[ad_1]

Bitcoin’s lovers and haters have been fiercely disputing whether the number-one cryptocurrency by market capitalisation is good or bad for the environment.

Bitcoin evangelists say that government-controlled fiat currencies and the whole financial infrastructure that backs them doom the climate. But Bitcoin critics counter that the process of mining new coins is a massive energy suck that benefits only a handful of people at a heavy cost to the planet.

The naysayers just won over a powerful ally. After months of cheerleading for Bitcoin, Tesla CEO Elon Musk told his 54.3 million Twitter followers on Wednesday that the electric vehicle maker is hitting the brakes on allowing customers to use Bitcoin as payment.

“We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel,” Musk wrote on Wednesday.

Tesla & Bitcoin pic.twitter.com/YSswJmVZhP

— Elon Musk (@elonmusk) May 12, 2021

Yet Bitcoin is far from the only environmental villain in the crypto space. There are plenty of other tokens that also rely on energy-sucking proof of work (PoW) consensus mechanisms to validate transactions and mint new coins.

PoW requires a decentralised network of mining rigs – sometimes made up of thousands of computers labouring in unison – to solve complex math problems in a race to verify transactions to win new Bitcoins.

Not all virtual coins use PoW, but all of the most energy-consumptive do.

Many experts say proof of stake can offer the crypto sector a dramatically greener future. The biggest coins using that consensus mechanism — which relies on larger coin owners to validate blockchain transactions — are Binance Coin, Cardano, Polkadot, Stellar and Solana.

Others hope a third consensus mechanism, proof of space, could be greener still. It relies on hard-drive storage rather than processing power. Chia coin is marketed as a cryptocurrency with an ecological “farming” method, though environmentalists say the e-waste issue is a problem.

Al Jazeera asked Alex de Vries, a Dutch crypto sustainability expert who runs the site Digiconomist, for his best estimates using the annual carbon footprint of PoW coins measured in terawatt-hours (TWh) of electricity consumption.

Bitcoin (BTC): 114 TWh

With a market cap just shy of $1 trillion, Bitcoin’s carbon footprint of 54 million metric tonnes of carbon dioxide is comparable to that of Singapore. The footprint of a single mined Bitcoin is estimated at 150 tonnes of carbon, which is around six times the pollution from the equivalent amount of mined gold, according to Digiconomist.

Some sources, including the Cambridge Bitcoin Electricity Consumption Index, say that the world’s largest cryptocurrency uses almost 150 TWh per year — more than the whole of Malaysia.

Put another way, a single Bitcoin transaction needs more power than the average United States household consumes in a month.

Ethereum (ETH): 44 TWh

Ethereum has been giving Bitcoin a run for its money, and its energy addiction has risen just as fast. Its carbon footprint is about 22 million metric tonnes, comparable to that of Lebanon. And its electricity use rivals that of Hong Kong.

The Ethereum network plans to switch over from PoW to a more efficient proof-of-stake system later in 2021. As of now though, Bitcoin and Ethereum together make up almost 90 percent of the annual electricity usage of all proof-of-work coins, so the rest comprise a small share.

Dogecoin (DOGE): 7.8 TWh

Elon Musk’s favourite meme crypto has surged in value since the beginning of the year. Its market cap rose above $75bn recently before giving back some gains, catapulting energy usage from the cute coin into third place, from tenth place in March 2020.

With the electricity usage of Zimbabwe, Dogecoin was originally designed as a joke.

Bitcoin Cash (CSH): 3.4 TWh

This cryptocurrency forked off of Bitcoin, spinning off as its own token in 2017. It still uses the same secure hash algorithm (SHA-256) as its parent.

With a market cap currently hovering around $23bn, its electricity usage is about the same as Nicaragua — a country that powers an economy producing $11bn of goods and services per year.

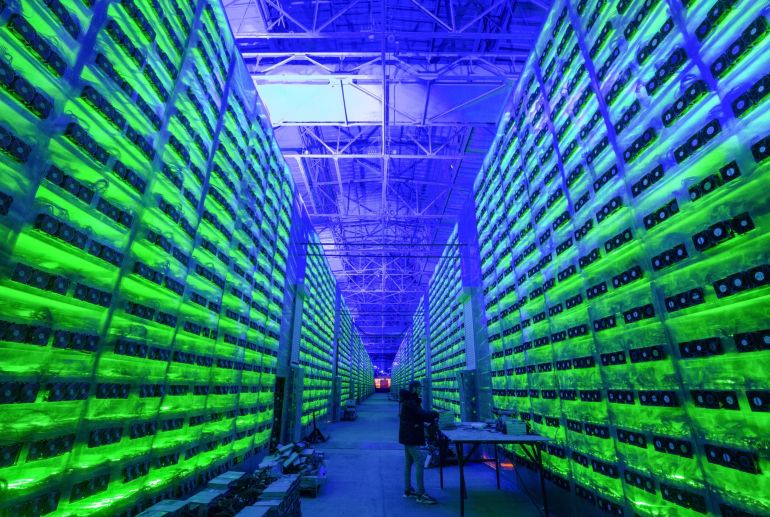

Proof of Work consensus mechanisms require a decentralised network of mining rigs – sometimes made up of thousands of computers labouring in unison – to solve complex math problems in a race to verify transactions to win new Bitcoins, leading to elevated energy consumption [File: Andrey Rudakov/Bloomberg]

Proof of Work consensus mechanisms require a decentralised network of mining rigs – sometimes made up of thousands of computers labouring in unison – to solve complex math problems in a race to verify transactions to win new Bitcoins, leading to elevated energy consumption [File: Andrey Rudakov/Bloomberg]Litecoin (LTC): 3.2 TWh

This cryptocurrency uses the same Scrypt-based algorithm as Dogecoin, though it too is a spinoff of Bitcoin. True to its name, the “Ł” crypto is lighter and faster than popular Bitcoin.

However, its annual electricity usage is about the same as the island of Jamaica.

Ethereum Classic (ETC): 1.7 TWh

ETC retains the original history of the Ethereum network and has a market cap around $10bn.

Its annual electricity consumption is approximately the same as the Bahamas.

Monero (XMR): 1 TWh

XMR, a privacy-focused cryptocurrency, uses proof of work with a RandomX algorithm and generally runs on graphics processing units. Every year, it uses about as much power as Benin.

Bitcoin SV (BSV), Dash (DASH) and Zcash (ZEC): Less than 1 TWh each

While these coins all clock in annually at under 1 TWh, the figures are increasing quickly as crypto prices rise and miners see big incentives to use more power.

[ad_2]