[ad_1]

XRP/USD closed at 1.06000 after placing a high of 1.58901 and a low of 1.06000. After posting gains for two consecutive sessions, XRP/USD dropped on Wednesday and reached its lowest since 26th April. XRP holders have been trying to gain a voice in action against Ripple Labs and some of its executives filed by the SEC. However, the regulator has opposed by any means at its disposal, and this has weighed on the cryptocurrency.

Despite its ongoing lawsuit against SEC, Ripple has announced a partnership with Egypt’s largest bank, the National Bank of Egypt (NBE). RippleNet, a global payments network, will connect NBE with LuLu International Exchange, a financial services provider based in UAE, and cross-border process payments. Egypt received remittances up to $24 billion in 2020 from its citizens in the Gulf States, including the UAE. The North African nation was one of the top five remittance recipients globally after India, China, Mexico, and the Philippines.

The group head of NBE said that the bank was continuously aiming to develop and enhance the infrastructure of cross-border remittances as it plays a vital role in the Egyptian economy. This news further capped losses in XRP/USD prices on Wednesday. But the coin ended its day with losses as the whole crypto market came under pressure after China announced trading in cryptocurrency as illegal and warned against it due to the high risk involved amid speculations.

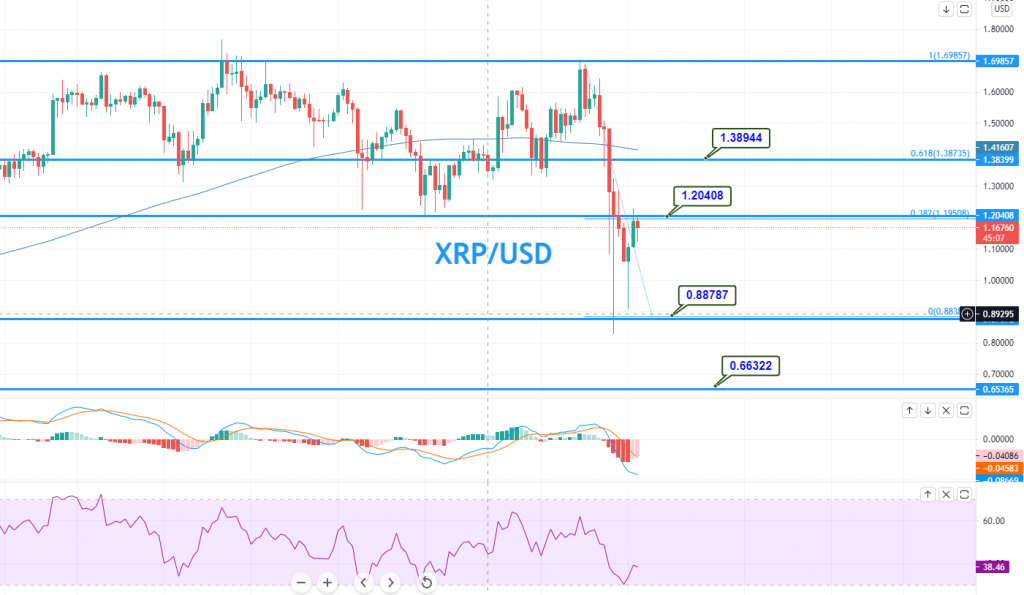

XRP/USD Daily Technical Levels

Support Resistance

0.88367 1.41268

0.70733 1.76535

0.35466 1.94169

Pivot Point: 1.23634XRP/USD has bounced off to trade below 1.2040 level, facing immediate resistance at 1.2040. This level also marks a 38.2% Fibonacci retracement level. Below this, the odds of bearish bias remain strong; therefore, we may look for a sell trade to capture a quick sell until 1 or 0.8890. However, in the case of a bullish breakout of 1.2040 level, the pair may soar until the 1.3894 level of 61.8% retracement. Good luck, and stay tuned!

[ad_2]