[ad_1]

Bitcoin mining and cryptocurrency in general are having what could very loosely be sort of described as a ‘coming of age’ moment. It’s loose because advocates of these digital currencies, which obtain ‘trust’ from requiring massive amounts of energy to generate (‘proof of work’), don’t seem to be handling the challenges of dealing with key issues like climate and environment particularly well.

This was explored recently in RenewEconomy, in this post detailing how there are many Bitcoin mining operations running massive server farms that either exist on carbon intensive grids, or even directly use fossil gas on mining sites where that gas would have otherwise been flared.

And last week, we covered a piece of research that predicted Bitcoin’s energy consumption will match that of Australia’s by the year 2024.

“Under the Paris Agreement, China is devoted to cut down 60 per cent of the carbon emission per GDP by 2030 based on that of 2005. However, according to the simulation results of the [blockchain carbon emission] model, we find that the carbon emission pattern of Bitcoin blockchain will become a potential barrier against the emission reduction target of China”, the researchers found. It’s significant, because the fate of China on energy and climate decides, by and large, the fate of the world.

Part of the reason interest has increased in Bitcoin was a significant purchase of it by Tesla. CEO Elon Musk is a well-known fan of cryptocurrency, including Dogecoin, an alternative to the more mainstream Bitcoin. But scrutiny of its extreme energy consumption, alongside a lack of any real sustainability or environment initiatives across the industry of Bitcoin miners, has led to nearly months now of constant criticism (including from this author).

Now, a new initiative is attempting to change that at a surprisingly ambitious and fundamental level. Last week, a range of organisations launched the ‘Crypto Climate Accord’, aiming to decarbonise the entire cryptocurrency industry, including Bitcoin trading house Coinshares.

Among the partners are the Rocky Mountain Institute (RMI), well-regarded among energy experts, and representations from the United Nations Framework Convention on Climate Change (UNFCCC). Energy Web and the Alliance for Innovative Regulation (AIR) are involved too, as are the cryptocurrency companies.

“The Accord intends to achieve this by working collaboratively with the cryptocurrency industry — including all blockchains — to transition to 100% renewable energy by 2025 or sooner. While many organisations are individually taking steps to decarbonise their operations, the Accord recognises that an industry-wide coalition and scalable solutions can quickly multiply impact.”

“This is a unique chance to publicly clean up the past, reject future #emissions, and push the boundaries of #climate leadership.”

– @topnigel, High Level Climate Action Champion for @UNFCCC @COP26 #cryptoclimateaccord #makecryptogreenhttps://t.co/IGHci1FWkm pic.twitter.com/zBG0OlMlGQ

— Crypto Climate Accord (@CryptoClimAcc) April 9, 2021

Total decarbonisation of power by 2025 comes along with full decarbonisation of all business operations by 2040, and with the active removal of historical emissions from the Earth’s atmosphere by 2040. These are both genuinely ambitious goals, and they seem to be closely tied to international climate diplomacy. It is a far cry from the decentralised, regulation-hating, unaccountable world of Bitcoin mining as it exists today.

While this seems like a step in the right direction, it is very likely its advocates will be swimming against the tide. The very philosophy of collective action to take responsibility for the externalities of profit-making business is contrary to the libertarian values of individual freedom. Some participants may not be all that invested. “Coinshares less than two weeks ago was arguing more energy consumption is about the best thing ever. I’m not sure how this is inspired by the Paris Agreement if they’ve clearly never read it or don’t understand it”, wrote Alex De Vries, author of the Digiconomist blog.

Meanwhile, Bitcoin seems only to be getting hungrier for energy, and there doesn’t seem to be much effort to direct that big ship towards clean power sources only. Cheap coal and gas will likely get cheaper, as they both get displaced from grids by renewable energy.

