[ad_1]

Ripple caused a wave of excitement earlier this year or rather its cryptocurrency XRP (CCC:XRP-USD) enjoyed that visible impact.

Source: Shutterstock

These days, it’s been a sinking stone. But in a market known to be always right until it’s not, what might investors expect from XRP going forward?

Let’s take a look at what’s happening off and on the XRP price chart, then offer a risk-adjusted determination based on those findings.

It’s proven a tough couple months for digital assets of all coin and token sizes, features and untold promises. From Bitcoin (CCC:BTC-USD) and the market’s largest cryptocurrency by valuation to the most meme-worthy decentralized finance (DeFi) play like Dogecoin (CCC:DOGE-USD), the group has succumbed to a rather fierce bear market.

Sentiment for cryptos has soured in the face of global regulators taking or warning of pending actions to curtail their use. Bad actors using digital assets as their choice of payment have only made matters worse. Poor XRP is simply caught in the middle, right? Not really.

XRP has a couple of other issues which it may or may not find its way past. XRP is not considered a safe-haven. More and more, that feature is reserved for BTC. It’s also not the market’s favored crypto for blockchain transactions and backbone for emerging non-fungible tokens or NFTs. That would be Ethereum (CCC:ETH-USD).

A Closer Look at Ripple

Today XRP can’t even claim it is cryptocurrency’s third banana. That title goes to Tether (CCC:USDT-USD) and its $62 billion valuation.

Speaking of real fruits, even DOGE’s Reddit-driven capitalization of $39.7 billion sits a spot above XRP’s $38.3 billion market cap in sixth place.

Granted, XRP’s current size is a good deal larger than most of the other 5,000 to perhaps as many as 9,000 tokens and coins in the crypto market, but there’s a reason behind XRP not commanding greater respect.

XRP is a coin with less utility value relative to its creation back in 2012. Even Ripple, the outfit behind XRP has largely moved on with other digital assets for faster and cheaper transactions in building the company’s cross-border, RippleNet payment network.

That could change though, right? Things could get better for XRP? Anything is possible, especially in a crypto market that is still evolving rapidly. But XRP has another issue: the Securities and Exchange Commission.

Unlike other major crypto plays which are created by digital open-sourced mining efforts, the altcoin’s supply is controlled by Ripple.

That inadvertently opened the door to an SEC investigation to determine XRP’s status as an unregistered security. Those regulators have until August 31 to conduct a fast discovery and reach an expert discovery by October 15. And today, right or wrong, the uncertainty has acted as an additional drag on XRP.

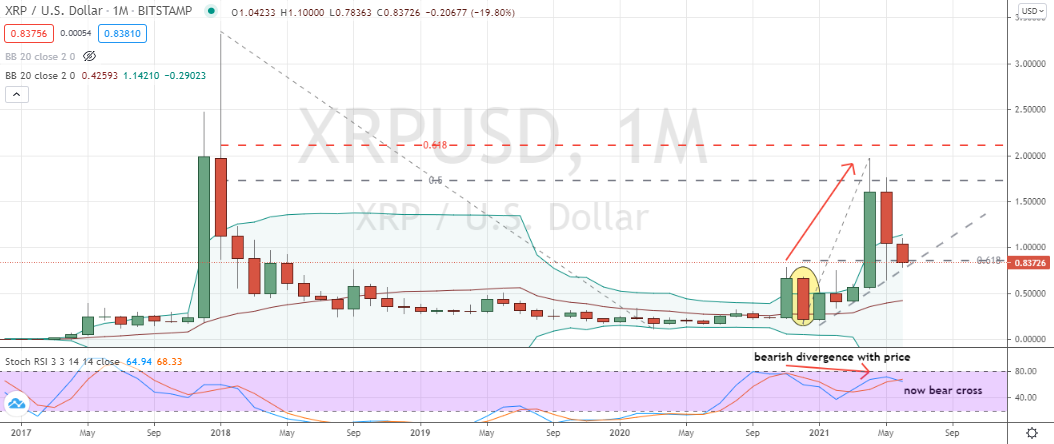

Ripple’s XRP Monthly Price Chart

Source: Charts by TradingView

In the stock market, low-priced stocks are often loudly-touted investments. Didn’t you buy Apple (NASDAQ:AAPL) at 50 cents back in the day? Actually and despite an abundance of claims to the contrary, nobody did. Not outright, at least. That kind of price tag only occurred in the aftermath of multiple stock splits.

In all fairness to Wall Street’s universe of analysts and promoters of all kinds, lower-priced investments are also often and rightfully discourage because they typically fail to ever become something more measurable. Still, here we are discussing a crypto fetching 83 cents, right? Actually, it’s not an apples-to-apples comparison, and that’s good news for XRP.

As with fiat currencies, with cryptos a low market price matters much less on average than a puny-priced stock representing a company’s value.

De-listing standards, charters of not trading instruments under $5 a share and other matters associated with equities simply don’t exist. That means it’s largely a bogus metric for XRP. Right now though, XRP’s value on the price chart may still be keeping investors at arm’s length.

Today, XRP is faced with an important challenge on its monthly price chart and a failure could prove unbelievably bad news for the digital coin’s bulls.

As the provided chart reveals, XRP has pulled into a testing position of the 62% retracement level tied to last fall’s low. At the same time, the coin is colliding with trend support associated with this year’s earlier festivities as XRP ran more than 830% from a low of 21 cents to a high of $1.96 before topping.

If the technical challenge fails, a full-blown return towards the coin’s low increases. Troublingly, XRP’s stochastics just formed a bearish crossover in neutral territory.

Further, with the secondary indicator having failed to trade in sympathy with the underlying rally, bearish warnings beneath the surface have been a consistent characteristic for the crypto this year.

The Bottom Line on Ripple

On a more positive note, if traders see some unique utility in XRP as a digital asset, today’s steep pullback does offer an extremely low risk, high reward profile.

The fact is today’s exposure of about 10 cents, before knowing whether support holds or fails, is countered by a much larger upside opportunity if XRP can rally and merely rhyme with recent history.

I’d personally wait for the monthly stochastics to confirm a buy decision. Paying up and accepting larger downside risk with a stronger bottom in place and sizing the position accordingly makes sense in our book.

For now though and regardless of your position on XRP, everyone involved will simply have to wait for the next chapter.

On the date of publication, Chris Tyler holds (either directly or indirectly) positions in Grayscale Bitcoin (GBTC) and Grayscale Ethereum Trust (ETHE) securities. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Chris Tyler is a former floor-based, derivatives market maker on the American and Pacific exchanges. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits.

[ad_2]