[ad_1]

Back in 2018, Ark Invest CEO Cathie Wood infamously predicted that Tesla shares would reach $4,000 in a matter of a few years. Investors and critics ostracized her high-conviction bet, as at the time, Tesla was facing a major liquidity crunch and on the brink of bankruptcy.

It seemed like an impossible task for the automaker to appreciate by 1,200% when it could barely stay solvent. But as luck would have it, Wood’s bet on Tesla came true earlier this year, as Tesla shares rose to $800, or the predicted $4,000 pre-stock split.

Cathie Wood remains Ultra-Bullish on Bitcoin

Now, the star-studded asset manager is betting on Bitcoin to continue soaring. Cathie Wood has been a long-time advocate for the digital asset, with her ARKW fund holding approximately $370 million in GrayScale Bitcoin Trust (GBTC).

As Bitcoin prices surged this year, its market capitalization reached $1 trillion in value. While a monumental achievement for the world’s largest cryptocurrency, many analysts and investors doubted the digital currency’s future growth, citing limited potential upside. Wood, however, argued that Bitcoin’s market capitalization of over $1 trillion was just the beginning. In a recent CBOE panel, she said:

“If we add all of the potential demand relative to the limited supply, we come up with incredible numbers over the long term. We have just begun. One trillion dollars is nothing compared to where this ultimately will be.”

She stated that one of the most surprising developments for the cryptocurrency was the massive surge in institutional demand. As the United States economy faces inflationary pressures with potential interest rate hikes by 2023, analysts have predicted the dollar to depreciate.

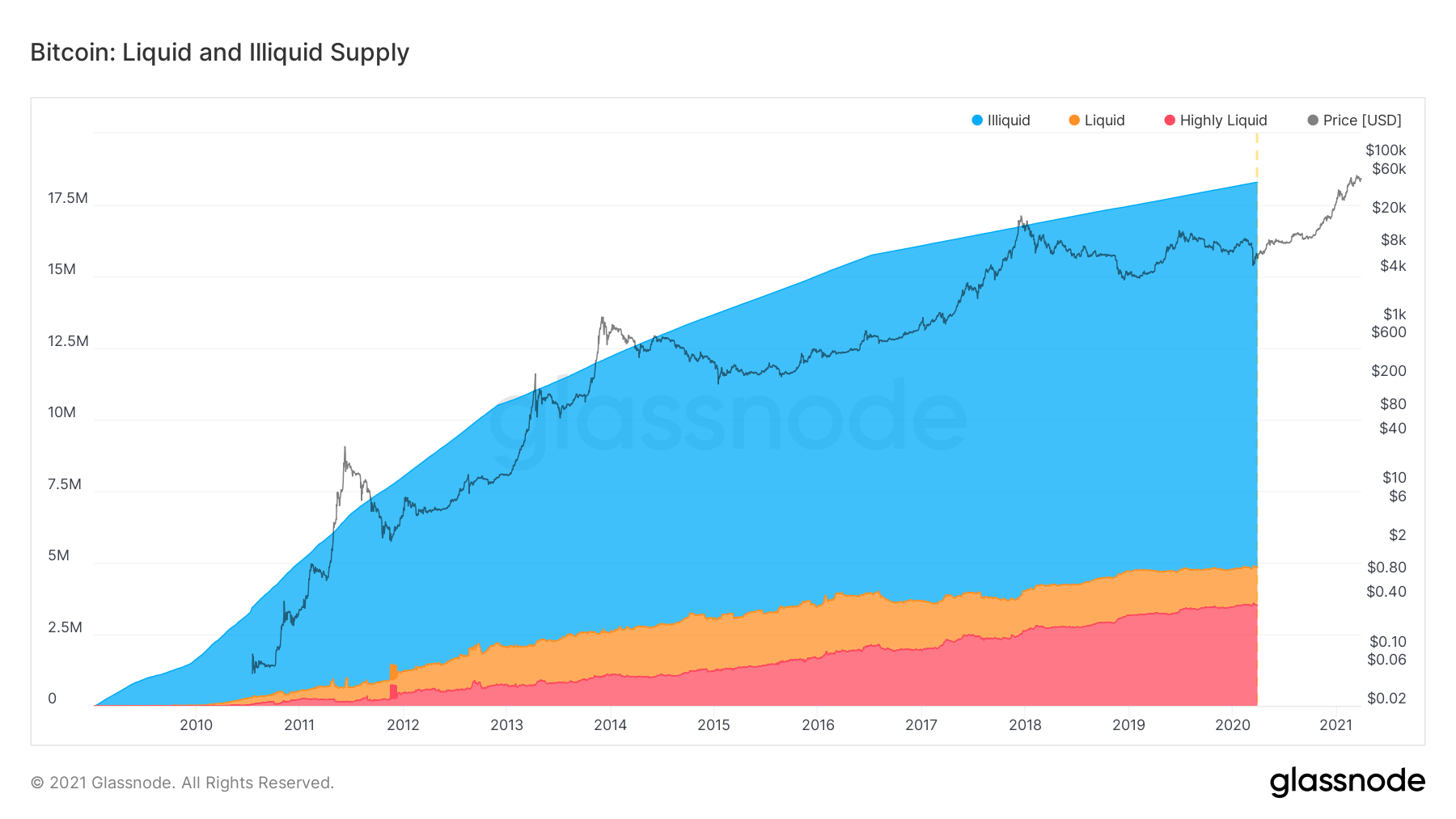

As a result, major institutional companies and asset management firms began hoarding Bitcoin and other cryptocurrencies, taking millions of coins out of circulation. According to figures from Glassnode, Bitcoin’s illiquid supply has continued to steadily rise throughout 2021.

Institutional Demand Far Exceeds Ark’s Expectations

Wood also commented on major tech companies adding Bitcoin on its balance sheet, and Tesla’s recent move to accept Bitcoin payments:

“We’ve seen Square do this, Tesla do it, MicroStrategy’s put, I mean, it’s defining its business around it now. And one of the reasons, as Tesla announced yesterday, is it would like to do business in Bitcoin in regions of the world… where conversion from one fiat to another is prohibitively expensive.”

Hailed as a “visionary” by some, Cathie Wood has often been ahead of Wall Street in adapting to an increasingly digital world. Will she be right on Bitcoin? That remains to be seen — but her past track record speaks for itself.

Featured image from UnSplash

[ad_2]