[ad_1]

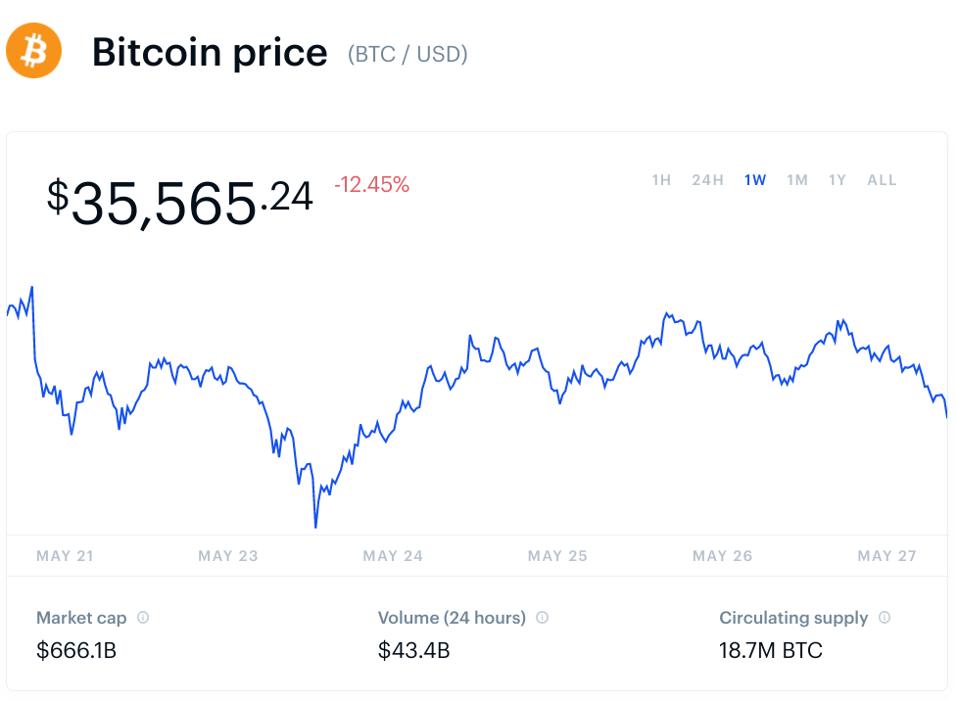

Bitcoin and cryptocurrency prices have dived after staging something of a recovery earlier this week.

The bitcoin price bounced back to over $40,000 per bitcoin following a sharp sell-off last weekend, however, the rally has failed to hold in the wake of the latest bitcoin monthly options expiry.

Bitcoin’s price plummet to $35,000, wiping 10% off of bitcoin’s value over the last 24-hour trading period, has weighed on the broader crypto market, with other top ten tokens ethereum, cardano, Binance’s BNB, Ripple’s XRP and dogecoin all recording double-digit percentage declines.

The bitcoin price has fallen sharply to under $40,000 per bitcoin, with the wider cryptocurrency … [+]

“After the recent volatility in the market this month, day traders [were] watching the expiry closely, but really for long-term [bitcoin and crypto holders] these end-of-month expiries are a bit of a side show,” Grant Whitlock, head of trading at U.K.-based digital asset broker GlobalBlock, said via email, adding long-term investors “could see this as a potential dip-buying opportunity.”

Bitcoin and crypto exchanges around the world settled almost 60,000 trading contracts worth some $2.2 billion in the early hours of Friday morning, according to bitcoin trading data from Skew.

While this month’s expiry is the smallest of 2021 in terms of nominal value, some bitcoin and crypto market watchers think the monthly options expiry can exacerbate trends affecting the market.

“As we’ve seen historically, there tends to be increased trading activity in the days leading up to a bitcoin expiry, with trends marked both by volatility and momentum,” Steve Ehrlich, chief executive of U.S.-based crypto-asset broker Voyager Digital, said in emailed comments.

“Typically, if there is a defined direction for bitcoin in the trend, that trend becomes amplified via the pressure of the expiration date, with increased momentum toward bullish or bearish price action.”

The bitcoin and cryptocurrency market roller coaster has rolled on this week, with extreme … [+]

The combined bitcoin and cryptocurrency market is down an eye-watering $1 trillion from its all-time high of over $2.5 trillion, set in mid-May, and confidence appears to be seeping out of the market as a regulatory crackdown in China and Tesla billionaire Elon Musk’s fickle attitude toward bitcoin weighs on prices.

“The move down today is once again a reminder that the crypto market has been dominated by selling on the upside since last month,” says Alex Kuptsikevich, FxPro senior financial analyst, speaking via email.

“Since the middle of last week, we can clearly see the selling intensifying on the approach to $40,000. In addition, the expiry of options and the upcoming weekend, a reminder of the failure a week earlier, are increasing buyers’ nervousness. Overall, the situation so far is very reminiscent of 2014 and 2018: After a powerful collapse from the historical peaks, there were attempts to strengthen growth, but they failed. Investors’ muscle memory is now forcing them to sell high.”

[ad_2]