[ad_1]

- Bitcoin swings toward $66,000 following news that Tesla has started accepting payments in BTC.

- Ethereum renews the uptrend above $1,700, while bulls target gains toward $2,000.

- Ripple price is pivotal at the ascending channel’s middle boundary as bulls gaze on $0.65.

Bitcoin jumped by more than $1,600 in a matter of minutes on Wednesday after Elon Musk announced that Tesla, the leading electronic car manufacturer, has started accepting payments in BTC. The firm’s news has once again put the flagship cryptocurrency in the spotlight, as investors speculate on gains above $60,000.

On the other hand, Ethereum is trading marginally above $1,700 while dealing with the delayed action toward $2,000. Ripple is trading at $0.55 amid the battle to secure higher support. The rest of the cryptocurrency market is dotted green and red. Crypto assets such as THETA, Crypto.com Coin, and Enjin Coin are posting double-digit gains.

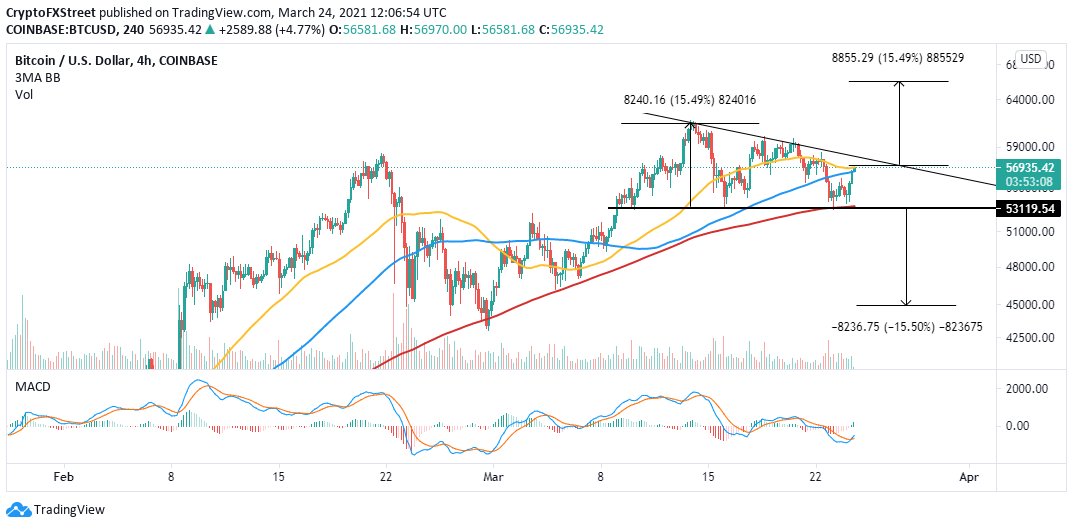

Bitcoin eyes upswing to $66,000

Bitcoin is trading above $56,000 after making a considerable rebound from the support highlighted by the 4-hour 200 Simple Moving Average (SMA) at $52,500. Meanwhile, bulls focus on gains above the 50 SMA and the 100 SMA. Trading above these two key moving averages would bolster BTC toward a breakout past the descending triangle pattern.

A 15% upswing is likely to occur if the bellwether cryptocurrency lifts beyond the triangle’s hypotenuse. Moreover, trading above $60,000 may trigger massive buy orders as the fear of missing out (FOMO) grips investors. The impending triangle breakout has a target at $66,000, as observed on the chart.

The ongoing uptrend has been validated by the Moving Average Convergence Divergence (MACD) indicator. As the MACD line (blue) crosses above the signal line, the bullish momentum becomes stronger, further securing the upswing.