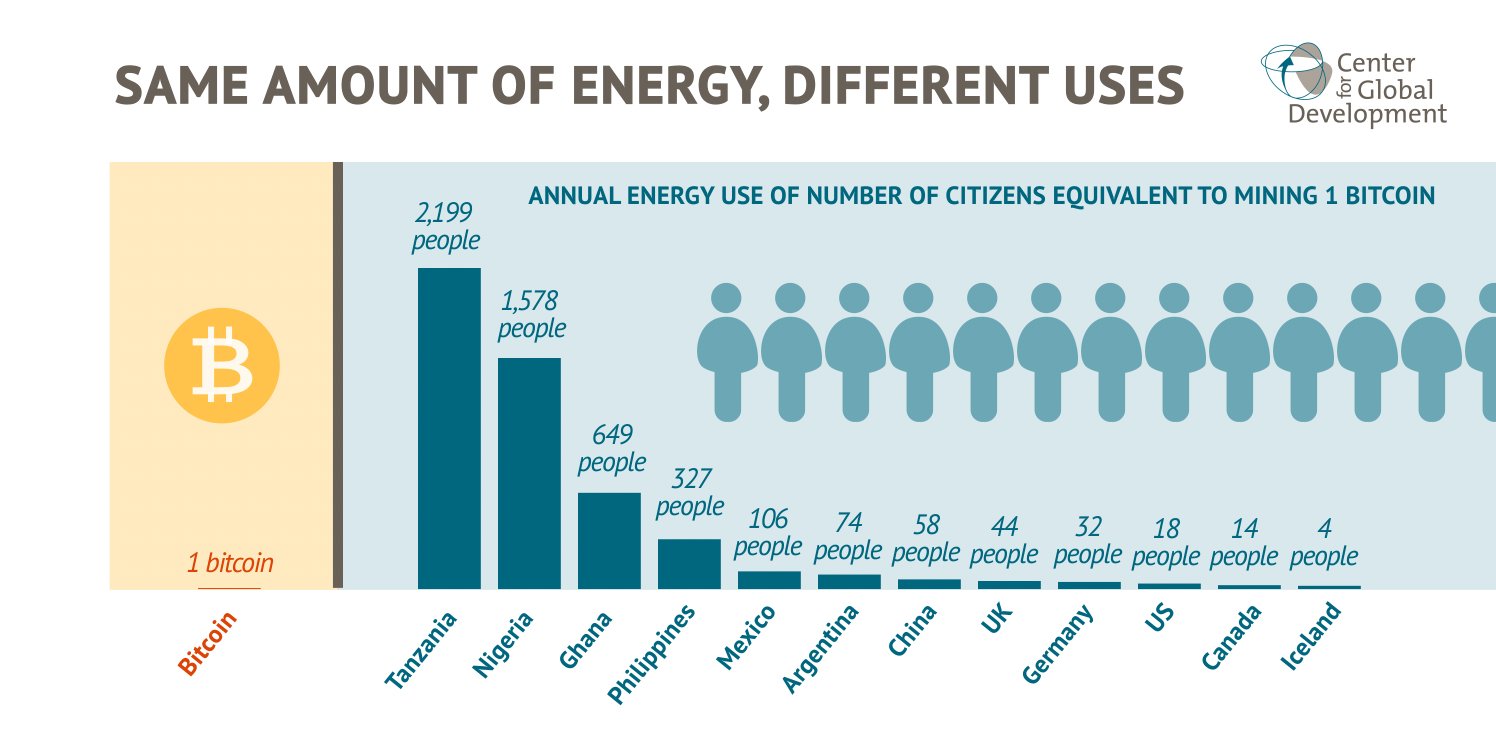

The Centre for Global Development just released a new analysis showing that mining a single Bitcoin is equivalent to the total annual energy usage of 18 Americans, or 2,199 Tanzanians.

They recommend a range of policy options to forcibly clamp down on the problem, including a ban of large mining operations and taxing mining activity. Neither of these will be welcomed by the industry. “The most hopeful case for the environment is that the price of bitcoin falls low enough to push most miners out of business, leaving behind only those with access to cheap renewable energy and the most efficient mining rigs”, they write.

They recommend a range of policy options to forcibly clamp down on the problem, including a ban of large mining operations and taxing mining activity. Neither of these will be welcomed by the industry. “The most hopeful case for the environment is that the price of bitcoin falls low enough to push most miners out of business, leaving behind only those with access to cheap renewable energy and the most efficient mining rigs”, they write.

The question is whether voluntary accords or forcible regulation win out in cleaning up Bitcoin. The alternative is very ugly – a major new threat to climate action at a sensitive time indeed.

[ad_2]