[ad_1]

“Taper” and “volatility” seem to be the words of the month as Bitcoin gets further away from its $69,000 November all-time high. Along with the short-term bearish sentiment in the crypto market, BTC had a pullback on December 13th dripping below $48,000. Some people see more downsides and others rather bid for BTCUSD gains.

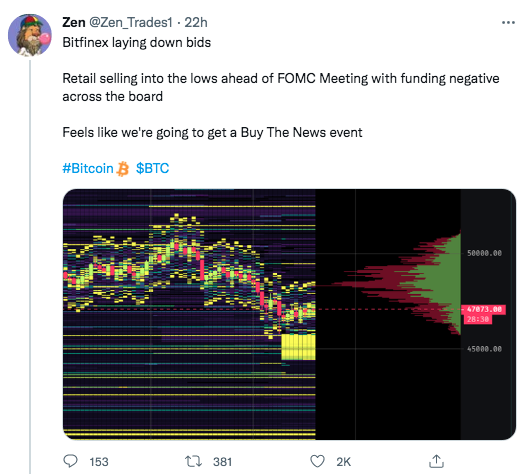

Investors have derisked as all eyes are on and the current Federal Open Market Committee (FOMC) meeting and the U.S. Federal Reserve tapering of asset purchases, fearing Chairman Jerome Powell will be –too– hawkish. There are many speculations running around and some experts have suggested this Wednesday could turn into a “buy the rumors, sell the news” event, thus Bitcoin could see more losses.

As NewsBTC has reported before, the central bank is expected to start reducing its net asset purchase month by month by $10 billion for Treasury securities and $5 billion for agency mortgage-backed securities.

The scenario could get uglier for the traditional and crypto markets if the Fed decides on a faster taper, doubling the pace to $30 billion a month, raising interest rates earlier, meaning higher volatility.

Related Reading | Surprise Bitcoin Selloff Causes Extreme Greed To Taper

What Traders Are Saying About Bitcoin

Analyst William Clemente claimed on Twitter that as the FOMC is “a known event”, then “anyone who is bearish BTC or wanted to risk-off lead up to FOMC has been and will have already done so by then.” Clemente wonders “how many sellers will be left + how much capital is on the sidelines.”

In a “sell the news” you have the opposite effect. The event is front ran by insiders first and then works its way to the bottom of the informational totem poll. By the time the event occurs, no one is there to buy, and everyone who bought in anticipation of that is offside.

For this reason, the analyst thinks that FOMC has a good chance to become a “sell the rumor, buy the news” event tomorrow.

Pair that with illiquid supply back at yearly highs and some large Bitfinex bids coming in. Just waiting for $53K to start bidding. Happy to miss some of the move and essentially pay for confirmation.

Basically, Clemente is saying there is so much uncertainty around the taper that once investors get a glimpse at what it will actually look like, they might start buying again. This, of course, does depend on how hard the tapering will be on the markets: the bull could resume if expected amounts are met, but huge dumps could come otherwise if the Fed tightens beyond those expectations.

Another Twitter user breaks it down: “It’s suggesting the market is overpricing in fear and selling off as a result. When the FOMC meeting occurs and uncertainty is removed, the market may react favorably even if at a headline it’s ‘bad’”.

But amongst traders, several opposite views are found on Bitcoin’s near-future. Michaël van de Poppe, on the other hand, commented that the market is dropping down, and “we’re looking for a bullish divergence to be created beneath the $46.5K area in order to have a reversal possible.”

A market report by the expert Ben Lilly read interesting warning signs and concluded:

It is clear next year will be tough sledding. Part of that is because the response by the Fed will require tools that have never been used before. It is a tough task to tone down inflation after unprecedented new money supply being added… All while not creating a massive deleveraging effect in the debt markets that could result in a recession.

Furthermore, Kaiko, digital assets data provider, analyzed the price movements as Bitcoin allegedly leans towards a higher correlation with traditional stocks than it does with gold:

Overall, Bitcoin’s correlation with traditional equities has been on the rise while its correlation with gold has been mostly negative. … Risk-off sentiment seems to be driving similar investor responses for equities and crypto, disrupting Bitcoin’s narrative as a safe haven and inflation hedge.

Related Reading | Crypto Market “Extreme Fear” Metric Reaches Multi Month Low

[ad_2]