[ad_1]

As part of its commitment towards helping crypto users understand the ever-volatile crypto market, Kraken, a global crypto exchange platform recently released its Monthly Crypto Market Outlook Report for April 2021.

The 22-page report succinctly documented the extensive bullish and bearish trends in the world of Bitcoin (BTC), Ethereum (ETH), and other Altcoins such as Uniswap (UNI), Binance Coin (BNB), Dogecoin (DOGE), Cardano (ADA), XRP, etc., together with the performance of NFTs and activities of DeFi trading over the four weeks.

In general, the month of April, according to Kraken, spelled widespread gains for the world of crypto with virtually all current top 5 coins recording successive greens and attaining impressive all-time highs. A brief breakdown of these performances as reported by Kraken is shown below:

What Lessons From BTCs April Performance?

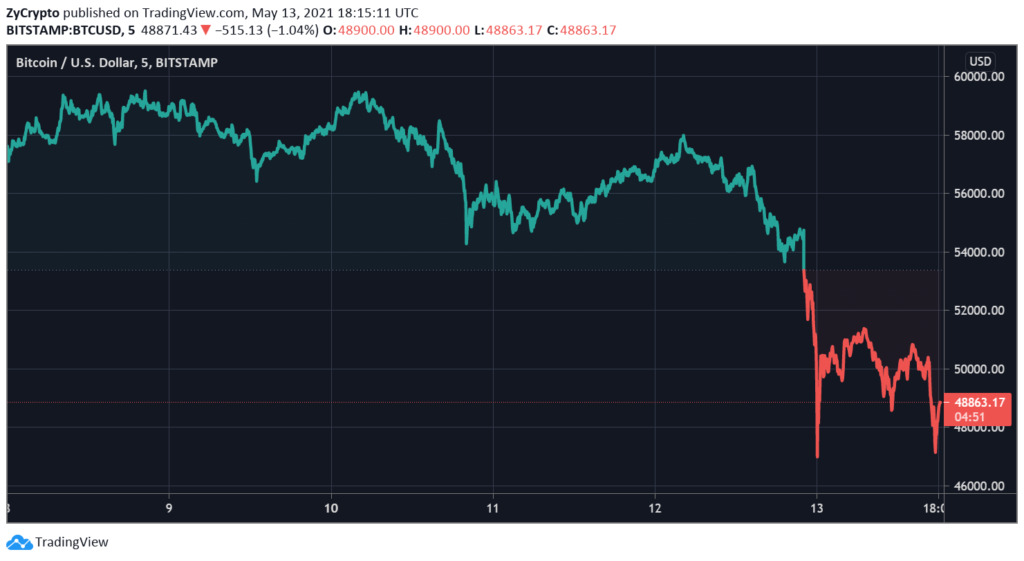

According to the report, BTC experienced an extremely elastic April. It was the month in which the trailblazing coin ended its six-month successive winning stretch. Within the first half of the month, users jollied as BTC smashed yet another milestone value record of $65K, only to dip to an astonishing -28% low, landing at $47k, just five days to the end of April.

For the first time in three years, BTC edged off its 50% market dominance as several major Altcoins rose to the challenge amidst a flourishing green season. All these indices point to a trend revolution in the holding of BTC that shows a majority of the new entrant buyers as large-scale long-term investors and big corporations interested in holding the asset.

The interpretation of these trends for short-term retail holders is that BTC may no longer be a suitable asset option for those looking for short-term value increase and rapid liquidation, as the asset and its new crop of significant market holders satisfied with small growth and incremental long-term rallies.

To draw a comprehensive comparative analysis, BTC’s activities must be compared with other significant cryptocurrencies in the market.

Ethereum’s Ethereal Performance

Ethereum (ETH) had a swell April recording its seventh month of a successive winning streak. By the end of the month, ETH had equally attained a personal ATH of $2,800 with the second most successful coin seeing a surge in trading volume up 60%.

This is no surprise as the ETH blockchain remains the most used blockchain, due to its flexibility and security for many upcoming cryptos.

With the launch of its hard fork native to Berlin and that of London now underway, including additional ETFs situated in Canada, to cater for the soaring demand amongst traditional banks and other financial corporations, Ethereum can be said to have had a busy April and a successful one which already set the tone for the strings of increasing successes it now continues to experience in May.

Did Cardano Fair Any Better?

Riding in the success of a historic partnership by its founding company, IOHK, with the government of Ethiopia, Cardano (ADA) in April, joined the league of ATHs by peaking to $1.55, moments before the end of the month’s first half.

It also saw astronomical volumes of trading doubling up 155%.

Doge Moon Expeditions

A 500% value upshot saw the meme coin finish April with only five steps left to the moon. The value run showed a delightful market capitalization record of $42 billion especially during the run-up to its infamous Dogeday celebration on April 21.

By the end of April, DOGE had become the most thriving of all coins both by value increase, market cap, and watchlist rankings. The only red alert posed by the sprinting coin is the reality that over 65% of the entire DOGE in circulation is held by just 107 persons.

Any Dot in Polkadot?

Like Bitcoin, Polkadot (DOT) had its fair share of ups and downs in April, capping a shocking $48.53 ATH in the first few days of April’s second half before descending to a $26.50 60-day low.

It experienced significant trade volume gains and announced several giant strides added to its project which includes: An investment series fund worth $16million of which it is a beneficiary, and a tentative stablecoin partnership with USD Tether.

…And Swathing Uniswap?

Another coin swept by the strong ATH currents is Uniswap (UNI). The biggest DeFi-based exchange surmounted a $44 peak value before settling in on a $40.66 surge deduction balance.

April saw UNI active on its busiest week, marking an extension of its +1650% success streak to six consecutive months. With over $117 million in revenue in the bag, courtesy of transaction fees, the coin is set to see more busy weeks ahead in May accompanied by successive growths as it launches its v3 version on the Ethereum native mainnet blockchain.

What about NFTs?

Kraken’s report shows that the highly buzzed art-themed token showed a deflationary trend in high contrast to March’s high-flying performance as the helium-filled hype bubble hovering around the technology began to dissipate.

Despite the downtrend, many institutions picked interest in NFTs with Binance and Crypto.com launching their own dedicated NFT trading platform and IBM looking to launch its NFT-themed patents.

The Summary.

In an overview, the crypto market continued to show potential and revealed an underlying trend where short-liquidity BTC owners are converting their coins to queue up under high-flying volatile altcoins. The market for BTC will continue to test people’s endurance to hold as it fast becoming unfavorable for a short-term trade.

There is a range of altcoins and DeFis to choose from depending on risk-reward outlook, capitalization, and other activity around the coin. The crypto market is shaping into a pattern that can be subjected to side-by-side analysis with traditional markets to see the influence of one on another. In the end, the choice is the users’ as the market gears up for an impressive lift-off in May, Kraken reports.

[ad_2]