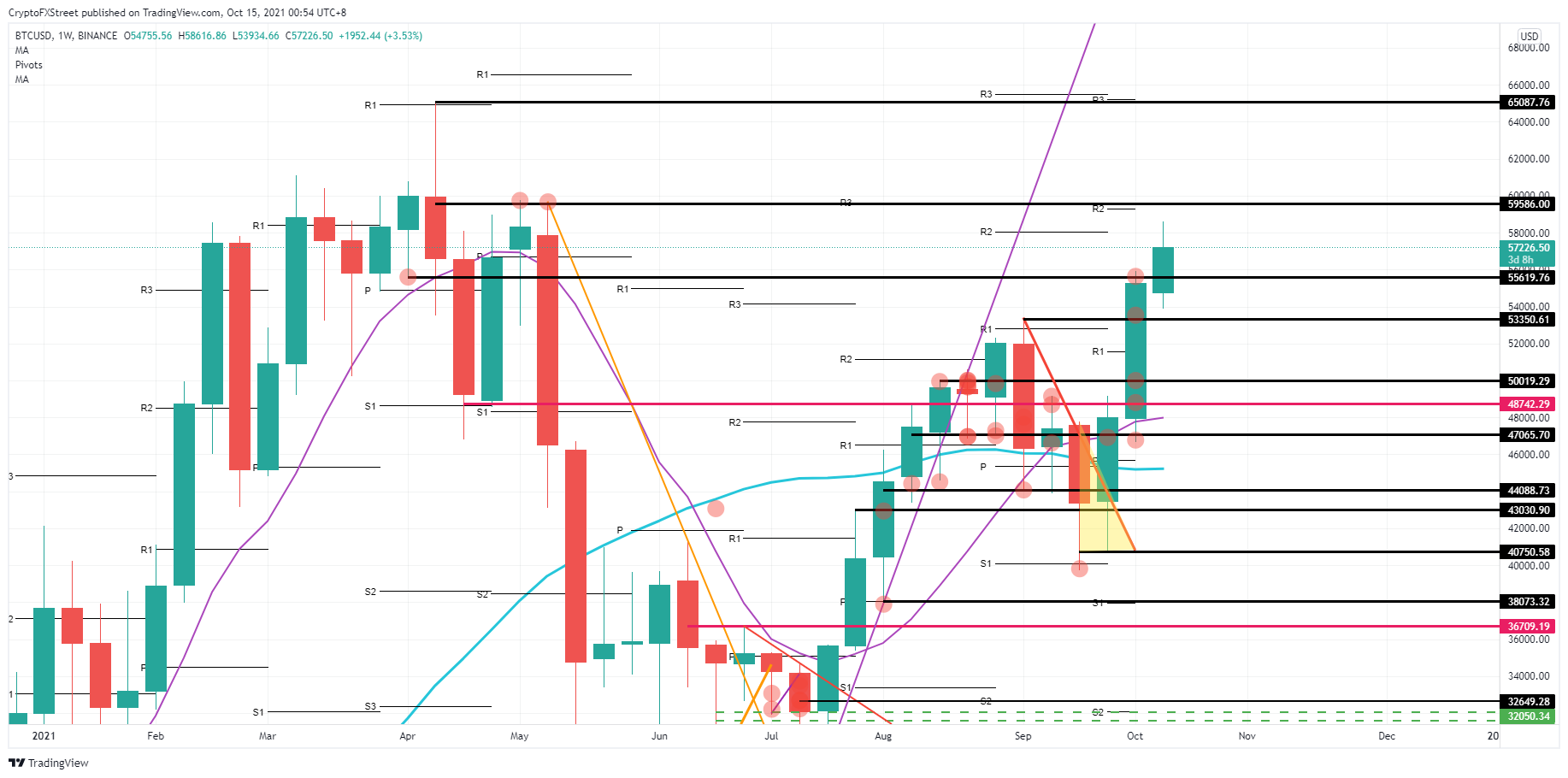

Bitcoin price targets $60,000, but the fundamental objective for bulls is new all-time highs

Bitcoin (BTC) price rose another 9% after the bulls pushed BTC prices up 38% in the past two weeks. This week, some profit-taking occurred in the wake of the $60,000 marker as Bitcoin faced some headwinds with markets on the back foot and global sentiment tilting to risk-off. With sentiment switching 180 degrees on Thursday on stock markets adding gains once more, major cryptocurrencies are seeing a favorable tailwind reemerging that could push Bitcoin price to $60,000 by the end of the week.

