[ad_1]

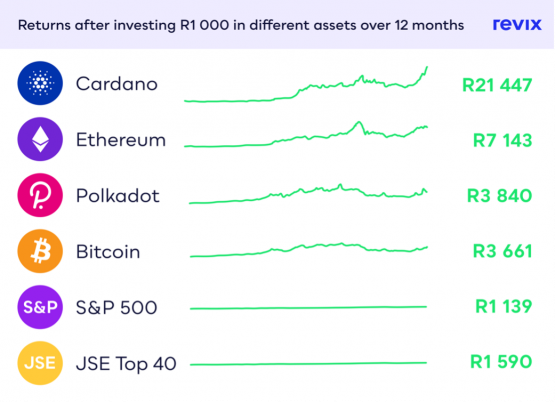

Polkadot’s (DOT) 284% price gain over the past 12 months is extraordinary when stacked against conventional market indices like the S&P 500 (13.1%) and the JSE Top 40 (15.9%).

Along with Cardano (ADA), DOT has been hailed as an ‘Ethereum-killer’. The fact that it has underperformed the likes of Ethereum (ETH) and ADA over the past 12 months is seen by some as a sign that DOT may be slow out of the starting blocks, but is likely to be a powerful finisher. All three are competing for dominance of the emerging ‘smart contract’ networks that are redefining the way we transact, invest and share information.

Smart contracts are pieces of computer code that allow people to transact safely in a ‘trustless’ environment. For example, you can already borrow money at relatively low interest rates on decentralised finance (DeFi) applications using your crypto assets as collateral. There is no credit vetting by a bank clerk, no KYC (Know Your Customer) obligations, and in many cases, you don’t even get asked for your name.

Smart contracts also let you buy insurance without a broker and get paid out without a company clerk interpreting the contract small print on your behalf. Soon, supply chains, purchase orders and a raft of business transactions will rely on smart contracts running on the blockchain – without intermediaries like lawyers and brokers extracting fees and creating inefficiencies.

Source: Revix

This is the space that Polkadot is aiming to dominate.

It seeks to become the blockchain of blockchains, allowing one blockchain to communicate with another.

So, what is Polkadot (the name of the network) and DOT (the currency used to transact on the network)?

Brett Hope Robertson (BHR), investment analyst at Revix, helps us sort this out.

What is Polkadot and what is it trying to do?

BHR: It is designed to allow transfers of any type of data or asset across different blockchains, so its appeal is its interoperability with all other blockchains, most of which were not built to communicate with different blockchains. For example, the Bitcoin blockchain serves an entirely different purpose than the Ethereum blockchain and is not designed to allow for the free flow of information or assets between the two. Polkadot is designed for exactly this. And while Ethereum has some great features, it has a critical shortcoming in its ability to scale. Polkadot has got some very intelligent functionality that allows it to scale and handle huge volumes of transactions, as many as one million a second, which is where you need to be if you are to be taken seriously in your quest to become the backbone of the new, emerging financial system.

Polkadot is led by Gavin Wood, who was the former chief technology officer for the Ethereum project. He left Ethereum with a clear vision in mind, and a goal to fix the bugs that bedevilled Ethereum in its early growth stages. Ethereum is currently trying to overcome some of its design flaws that resulted in network congestion and high ‘gas’ fees, through the Ethereum 2.0 upgrade, but Wood wanted to develop a technology from the ground up that would allow for massive scaling and protocol changes without disrupting the core network.

Should we be excited about it?

BHR: There are plenty of people who are excited about it, and the evidence of that is in the price of DOT, which is up 284% over 12 months. That’s by no means a blow-out performance in crypto terms, but it’s still pretty stunning. Now we are looking at a largely three-way race between ETH, ADA and DOT to see who comes to dominate this space. I wouldn’t rule out DOT as a dark horse in this race.

How does Polkadot work?

BHR: It is designed to join other networks together. As things stand, developers have to choose what blockchain to build applications on. Each chain has its own strengths and weaknesses that developers have to weigh up when deciding where to develop. Polkadot solves that problem by allowing for interoperability between chains, and it solves a lot of other problems too, such as excessive use of electricity for mining tokens and, crucially, the inability to transact at speed and instantly scale the network. There’s some fancy architecture behind all this, but the bottom line is that developers can build applications and pick and choose which parts of the Polkadot technology they want to use and which parts they don’t. This gives them flexibility to opt into those parts of the Polkadot network that suit them and stay away from those parts that don’t.

At the end of the day, the user doesn’t really care about the type of technology being used.

Consumers want to know that they can transact safely, and at speed, without having to switch between different networks.

Think of cellphone users hopping between MTN and Vodacom networks without ever knowing which one they are using. That’s what Polkadot aims to achieve in the financial space. It’s going to open a world of possibilities that are barely conceivable today.

How can one invest in Polkadot?

BHR: Revix has just launched DOT as a standalone cryptocurrency. If you buy in the next week (September 3 to 9) and pay in GBP or ZAR, your purchase will not be subject to fees.

Revix.com now offers Bitcoin, Ethereum, Uniswap, Cardano, PAX Gold and USDC as standalone cryptocurrencies. As well as a USDC Savings Vault, similar to that of a savings account.

In addition to this, Revix offers ‘bundled’ products giving you balanced exposure to these crypto sectors:

- The Top 10 Bundle, which spreads your investment equally across the 10 largest cryptocurrencies as measured by market cap;

- The Smart Contract Bundle, which spreads your investment equally across the Top 5 smart contract cryptocurrencies; and

- The Payments Bundle, which spreads your investment equally across the Top 5 cryptocurrencies focused on payments.

Should Polkadot form part of a diversified crypto portfolio?

BHR: Diversification is always the smart thing to do when it comes to investing. Without giving investment advice, do some research on smart contracts and Polkadot, and form your own view on what the future holds. I think if you see a future for smart contracts and blockchain technology, it would be worthwhile including some Polkadot in your crypto portfolio.

About Revix

Revix brings simplicity, trust and great customer service to investing. Its easy-to-use online platform enables anyone to securely own the world’s top investments in just a few clicks. Revix guides new clients through the sign-up process to their first deposit and first investment. Once set up, most customers manage their own portfolio but can access support from the Revix team at any time.

For more information, please visit www.revix.com

This article is intended for informational purposes only. The views expressed are not and should not be construed as investment advice or recommendations. This article is not an offer, nor the solicitation of an offer, to buy or sell any of the assets or securities mentioned herein. You should not invest more than you can afford to lose, and before investing, please take into consideration your level of experience, investment objectives and seek independent financial advice if necessary.

Brought to you by Revix.

Moneyweb does not endorse any product or service being advertised in sponsored articles on our platform.

[ad_2]