[ad_1]

What’s an investor to do as crypto enters a new stage in 2021? Free fall ?

Highlighted by declines in everything from dogecoin

DOGEUSD,

to Ether

ETHUSD,

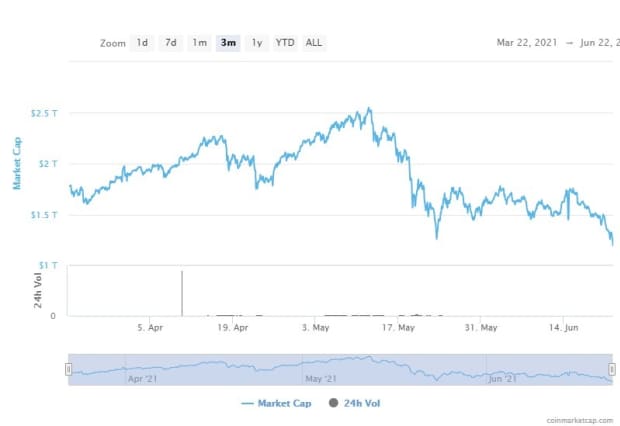

crypto values are collapsing, if not crashing, wiping out more than $1 trillion in value since a peak for the digital-asset complex in May.

CoinMarketCap.com

Indeed, the world’s No. 1 crypto, bitcoin

BTCUSD,

was on the verge of erasing its year-to-date gains on Tuesday, after briefly slipping below a psychologically important level at $30,000. At last check, bitcoin was changing hands at $31,005,61, after hitting a 24-hour low of $28,814.75, which marked its lowest level since around January this year. Bitcoin is nursing a year-to-date gain of under 4% after boasting a gain earlier in the year of over 100%.

Here’s what some crypto and investing professionals are advising against that backdrop.

Iqbal Gandham vice president of transactions at Ledger said that a pullback in crypto was inevitable, given the run-up.

“ Any asset class which sees a meteoric rise in the same way as we have seen in crypto is expected to correct,” he wrote, in emailed remarks.

He said that China’s intensified crackdown on crypto, including bans on mining and trading, has only amplified the downside.

That said, he believes that “the underlying fundamentals of the crypto-asset world have not changed.”

Sean Rooney, head of research at crypto asset manager Valkyrie Investments said that the ban on crypto activities in the People’s Republic has forced mining operations to shift to other areas outside of China, which was one of the most active areas of bitcoin mining, and that may take a while to resolve itself.

“Recent regulations in China have forced many Bitcoin miners to pack up and look for alternate locations,” he wrote.

He says that the decline in crypto could be lengthy and pronounced.

“The drop from a high of almost $65,000 is now down well over 50%, signaling that Bitcoin traders could find themselves in choppy waters for weeks to come,” Rooney wrote.

Nick Mancini, research analyst at crypto sentiment analytics provider Trade The Chain, said that at least part of the decline in prices for bitcoin is due to mining operations being forced to sell their stock of bitcoin to offset the cost of closures.

“The market is currently being inundated with supply as Chinese miners have been selling their crypto to cover the cost of shuttering operations,” he explained. “This is having a negative impact on all prices, with altcoins being the most impacted,” the analyst added.

Mancini said that savvy investors “may want to watch Bitcoin for increased order book interest in the $20,000 range,” suggesting that it could fall to that level, signaling a possible reversal is at hand, however.

To be sure, there is no one-size-fits-all model for investing in crypto and buying is dependent on investors’ tolerance to losses and their long-term perspective, strategists note.

Nicholas Cawley at DailyFX wrote that these downturns aren’t uncommon in crypto but said that recent investors may be more inclined to hold on for an uptrend, given the recent crypto price collapse.

“We have seen these moves before, and will likely see them again. If you believe in cryptos, and are a holder, your exit strategy has just been pushed further into the distance,” he wrote.

Crypto watchers have said that the sector tends to operate in four-year cycles, which begins with euphoria, followed by a crash and ending with a persistent period of languishing prices.

That has been the case thus far in 2013, 2017 and this year’s most recent moves.

Declines for crypto come as the Dow Jones Industrial Average

DJIA,

the S&P 500

SPX,

and the Nasdaq Composite

COMP,

indexes were trying to recover from a withering selloff last week. Some strategists have speculated that the drop in digital assets also is being fueled by a rotation out of crypto and into traditional equities.

[ad_2]