[ad_1]

Bitcoin’s options contracts used to hedge spot and futures market exposure are exhibiting bullish sentiment across all time frames in a sign of confidence in the cryptocurrency’s price rally.

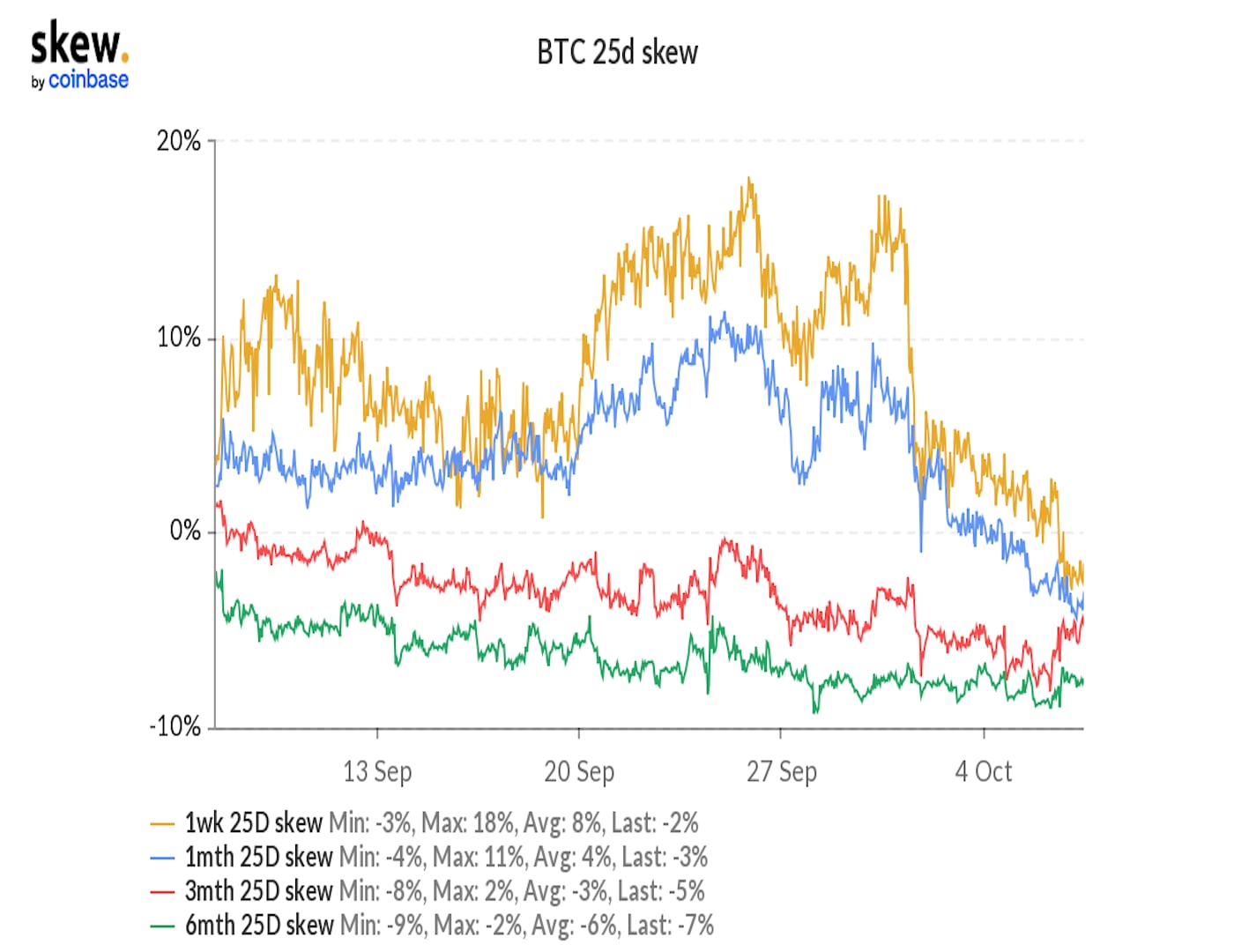

The one-week and one-, three- and six-month put-call skews are hovering below zero, indicating calls – or bullish bets – are drawing higher prices than puts, which are bearish bets.

The one-week and one-month metrics have recently flipped bullish, having seen positive values greater than 10% in the past month. Back then, traders sought short-dated downside protection on concerns the instability in China’s property industry and risk aversion in traditional markets would drag bitcoin lower. However, since Sept. 29, bitcoin has decoupled from the falling stock market.

“When the skew moves from over +10% in the past month to below zero, it indicates a more bullish overall sentiment,” said Luuk Strijers, chief commercial officer at Deribit, the world’s largest crypto options exchange by volumes and open interest. “Premiums [the price paid for options] for downward protection are getting cheaper.”

