[ad_1]

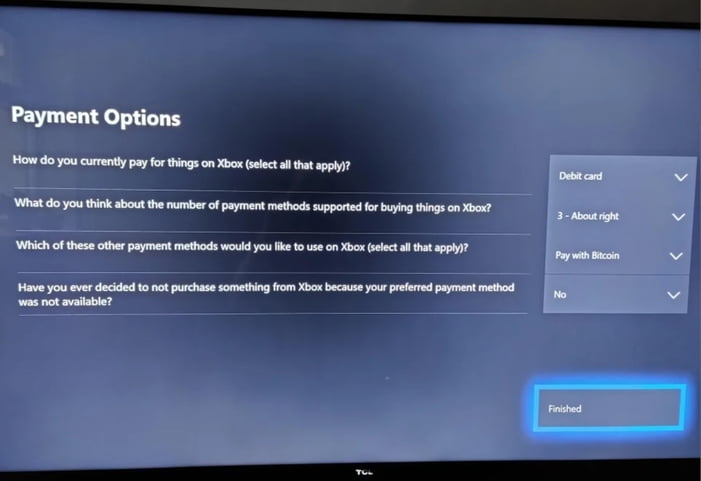

As part of an internal program, Microsoft has asked its users for their payment preferences. In a poll shared on Bitcoin’s subreddit (r/bitcoin), a user named “Jebusura” reported that the software company began polling for alternative payment methods. Microsoft asked the follow giving BTC as an option:

Which of these other payment methods would you like to use on Xbox?

Microsoft’s goal is to determine whether users would be comfortable paying for the Xbox gaming platform’s online store services with Bitcoin. The software company included BTC as a payment option for Windows apps and Xbox games in 2014.

Other users subsequently reported that this program was stopped. The software company reportedly resumed accepting payments with Bitcoin earlier this year for items in the Microsoft Store. This internal Xbox program appears to be an expansion of that first initiative.

Microsoft will not buy Bitcoin like Tesla

The last major company to accept Bitcoin as a payment method was Tesla. The automobile company led by Elon Musk included the cryptocurrency as a payment method in mid-February. The company added Bitcoin as part of its balance sheet and boosted the cryptocurrency price to $58,000.

Unlike Tesla‘s CEO, former Microsoft CEO Bill Gates has an ambiguous position on the cryptocurrency. Gates has expressed concerns about the energy consumption of the Bitcoin network.

Both Gates and current Microsoft CEO Brad Smith have denied that the company will follow in Tesla’s footsteps about adopting BTC in its treasuries.

Bitcoin has performed negatively during the day, after a weekend moving sideways. BTC is trading at $54,600 and has lost key support at $55,000. Therefore, the price could continue to drop towards the low range of $50,000.

Analyst firm Glassnode has recorded strong support for Bitcoin from retail investors. In a report, Glassnode stated:

The persistent accumulation of small holders demonstrates a willingness to HODL through volatility with the trend unbroken from mid 2018 through the chaos of 2020. We also see a large swelling of 0.1 to 1 BTC holders immediately following the March 2020 Black Thursday sell-off. Despite a small degree of spending in the rally up to $42k, ‘sat stackers’ are back at an all-time-high of holdings.

[ad_2]