[ad_1]

America and Russia, two old Cold War-era Space Race opponents, are leading our northern hemisphere hump-day crypto news roundup. “The moon” is not much closer for Bitcoin and the hopium-fuelled crypto market just yet, however.

It’s now about five months since China began its heavy crackdowns on crypto mining (before the recent outright crypto ban). In that time, there’s been a reasonably swift exodus of miners, mining rigs and a crapload of cords and wires from the East Asian powerhouse.

And the ultimate beneficiary? American Bitcoin miners, it seems. Although Kazakhstan was doing okay out of it all, last we checked, too.

Mission accomplished. https://t.co/2saFZv6hFT

— The Wolf Of All Streets (@scottmelker) October 13, 2021

New data, published this week by the UK’s Cambridge Centre for Alternative Finance shows that the US has now surpassed China for the largest share of the world’s bitcoin mining, with 35.4 per cent of the global hash rate as per the end of August.

The US is followed by Kazakhstan (18%), Russia (11%), Canada (9.6%) and, somewhat surprisingly, Ireland (4.7%) on this global hash-rate share list.

Wowsers that happened fast! #bitcoin https://t.co/lyu8H7TlxC

— Lark Davis (@TheCryptoLark) October 13, 2021

“US overtakes China as biggest bitcoin mining hub after Beijing ban” https://t.co/N96NqylbLJ pic.twitter.com/rsSyjBeip3

— Mike DAOdas (@mdudas) October 13, 2021

China has historically accounted for as much as three-quarters of the Bitcoin mining power, thanks to low electricity costs.

But, as reported by Cointelegraph, North American crypto mining firms, such as Argo Blockchain, Riot Blockchain and Marathon, have been significantly adding to their hardware capacity in recent months. And more crypto mining companies are also reportedly seeking to publicly list on US stock exchange markets.

‘Not banning’: Russian deputy finance minister

Despite some unofficial rumours and rumblings it might, Russia’s government is not planning to put a cap in crypto’s ass, a la China, any time soon.

The eastern nation’s deputy finance minister, Alexey Moiseev, confirmed that the Russian Federation has no intent to impose a total crypto ban.

It’s not all CryptoPunks, Bored Apes and lightning-fast cross-border payments in Moscow, however. Cryptocurrencies are currently prohibited as a payment method within the borders of Russia, and will remain that way for the forseeable.

According to a local report slightly lost in Google’s translation AI, the Russian finance minister said: “At the same time, citizens can buy and use wallets outside the Russian Federation. So it will remain so, I think. There are no plans yet [to change this]”.

Moiseev believes that if his government allowed crypto payments within Russian borders, it could mean a “loss of control behind the money supply”.

Also making crypto headlines

• Irish-American payments processor giant Stripe is re-entering the crypto market, recruiting a team to “build the future of Web3 payments”.

• VC firm Andreessen Horowitz’s crypto division is actively seeking to guide US policymakers on “do no harm” regulation standards for crypto and Web3.

• The International Monetary Fund (IMF), meanwhile, has called out “cryptoization” (their word) as a threat to the global economy in a new report.

• Galaxy Digital’s Mike Novogratz and Coinbase’s Brian Armstrong have hit back at the latest negativity about Bitcoin from JP Morgan’s Jamie Dimon.

So strange. For a man who has done a brilliant job running a giant bank, his answers around $BTC are sophomoric and he keeps doubling down on them. I pray I stay open minded my whole life. https://t.co/d4rJpUFGKH

— Mike Novogratz (@novogratz) October 11, 2021

Yes, I read it.