A call option gives the holder the right, but not the obligation, to buy the underlying asset at a predetermined price on or before a specific date. A put option gives the purchaser the choice to sell. A call buyer is implicitly bullish on the market, while a put buyer is bearish.

While short-dated puts drew higher prices than calls in September, the long-dated puts remained relatively cheap, implying continued confidence in long-term price prospects.

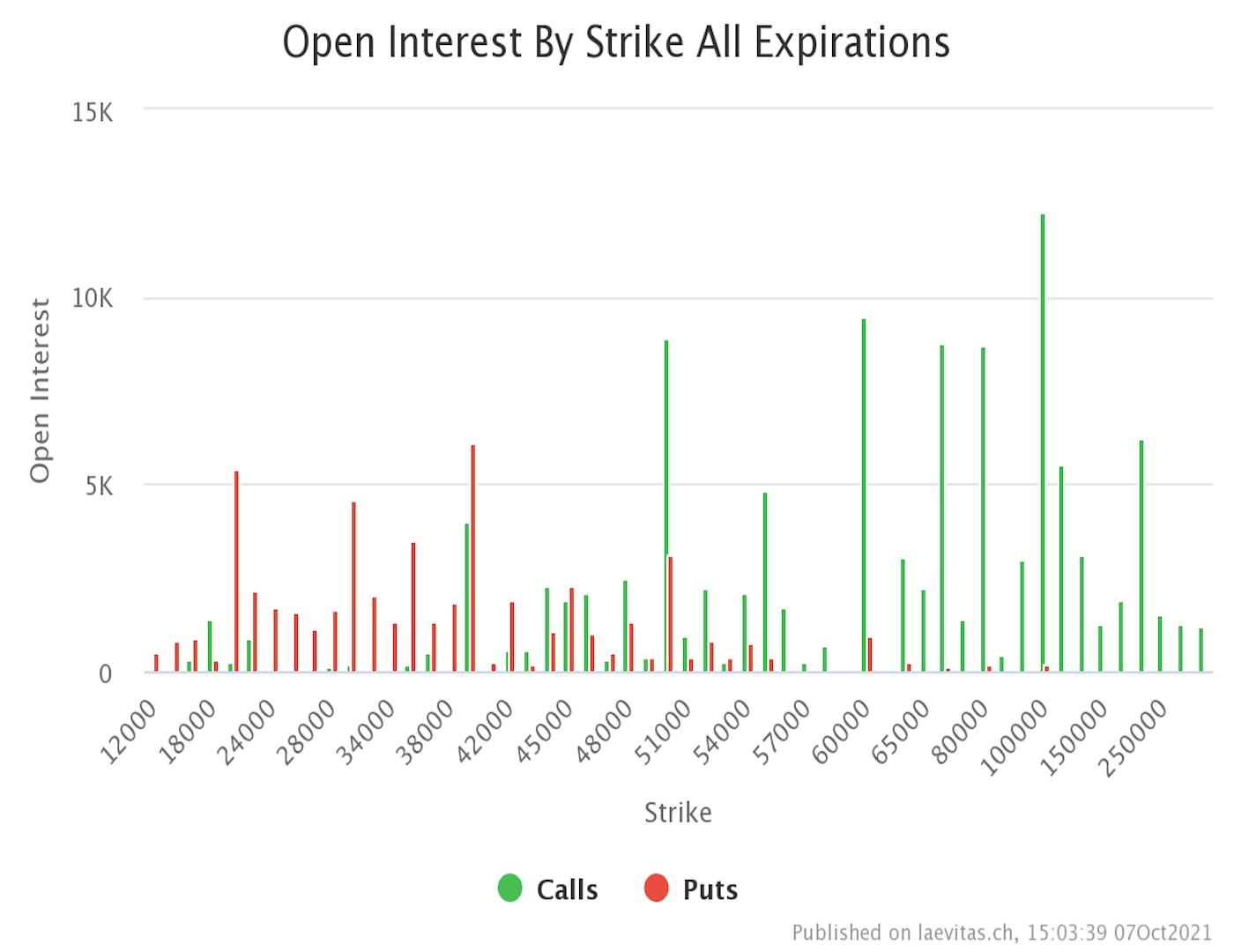

Now all four gauges are aligned in favor of the bulls. A closer look at the market activity reveals the call option at the $100,000 strike price has an open interest of more than 12,000 contracts and is the most popular option on Deribit.

Most of the call option open interest is concentrated in strikes well above bitcoin’s current market price.

When the trend is strong, traders often buy these cheap call options like lottery tickets. In the last 24 hours, the November expiry $80,000 call has seen significant volumes.