Bitcoin price bulls were able to defend $54,000 and keep any profit-taking as limited as possible. With reclaiming $55,619, a weekly close above would spell more uptrend for Bitcoin price action. This would add more buyers into the rally and make the momentum build-up necessary for a pop higher above $60,000.

When Bitcoin price is above that $60,000, expect the monthly R2 resistance level to give some support. That monthly R2 comes in just below $60,000. On the retest of that area, BTC should see new interest and buying volume as headlines will make the news that BTC price has broken $60,000 to the upside, which should add more positive tailwinds to the bull run. If the tailwinds keep prevailing, expect possible new all-time highs above $65,087 by the end of next week.

BTC/USD weekly chart

When market sentiment would turn back into a headwind and global risk sentiment is on the back foot, expect bears to reverse the gains made from this week with a possible retest of $53,350. Should market sentiment turn even further to risk-off, with several consecutive down days in the US equity indices, expect bears in Bitcoin to push price back toward $50,000.

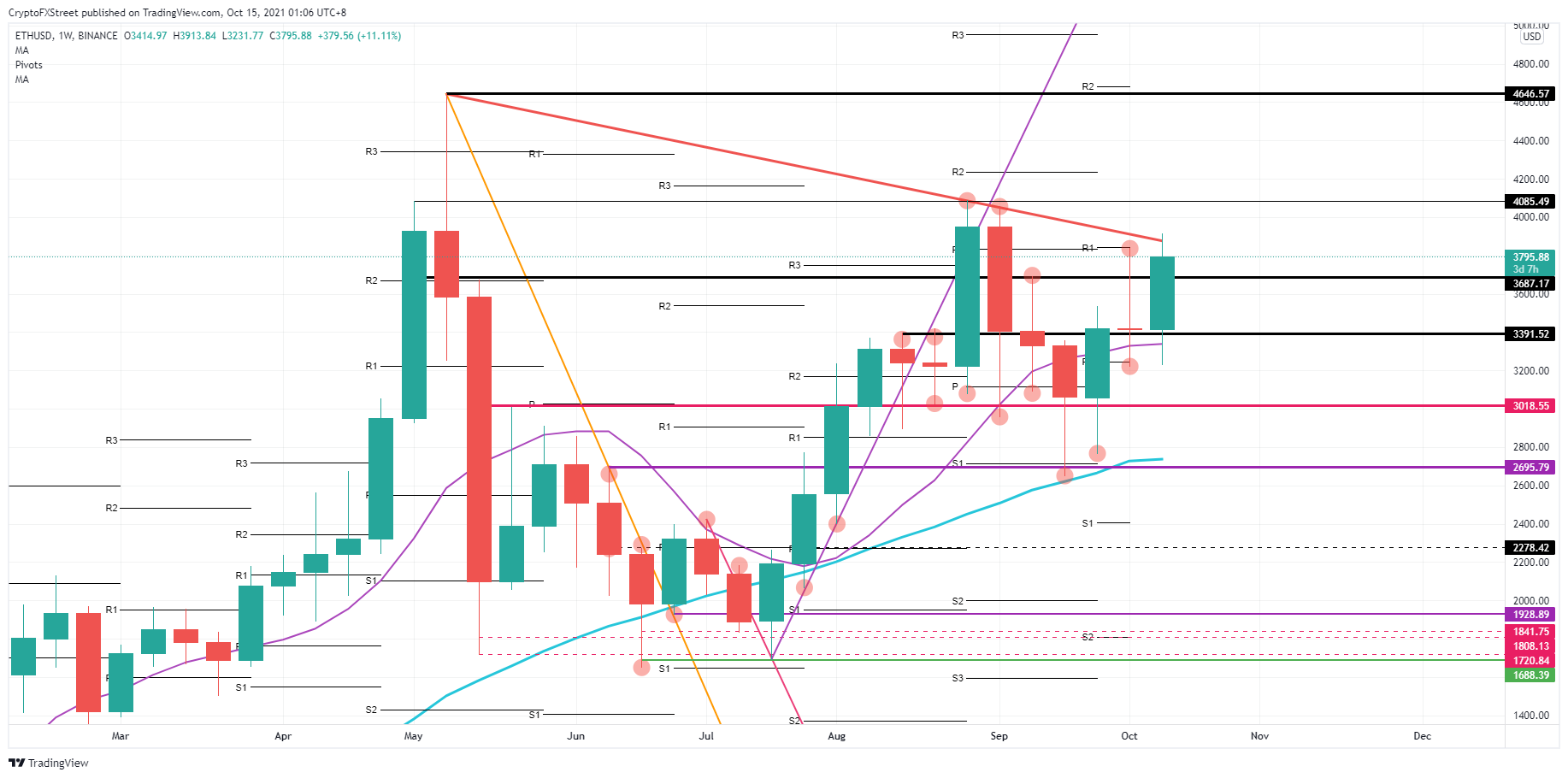

Ethereum price sees bulls breaking the bearish top line and hitting new all-time highs

Ethereum (ETH) was a bit of a puzzle last week, with both bulls and bears being served on the wide range of the price action in ETH. This week proved to be more favorable for the bulls, with a squeeze and break against the top line originating from May 10 and has kept ETH price to the downside ever since. With that break above, it will be essential to see a weekly close above the descending top line to attract more buyers into the rally and match the profit-taking with new volume.

Expect next week that bulls will want to defend $3,687 first and take it from there to make a jump toward new all-time highs. At the same time, Bitcoin price will be doing the same, which will cause a spillover effect into ETH, with more buyers coming in at any entry to profit from the certainty that new all-time highs will be just around the corner in Ethereum price. So expect both Bitcoin and Ethereum to rally in tandem to new all-time highs.

ETH/USD weekly chart

This all is based on the fact that favorable tailwinds in global market sentiment and the media attention for Bitcoin will pick up and cause a spillover effect in ETH price. Should global market sentiment start to turn over and be on the back foot, expect a false break on the red descending top line, forming a bull trap and possibly squeezing bulls back toward $3.018. From there, not much in the way to nosedive further toward $2.741, where the 200-day Simple Moving Average (SMA) will give support as it has already done on previous occasions.

