[ad_1]

U.S. largest bank launches a crypto-related stock basket, raising questions about the true extent of … [+]

JPMorgan

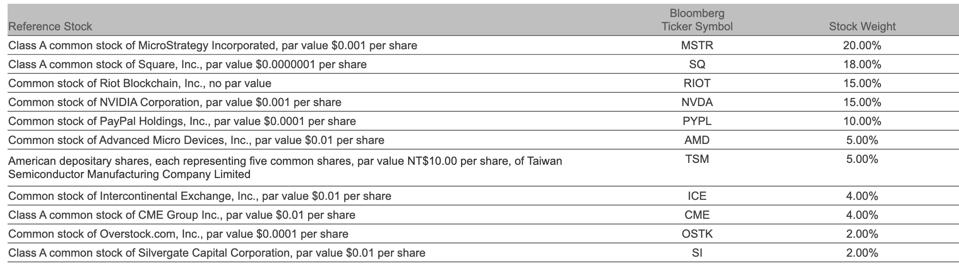

According to the U.S. Securities and Exchange Commission filings, the notes do not provide direct exposure to cryptocurrencies but instead are tied to JPMorgan’s basket of 11 unequally weighted stocks that are directly or indirectly related to cryptocurrencies or other digital assets. The weights of the stocks in the basket were determined based in part on each company’s exposure to bitcoin and liquidity.

Given that the U.S. Securities and Exchange Commission has yet to approve a cryptocurrency backed ETF, these JPMorgan notes in some way circumvent regulation and represent an ETF or mutual funds of sorts, holding 11 stocks. The market value of the notes and payment at maturity will largely depend on the performance of Class A common stocks of MicroStrategy

The JPMorgan notes, maturing on May 5, 2022, cost a minimum of $1,000 and investors will be charged a basket deduction, basically a fee, of 1.5%. They are structured so that at maturity in a year or so, you reap the gains, or losses of the basket, minus the fee. DIY could simulate the note by simply buying the stocks through a brokerage, commission free.

Reference stocks in JPMorgan’s Cryptocurrency Exposure Basket

The new product could offer an opportunity for more risk-averse investors to take part in the crypto surge. MicroStrategy and Square, in particular, have emerged as major institutional bitcoin bulls over the past few months, putting hordes of the cryptocurrency in their treasuries. PayPal introduced more than 300 million of its customers to bitcoin in October and on Monday announced it is acquiring Curv, a Tel-Aviv-based provider of cloud-based crypto custody, for an undisclosed amount.

However, the bank’s initiative immediately came under fire. Jeff Dorman, chief investment officer of crypto investment firm Arca, called it a “garbage” portfolio” in a tweet. The critique is not baseless. Crypto and blockchain have little to do with the core business and profitability of companies like Square, AMD, Paypal, Overstock.com or NVIDIA. AMD represents some 5% of the JPMorgan’s basket yet its most significant connection to cryptocurrency is the fact that its chips are used by high performance computers engaged in development of blockchains and in cryptocurrency mining, along with dozens of other uses like AI, machine learning, virtual reality and autonomous driving. It’s doubtful that changes in crypto prices would have a significant impact on AMD’s $9.8 billion in revenues, despite the company’s commitment to support crypto miners.

According to Jack Tatar, managing partner of crypto venture firm Doyle Capital Management and contributing editor of Forbes Crypto Asset & Blockchain Advisor investment newsletter, JPMorgan’s play could be considered a “gateway drug for investing into crypto” because many financial advisors and institutional investors are prohibited from investing in bitcoin directly. “What really needs to happen is that the SEC needs to provide some guidelines” and the financial and wealth management firms “need to step up and recognize that they are denying the best performing asset of the decade, bitcoin, to their investors.” Not allowing clients to invest directly in it – “some would call it fiduciary malpractice,” adds Tatar.

In Tatar’s opinion, putting the 1.5% fee tag on a product that does not offer direct exposure to bitcoin, like a bitcoin ETF, is a way for the banking powerhouse to “cash in” on the booming market for its own benefit. Regulators are yet to approve the first bitcoin exchange-traded fund in the U.S. On March 1, U.S. largest options exchange, Cboe, submitted its third bid for a bitcoin ETF.

JPMorgan’s crypto-proxy basket is the latest investment product with access to the crypto market from a major U.S bank. Last week, Goldman Sachs announced the reboot of its cryptocurrency trading desk, which is set to begin dealing bitcoin futures for clients later this month.

[ad_2]