[ad_1]

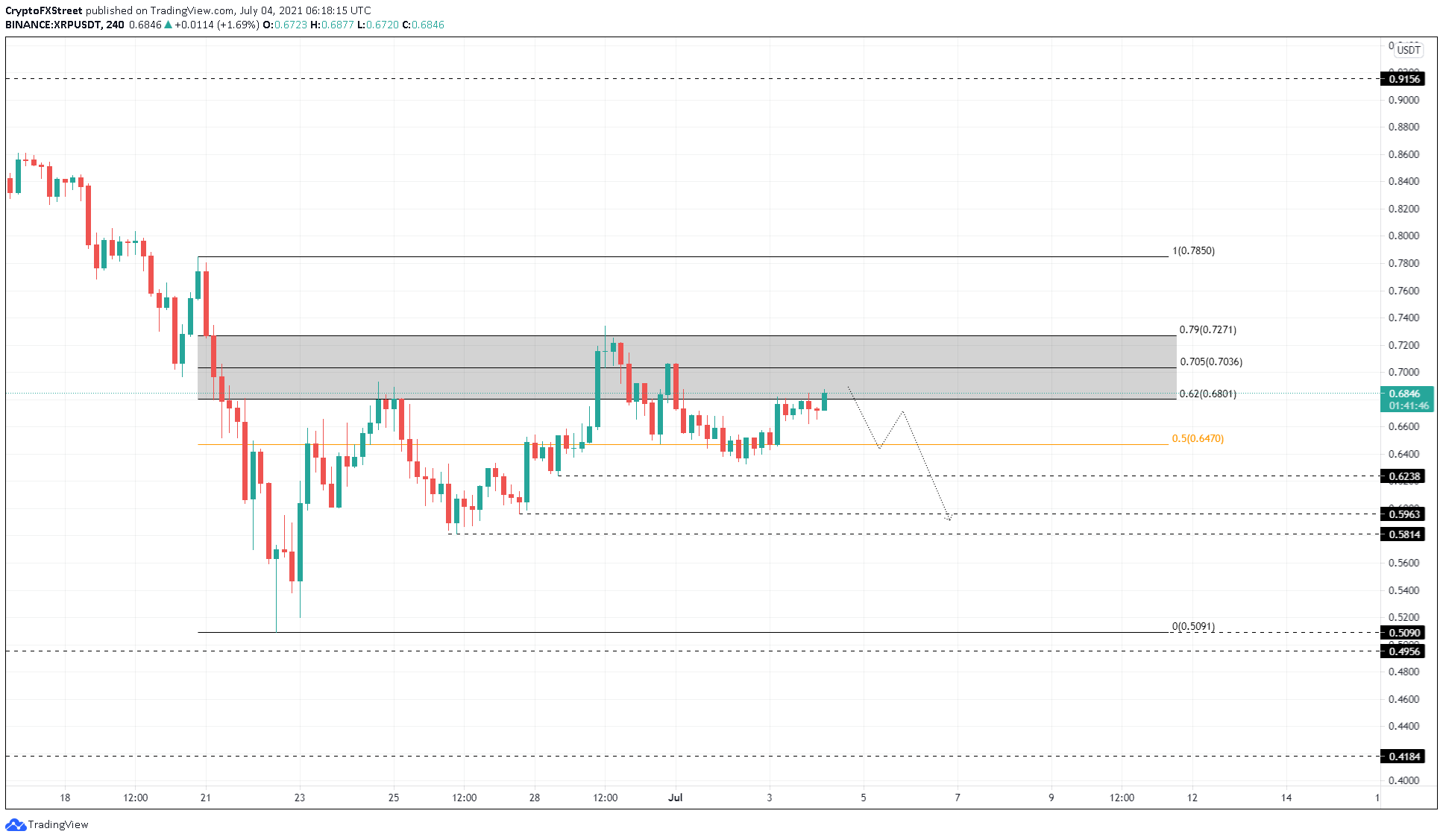

- XRP price continued to rally after consolidating around $0.647, the mid-point of the range

- If the uptrend continues, Ripple might tag 70.5% Fibonacci retracement level at $0.704 before heading lower.

- The bearish thesis might face invalidation if the remittance token produces a decisive 4-hour candlestick close above $0.727.

XRP price has been on a slow uptrend as it ended a consolidation phase and is entering a high probability reversal zone. If the bullish swings continue, Ripple is likely to enter this area and create a local top.

If investors continue to book profit in this area, the reversal might push the remittance token toward the mid-point of the trading range. A breakdown of this barrier will confirm the start of a new downtrend.

XRP price might hit a local top soon

XRP price has rallied 8% since July 2 to where it currently stands, $0.685. This upswing pushed through the 50% Fibonacci retracement level at $0.647.

The bullish momentum will likely continue to hold at the current levels, which will push Ripple to tag the 70.5% or 79% Fibonacci retracement level at $0.704 and $0.727, respectively.

XRP price set up a local top at $0.734 on June 29, so investors can expect a similar local top to be set up.

Such a move will likely result in a downtrend that could push the remittance token down by 11% to the range’s mid-way point at $0.6470. If investors continue to book profits, the support level at $0.624 might be tagged.

XRP/USDT 4-hour chart

On the other hand, if XRP price slices through 79% Fibonacci retracement level at $0.721 and bounces off, it will signal a potential uptrend continuation.

In such a case, the bulls might trigger an 8% rally to retest the range high at $0.785.

[ad_2]