And then I wrote it (coding up our own Bitcoin node) to make sure I understood it. https://t.co/yg46xyvkMq

— Brian Armstrong (@brian_armstrong) October 11, 2021

Mooners and shakers

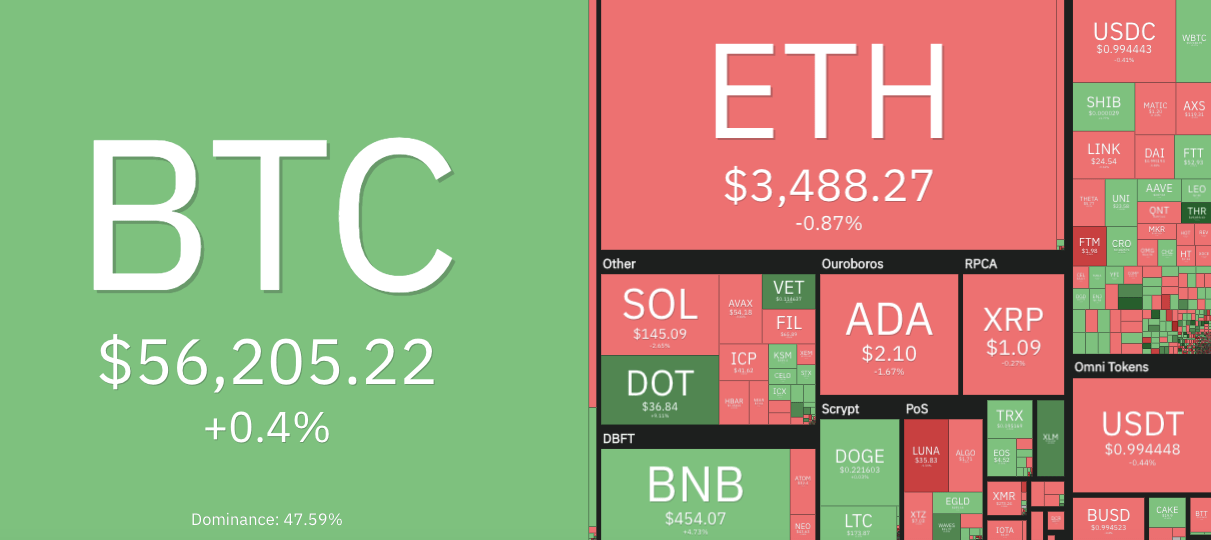

The overall crypto market cap right now stands a shade above US$2.4 trillion at the time of writing, up roughly one percentage point since this time yesterday.

Bitcoin has been trading below US$56K for much of the day, hitting as low as US$54,455. Around press time, though, it’s made a fairly solid move back to the upside, currently changing hands for US$56,205.

Analyst Rekt Capital is seeing a nice BTC rebound from a “higher low” level of support. He wants to ideally see a daily close above US$55,335 to see a good chance of the OG crypto maintaining its highs, and forming a possible bullish continuation from there.

#BTC continues to hold its multi-day Higher Low, despite the volatility$BTC #Crypto #Bitcoin pic.twitter.com/SuLcUO8vgm

— Rekt Capital (@rektcapital) October 13, 2021

Statistics based on human psychology

— MICKrypto Trades | Bitcoin Charts (@MICKrypto) October 13, 2021

Elsewhere in the market, Polkadot (DOT) is the only double-digit percentage gainer in the top 10 (+10.8%) at the time of writing, and is trading a fraction below US$37.

You can put this DOT surge down to buzz beginning to increase about its upcoming parachain auctions…

NEW: The hotly anticipated @Polkadot parachain auction process begins next month, according to a governance proposal submitted today. $DOT@IanAllison123 reportshttps://t.co/DBCKDmDpB5

— CoinDesk (@CoinDesk) October 13, 2021

Parachains are scarce slots (there will ultimately be about 100), that can be considered fully functional and fully customisable blockchains that run alongside the Polkadot main chain.

Polkadot-built projects are busting to get them because the benefits are reportedly greater levels of scalability, flexibility and interoperability, plus, with pre-built models to choose from, more ease when it comes to creating effective governance.

At number 22 on CoinGecko’s market cap list, Stellar (XLM), is also having a very decent day, up 10.85 per cent at press time. The crypto payments/XRP rival is still riding high on this pretty massive recently announced news…

We are in the #big leagues just in time for the #MLB playoffs ⚾️🏟#XLM #Moneygram #Stellar #majorleagues https://t.co/OnkQujc7r3 pic.twitter.com/NEoT9dPhNe

— RockinFREEWorld (@ReachROCKIN) October 13, 2021

[ad_2]