[ad_1]

- XRP price bounces off with force after a brief dip into the $1.37-$1.47 demand zone.

- The funding rate, weighted sentiment and MVRV have reset, allowing the bulls to launch Ripple higher.

- A breakdown below $1.37 will invalidate the bullish outlook.

XRP price shows a consolidation in play that could lead to a new yearly high. The recent recovery from the dip into the demand zone suggests the presence of strong buyers.

XRP price remains focused on $2

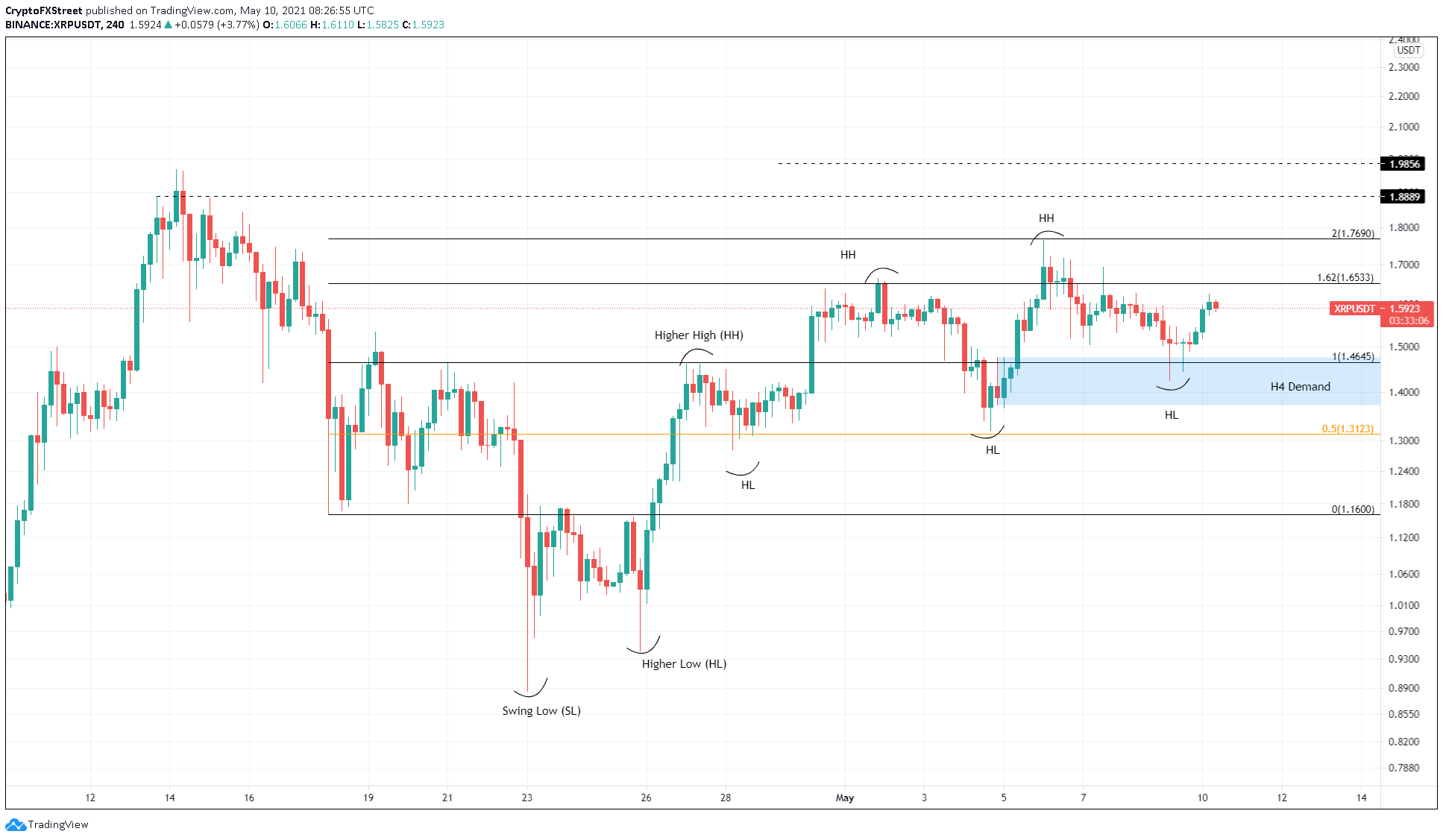

XRP price continues a steady climb since the crash in late April. Since then, Ripple has set up three higher highs and four higher lows, indicating a steady uptrend. The recent dip on May 9 saw XRP price enter the demand barrier that stretches from $1.37 to $1.47.