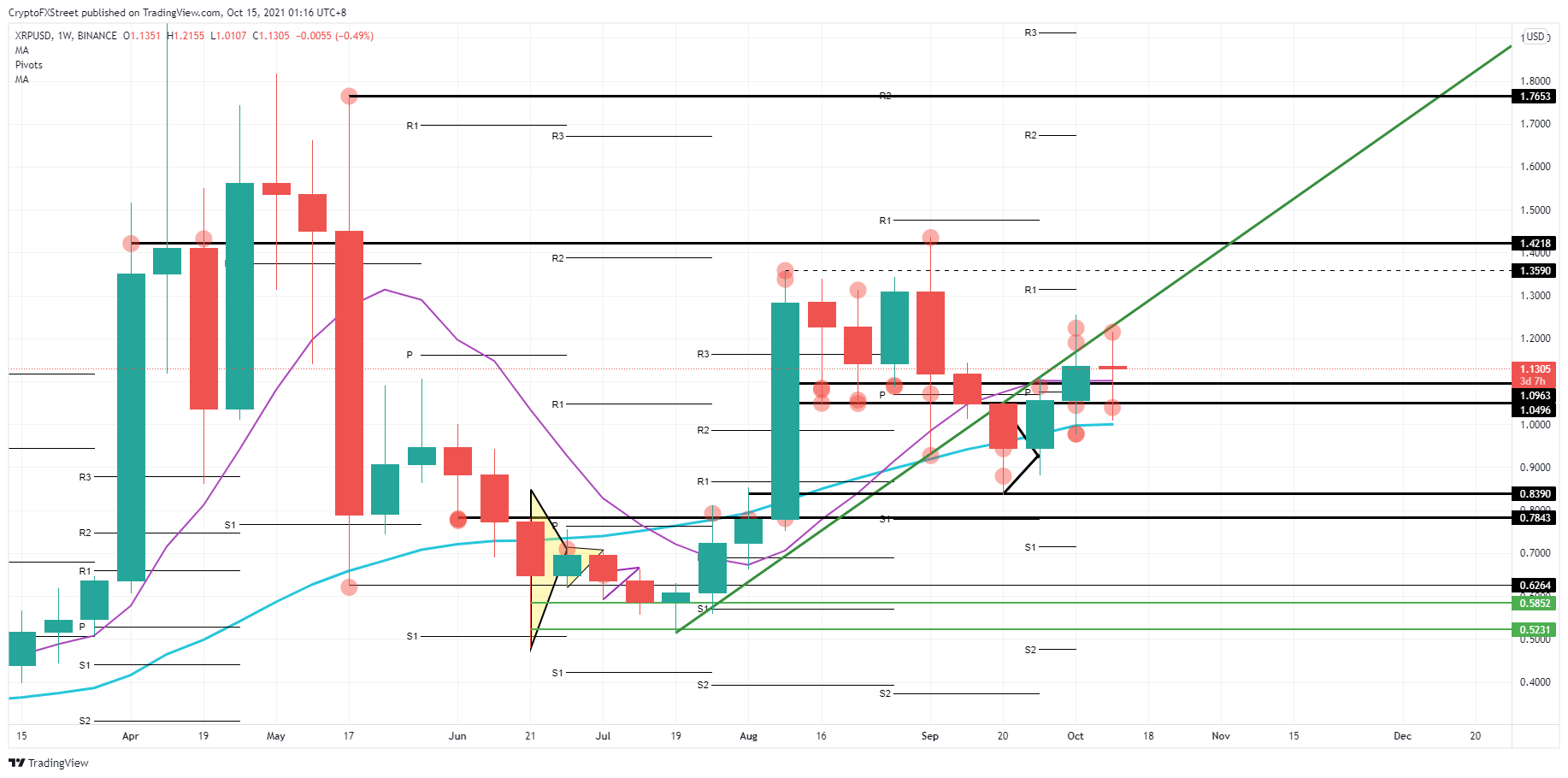

Ripple price looks to be without bulls for the moment as price consolidates

This week, Ripple (XRP) price was rejected to the upside against the green ascending trend line, trapping bulls that got in on the break above last week. Probably bulls were more than happy to take the small losses and did not want to wait for some possible upside return. With that, bears got a free ride to push price-action back below toward $1. The 200-day SMA looks to be too strong for them to crack for now.

As XRP price is just smack in the middle of the weekly price range, it shows that bulls are losing confidence in XRP and do not want to engage unless it is worth the wild ride. That only comes at a discount. A break below the 200-day SMA this week would offer bears more room to the downside toward $0.84 and $0.80.

XRP/USD weekly chart

If bears can push price action that low, expect bulls to happily start with a fade-in trade between $0.80 and $0.84. That will offer bulls their wanted discount in XRP price and will quickly push price action back toward $1.42. Should market sentiment continue to allow further risk and if Bitcoin hits new all-time highs next week, expect XRP to be lifted by these favorable tailwinds. New all-time highs might be a bit far-fetched, but $1.76 should be in the cards.

[ad_2]