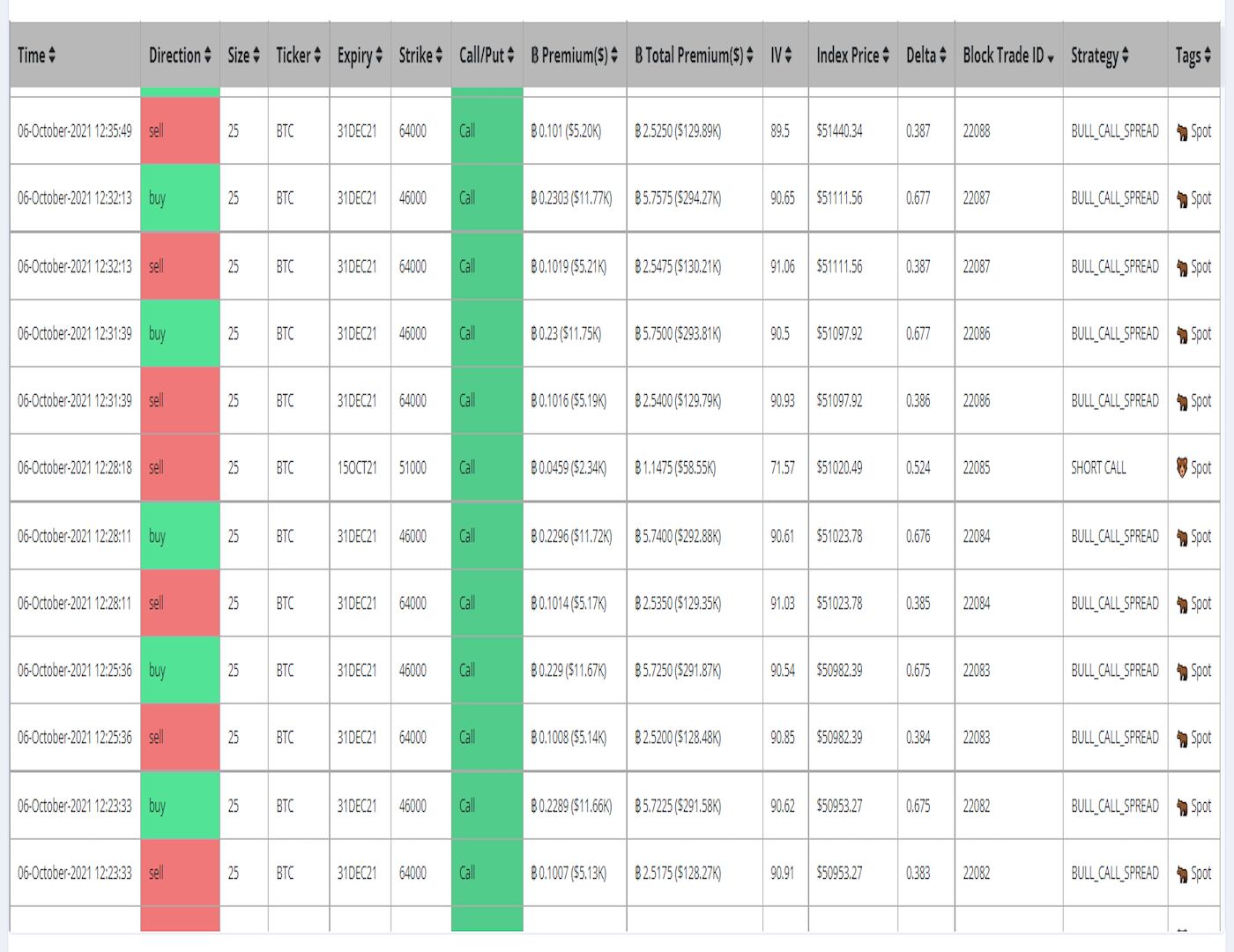

Some traders booked bulls call spreads early this week, according to data shared by Swiss-based analytics platform Laevitas.

The bull call spread involves buying call options below or above the spot market price and selling an equal number of calls with the same expiry at a higher strike price. It’s a limited-risk, limited-reward strategy designed to benefit from an increase in the underlying asset.

In the chart above, traders have bought December expiry call spreads at $46,000 and $64,000 strikes. The maximum profit is earned if the asset expires at or above the short call’s strike price, which is $64,000 in this case, on the settlement day.

The maximum loss is limited to the net premium paid while setting the strategy. It is arrived at by subtracting the compensation received for selling the $64,000 call from the premium paid for buying the $46,000 call.

The total amount of funds dedicated to bitcoin options has risen to $10 billion, the highest since May, according to Skew.

[ad_2]