[ad_1]

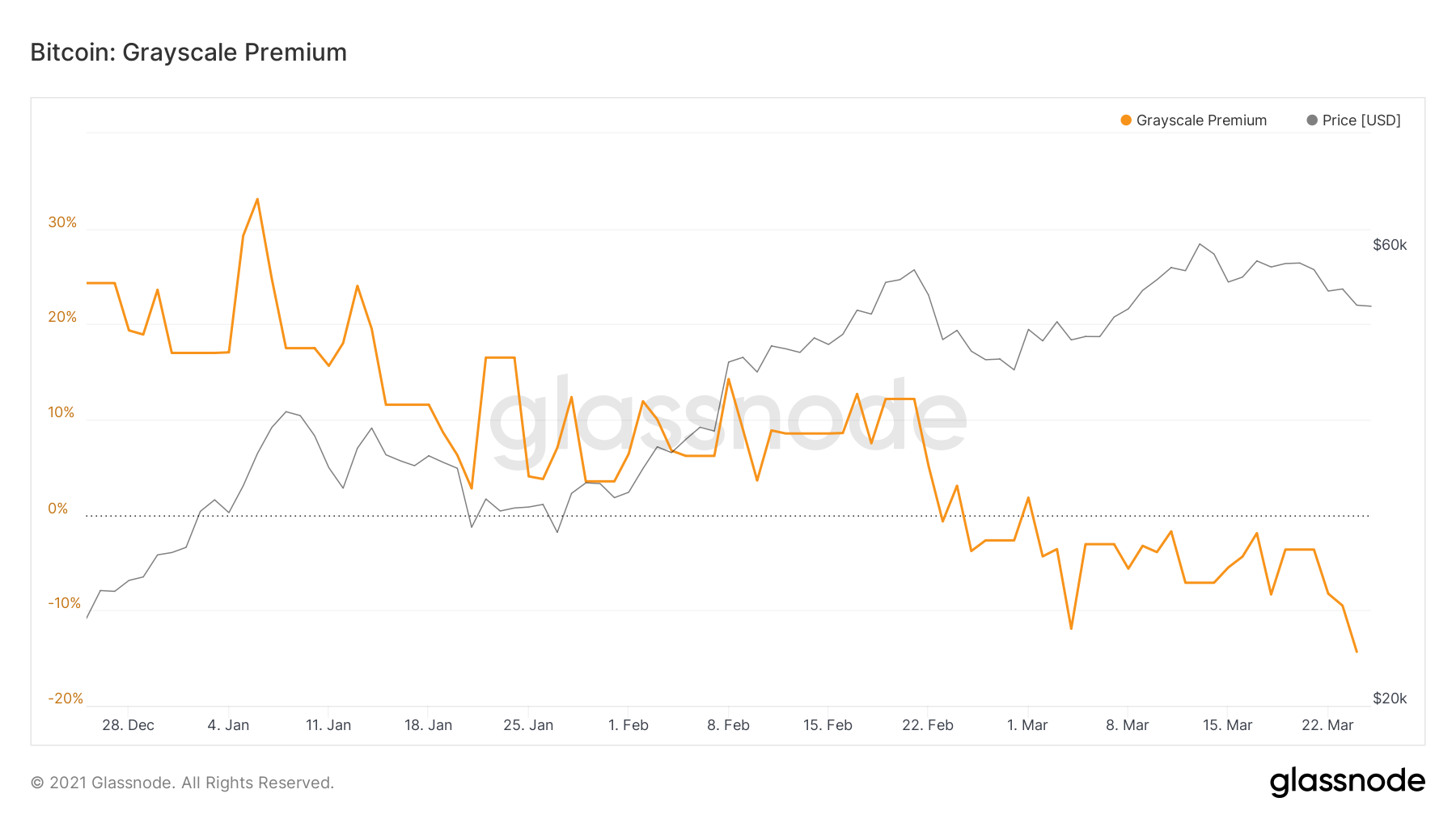

Since trading at a negative for nearly 2 months, GrayScale Bitcoin Trust (GBTC) premium plummeted to -14.21% this morning. Historically, GBTC has traded at a high premium relative to the underlying Bitcoin, commanding an average of 15.02% premium since the fund’s inception. But as competition grows and firms create cheaper, more accurate financial products, GBTC’s appeal has dropped dramatically — and its premium clearly shows for it.

Analyzing Why Grayscale Bitcoin Trust Premium Continues to Trade at a Discount

In late 2020, when Bitcoin prices nearly doubled, investors were willing to pay a hefty premium to gain exposure to the major cryptocurrency. This resulted in a huge increase in inflow, leading to the number of GBTC shares skyrocketing to 692 million at the time. However, the fund does not allow conversions or redemptions, meaning that shares can only be created, not destroyed.

This was not an issue when GBTC’s market demand allowed for a continuous increase in its supply. But with Bitcoin’s rally now lagging behind, there’s an overt imbalance between the supply and demand. This is further exacerbated by institutions taking profit, as their six-month lock-up periods end.

Another reason why Grayscale Bitcoin Trust premium has continued to decline is due to the launch of new Bitcoin-based financial products and exchange-traded funds.

Major investment banks Goldman Sachs and Morgan Stanley began offering Bitcoin-futures products earlier this year, with other banks showing their interest. Just yesterday, asset management giant Fidelity filed to create their own Bitcoin ETF available to U.S. investors. With sky-high management fees and massive slippages marring the fund’s credibility, GBTC will undoubtedly lose out to newer, more efficient funds.

Nate Geraci, President of advisory firm ETF Store, shared his thoughts on the matter: “[t]he unpleasant truth for GBTC investors is that competition erodes demand for the product, which can lead to a collapsing premium or even a discount.” Although Grayscale Bitcoin Trust still holds the title as the largest Bitcoin fund with an estimated AUM of $11 billion, it seems only a matter of time until the fund becomes obsolete.

Featured image from UnSplash

[ad_2]