[ad_1]

Cryptocurrencies have had an interesting week, to say the least.

Shortly after El Salvador recognized Bitcoin as legal tender and the SEC threatened to sue Coinbase if it launched a digital lending product, Bitcoin prices tumbled to as low as $42,900. Despite the flash-crash, Bitcoin and other cryptocurrencies remain fascinating to both their evangelists and to outsiders. Everyone from sports figures like Stephen Curry to actors like Gwyneth Paltrow have shown interest in the space.

Today, Bitcoin and cryptocurrencies in general have been rallying. Bitcoin is trading at $47,000, up 2%, and Ethereum is up 1.5%. Dogecoin is up $0.25, with Cardano, Uniswap, Litecoin, Stellar, and other altcoins all seeing gains as well.

So Many Altcoins, So Little Time

For investors new to the space, it can be challenging to parse which altcoins have upside and stand a shot at competing with the sector standard-bearers — namely Bitcoin and Ethereum. Fortunately, there are other investment alternatives besides just tacking on pure exposure to one of hundreds of possible cryptocurrencies.

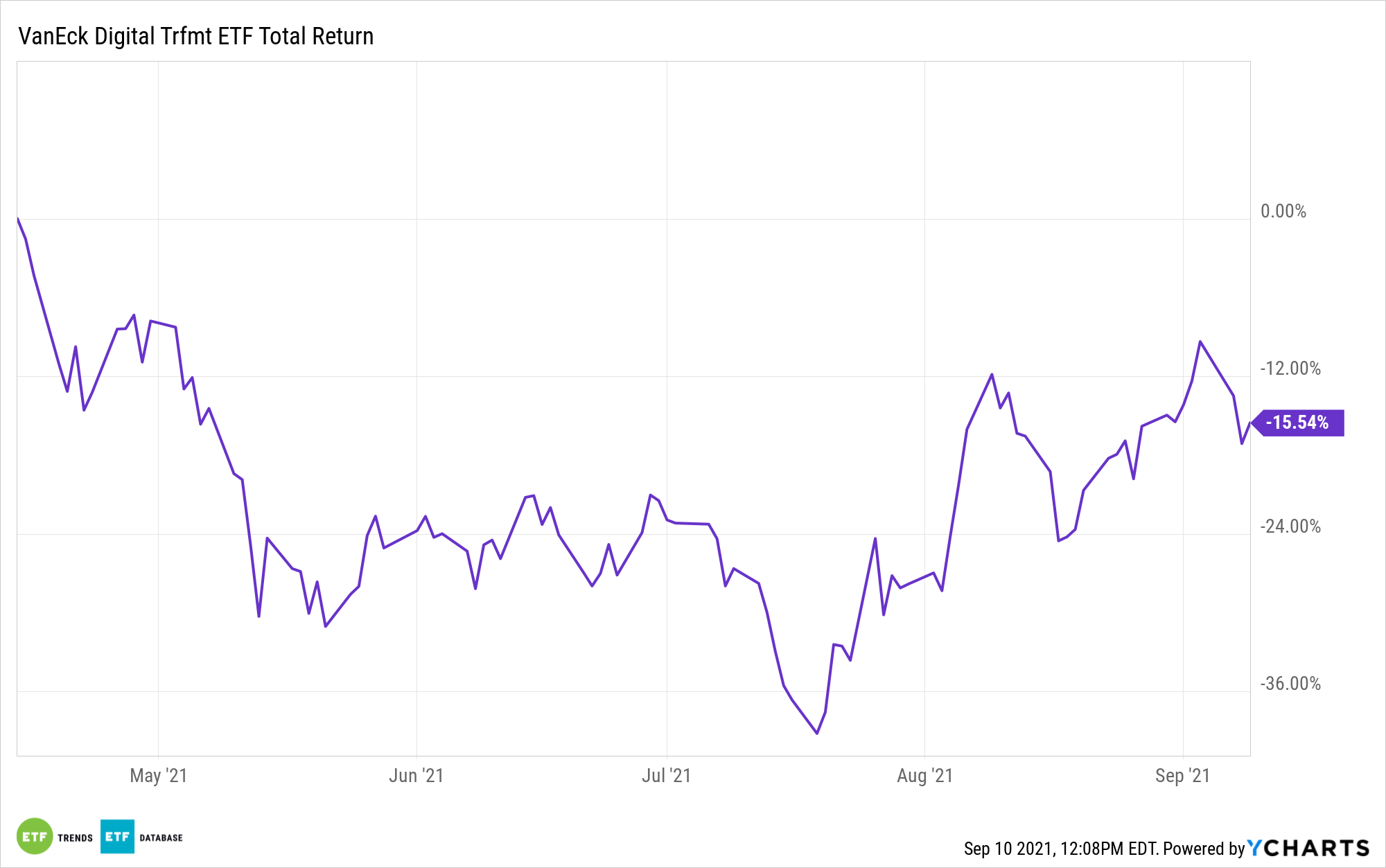

The VanEck Vectors Digital Transformation ETF (DAPP) focuses on companies geared toward digital infrastructure. A lot of digital infrastructure does revolve around cryptocurrency, but many of these companies, such as Square Inc, have utility outside the crypto realm. DAPP focuses on companies that have the potential to earn 50% of their revenue from digital assets. This means that DAPP’s holdings are from companies that benefit from the cryptocurrency space in general but aren’t tethered to the fortunes of any individual currency. Some of their holdings include Marathon Digital Holdings, which aims to build the largest crypto mining operation in North America at the lowest possible energy cost. Coinbase is another key holding, as is Hut8, which quadrupled its Q2 revenue from last year. These are companies that can provide exposure to cryptocurrency without investors needing to own cryptocurrency directly.

DAPP tracks the MVIS Global Digital Assets Equity Index and has an expense ratio of .50%.

For more news, information, and strategy, visit the Crypto Channel.

[ad_2]