Now, investors can expect the remittance token to surge toward the immediate resistance at the 162% Fibonacci extension level, located at $1.65.

A successful breach of this wall will allow the buyers to charge toward $1.76, a level last seen in mid-April. Depending on the buying pressure, XRP price could either take its time to overcome these levels or just slice through them with consecutive green candlesticks.

Regardless, XRP price looks primed to tag $2.

XRP/USDT 4-hour chart

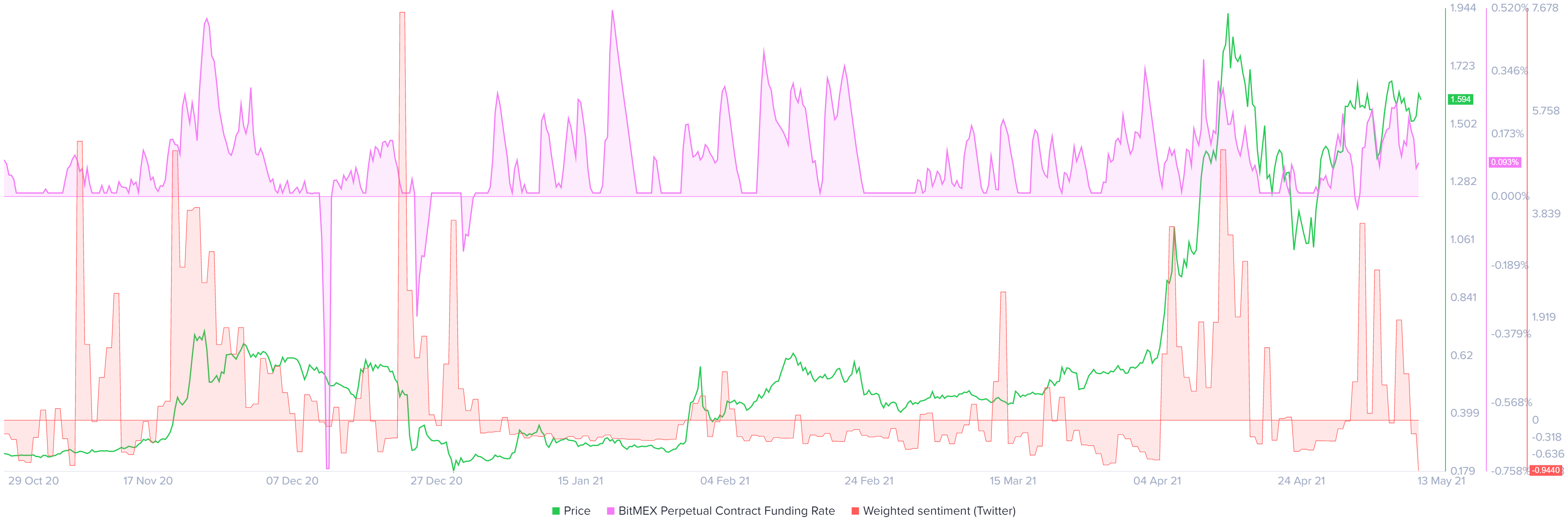

The funding rate for XRP price is 0.093%, after dropping from 0.226% on May 8. Such a low funding rate, coinciding with the recent crash, indicates that the highly leveraged long positions are either liquidated or closed, allowing sidelined investors to step in and ride the wave to $2.

