[ad_1]

- Ethereum is back in the bulls’ hands after reclaiming support at $2,100.

- Polkadot renews the bullish outlook after reclaiming the 50 SMA support.

The cryptocurrency market’s price action has been mundane in the last few days. Most of the recoveries witnessed last week stalled, leading to periods of consolidation. At the time of writing, most crypto assets are in the green. Note that Bitcoin has settled above $34,000 as bulls gaze toward $40,000.

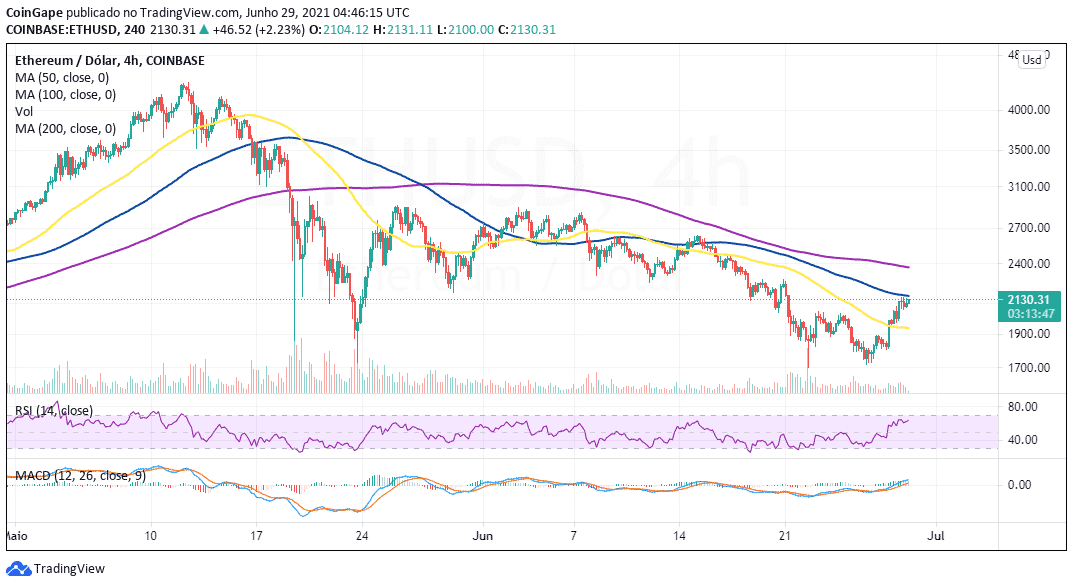

Ethereum:-

Ethereum price lifted from support at $1,700 but for some time could not rise above $2,000. Over the weekend session, the smart contract token reclaimed the ground above $2,000. Sustaining the uptrend became a problematic endeavor, especially with the hurdle at $2,100.

In the meantime, Ether has made it above $2,100, thus validating the bullish building uptrend. Its immediate upside is capped at the 100 Simple Moving Average (SMA) on the four-hour chart. It is worth mentioning that Ethereum trades at $2,126 at the time of writing.

If the 100 SMA resistance comes out of the way, Ethereum will extend the price action toward the key hurdle at $2,400, as highlighted by the 50 SMA. The uptrend has been validated by the Moving Average Convergence Divergence (MACD), as seen on the four-hour chart. If the MACD settles above the zero line, bulls will gain more momentum.

ETH/USD four-hour chart

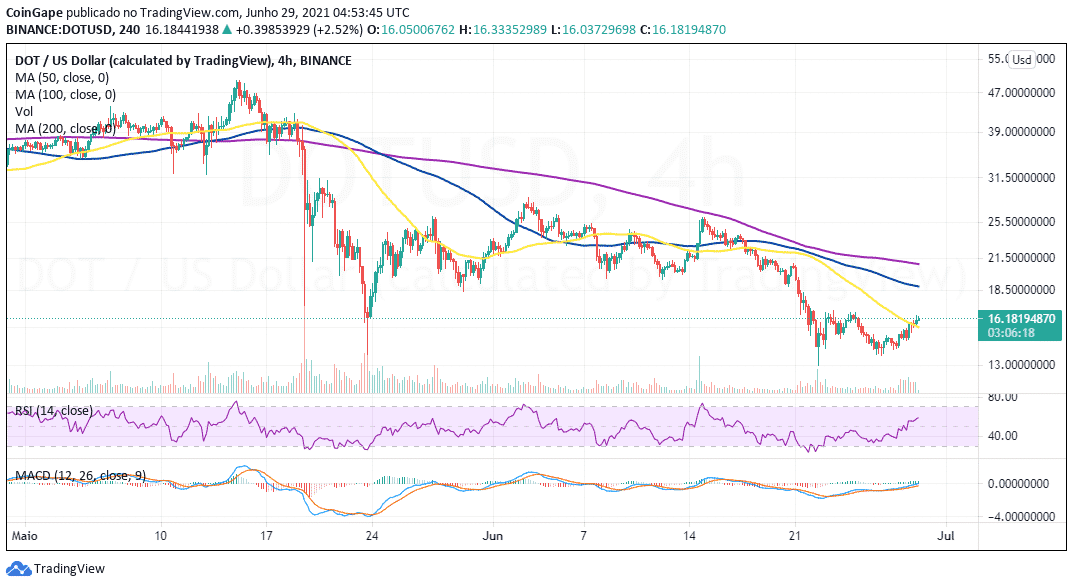

Polkadot:-

Polkadot price seems to be flipping bullish along with other crypto assets. After the recent freefall to $13.5, recovery has been gradual but consistent. Note that with the 50 Simple Moving Average (SMA) working as the immediate support, the least resistance path will be upward in the coming sessions.

DOT/USD four-hour chart

The MACD and the RSI already validate upswing as observed on the four-hour chart. If the latter crosses into the positive region, Polkadot may renew the uptrend to the next hurdle at $18.5. Closing the day above this level is crucial for sustaining the uptrend above $20. Similarly, the RSI affirms that bulls are in control by closing the gap toward the midline.

Disclaimer

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

[ad_2]