BTC/USD 4-hour chart

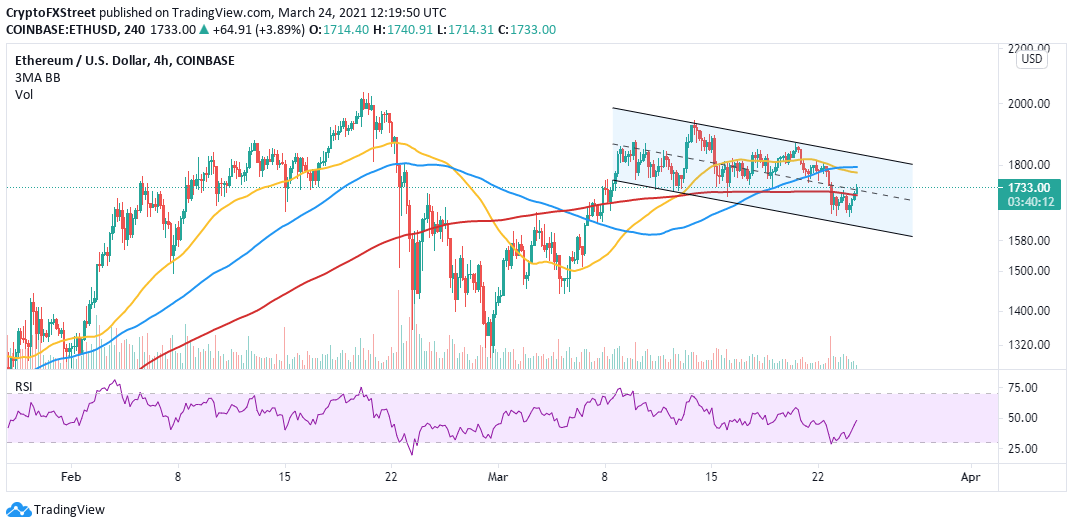

Ethereum embarks on journey to $2,000

Ether continues to exchange hands within the confines of a descending parallel channel, as seen on the 4-hour chart. The channel’s lower boundary support played a key role in ensuring bearing pressure is checked, hence the anchor at $1,650.

Meanwhile, a recovery is underway, with Ethereum stepping above $1,700. Other key resistance zones that already flipped into support levels include the 200 SMA and the channel’s middle boundary. Holding above these crucial areas will ensure that the uptrend remains intact. On the other hand, gains past the 50 SMA and the 100 SMA may catapult ETH beyond the channel, opening the door toward $2,000.

The Relative Strength Index (RSI) on the 4-hour chart emphasizes the bullish outlook as it heads into the overbought region. Similarly, holding at $1,700 is a bullish signal likely to encourage more buyers to join the market.

ETH/USD 4-hour chart

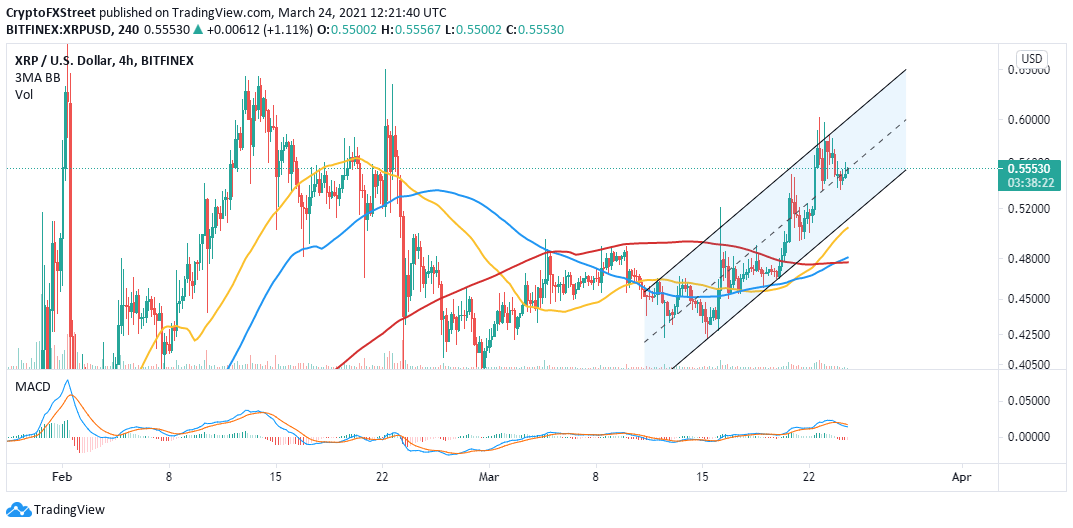

Ripple nurtures uptrend as technicals strengthen

The cross-border token is holding at $0.55, as well as the ascending parallel channel’s middle boundary. If this support is confirmed, we may see Ripple spike above $0.6.

It is worth mentioning that XRP recently tested this region but failed to make a real break. Trading past this level would be a bullish signal calling out to buyers to come from the sidelines and board the bandwagon for highs above $0.65.

XRP/USD 4-hour chart

On the downside, the MACD shows that Ripple is not quite out of the woods yet. Although the indicator is in the positive region, the MACD line (blue) has crossed under the signal line.

A move such as this implies that overhead pressure is increasing and that the asset may correct further. Support is envisioned at the channel’s lower edge, $0.5 and $0.48, respectively.

[ad_2]