Moreover, the brief collapse on May 9 could have caused the weighted sentiment to enter the negative territory, portraying that investors are not optimistic about XRP price, which is bullish from a counter-sentiment perspective.

XRP funding rate, weighted sentiment chart

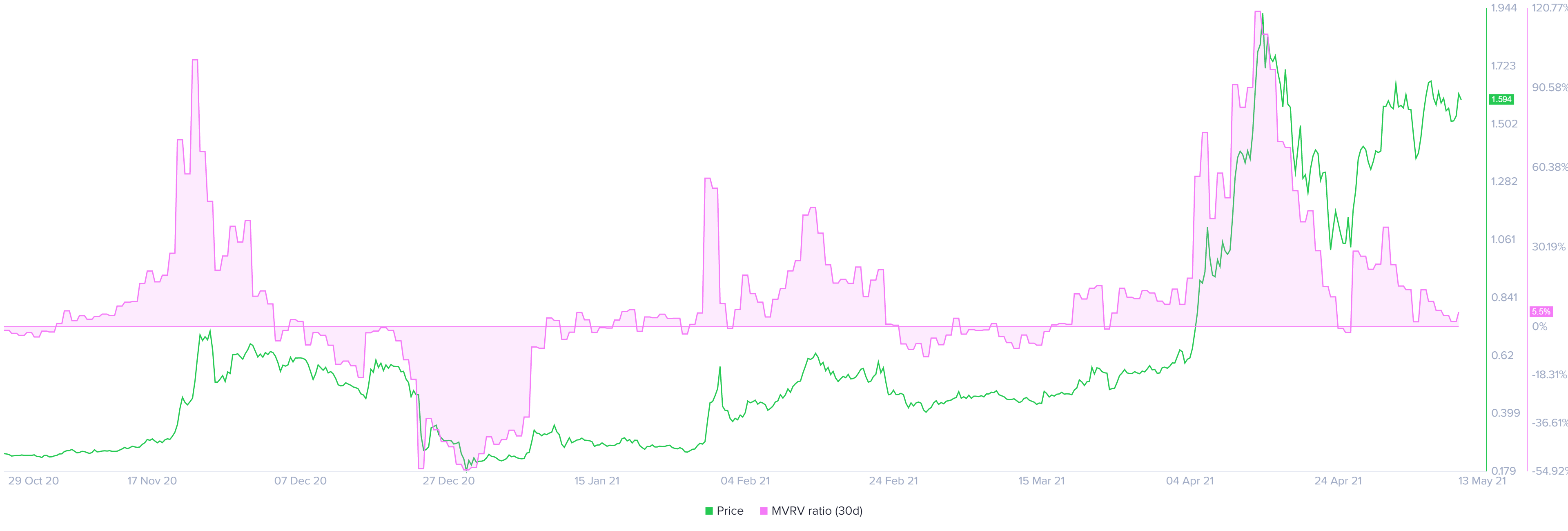

Another metric that portrays the bullishness around XRP is the 30-day Market Value to Realized Value (MVRV) model, which tracks the network’s profit/loss of investors that purchased XRP in the past month.

The MVRV value for Ripple currently stands in the opportunity zone at 5.5%, which indicates that only 5.5% of the network participants are in profit. Hence, the possibility of a correction induced by investors booking profits is almost zero.

XRP 30-day MVRV chart

All in all, XRP price looks bullish, but a potential spike in bearish momentum that pushed the remittance token below $1.37 would invalidate the bullish outlook and kickstart a bearish one.

Under such conditions, Ripple price could slide toward the 50% Fibonacci retracement level at $1.31. Breaching this level could trigger an 11% downswing to $1.16.

[ad_2]