[ad_1]

June was a volatile, eventful month for cryptocurrency markets, as China cracked down on its domestic crypto mining industry. Many investors and funds, including the Amplify Transformational Data Sharing ETF (BLOK), took the opportunity to shift their crypto investments, buying direct exposures at reduced prices.

BLOK is an actively managed ETF and the first of its kind to track companies in the blockchain industry.

All the volatility was actually a positive for BLOK, which rebounded 4.04% in June, despite Bitcoin’s price plunge, as the ETF’s active management team took advantage of the volatility to reallocate the portfolio.

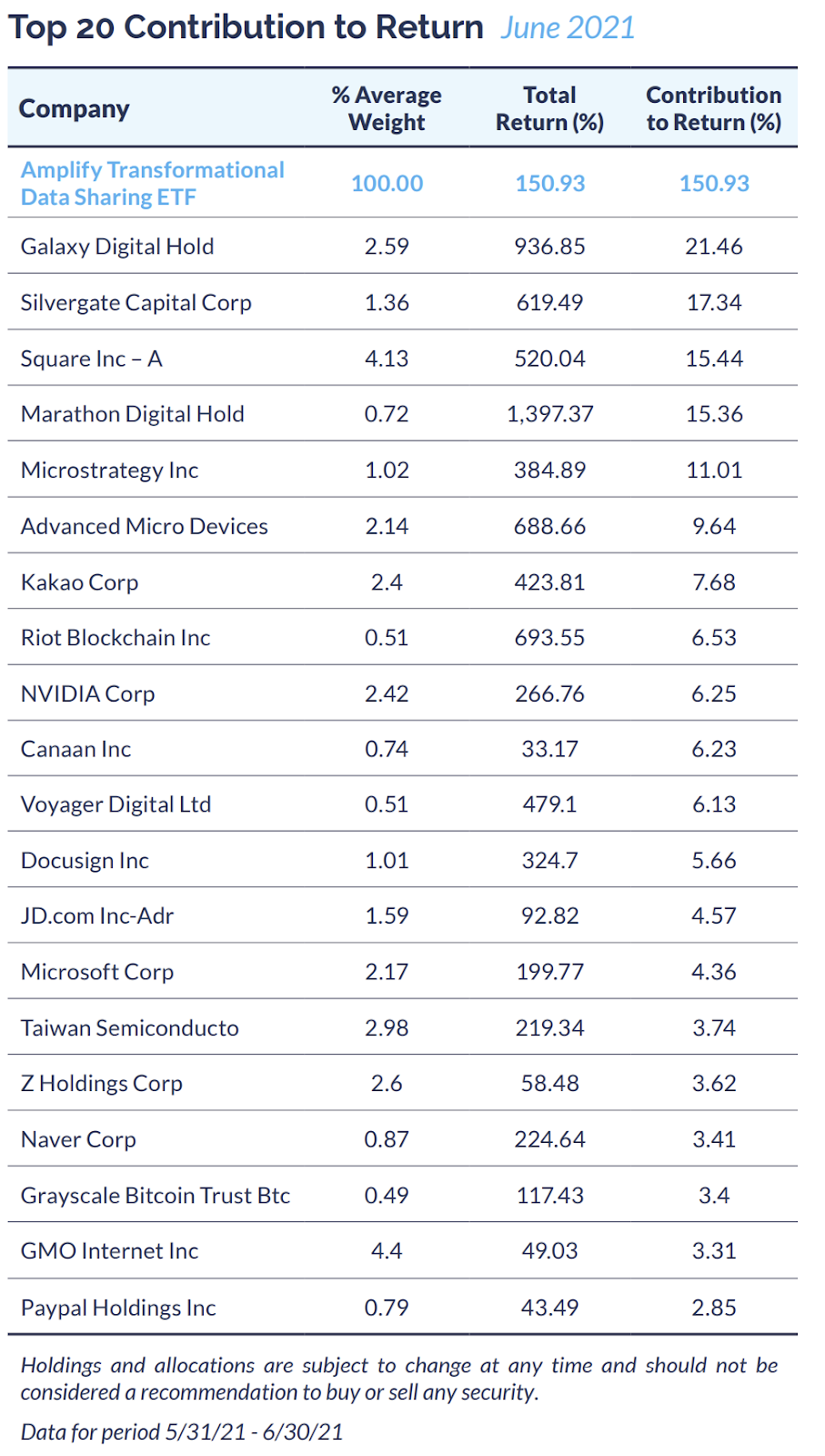

Since inception, the fund is up 150.93%, as of the end of June.

China’s Crackdown Highlights Miners’ Importance

China’s regulatory shutdown of cryptocurrency and Bitcoin mining resulted in a massive drop in crypto mining activity within the country, which had previously been responsible for roughly 65% of Bitcoin processing, according to June’s “The BLOK-Chain Monthly” from Amplify.

As a result, the hash rate (the number of mines actively operating online) plummeted, and Bitcoin prices tanked.

Before the crackdown, it had taken roughly 10 minutes for a new block to be added to the blockchain, but with a large core of the operating power gone from the system, computational times rose up to 20 minutes last month.

The Bitcoin Satoshi algorithm automatically adjusted accordingly on July 3rd to make mining 28% easier in compensation for the missing processing power. It was the largest adjustment in the history of Bitcoin and stands to increase gross margin substantially in the interim as mining operations shift elsewhere.

The Bitcoin Mining Council

The report also provided insight about the Bitcoin Mining Council (BMC), an industry group comprised of independent firms that aim to provide education and information on Bitcoin.

The BMC believes that Bitcoin mining energy usage compared to total global energy usage is minimal, and that Bitcoin mining could even be considered ESG. This is a hotly contested stance, as Bitcoin has made headlines last month for its significant carbon emissions profile.

As the physical locations of crypto mining operations shift, the BMC points out that new locations like the United States are more focused on sustainability.

BLOK Captures the Increasing Interest in Crypto

As Bitcoin prices fell, BLOK took the opportunity to invest in mining and transactional platforms, as the fund’s advisors remain bullish on Bitcoin’s long-term prospects.

Mining provides high profit potential, and the fund increased its exposure to HIVE Blockchain and added BIGG Blockchain. Mining now accounts for 23.46% of the total portfolio.

Currently, BLOK’s top 20 holdings represent 70.83% of the fund’s total assets, as of end of June. The top three holdings contributing to returns Galaxy Digital Holdings, contributing 21.46% of returns; Silvergate Capital Corp (SI), contributing 17.34% of returns; and Square Inc (SQ), contributing 15.44% of returns.

Source: Amplify ETFs

BLOK carries an expense ratio of 0.71%.

For more news, information, and strategy, visit the Crypto Channel.

[ad_2]