[ad_1]

October has been a strong month for cryptocurrencies like bitcoin but a number of decentralized finance (defi) tokens have seen higher double-digit gains this past week. Moreover, non-fungible token (NFT) sales have picked up and after the total-value locked (TVL) in defi crossed $200 billion on October 5, two weeks later another $22 billion has been added to the TVL.

Defi Network Tokens Polkadot, Polygon, Binance Coin, Stacks Outperform Bitcoin’s Weekly Gains

Bitcoin (BTC) has been doing extremely well and BTC dominance has increased to 45.3% during the last week. However, a decent quantity of defi tokens from specific blockchain networks have outperformed BTC during the last week.

In fact, out of all the crypto assets in existence today, nine different digital assets saw better gains than bitcoin and a great deal of them are focused on defi. Polkadot (DOT) was this week’s leader with an increase of 19.6% and those gains were followed by polygon’s (MATIC) 19.4% percentage gains. Other strong gainers that outperformed bitcoin included binance coin (BNB), stacks (STX), and stellar (XLM).

Total-Value Locked in Defi Sees $22 Billion Added in 2 Weeks

Two weeks ago, on October 5, the total-value locked (TVL) in defi surpassed $200 billion and today defillama.com stats indicate the TVL is $222 billion. The decentralized exchange (dex) platform Curve holds the largest dominance with 7.72% of the TVL in defi. Curve is followed by Aave, Makerdao, and Wrapped Bitcoin in terms of defi dominance on October 18.

Ethereum captures $152.27 billion of the total TVL in defi and the Binance Smart Chain (BSC) commands $19.22 billion. Blockchains that have seen significant increases in TVL in defi include networks like Solana, Terra, and Avalanche. While Avalanche saw a 31.24% TVL gain, Harmony’s TVL increased by 24% during the last week.

Monthly Non-Fungible Token Sales Increase, Opensea Nears $10 Billion in All-Time NFT Sales

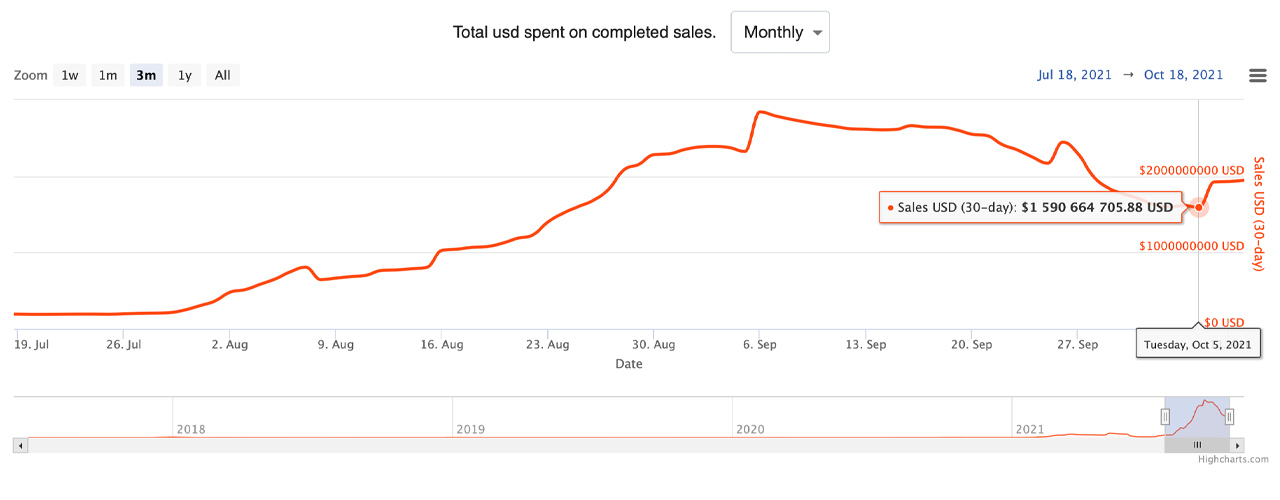

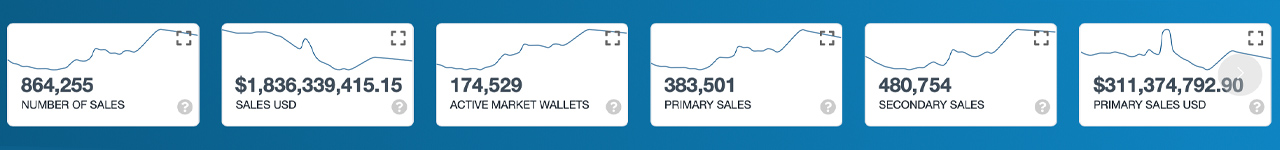

Metrics from nonfungible.com’s 30-day market history indicates that NFT sales jumped a great deal on October 5, and have continued to rise. NFT sales recorded during the last month were around $1.836 billion across 174,529 active market wallets.

Statistics from Dune Analytics show that the total transaction volume for NFTs measured in ETH, across 5.9 million transactions, is around 3,886,298 ether or $11.1 billion using today’s exchange rates.

Moreover, dappradar.com data shows that the NFT marketplace Opensea is nearing $10 billion in all-time sales and currently has $9.19 billion recorded so far. Axie Infinity has $2.61 billion and the NFT marketplace Rarible has recorded $230.76 million in all-time sales.

Polygon, Binance Smart Chain Addresses Tap All-Time Highs, Dex Trade Volume Remains Flat While Sushiswap Volume ‘Increased Sharply’

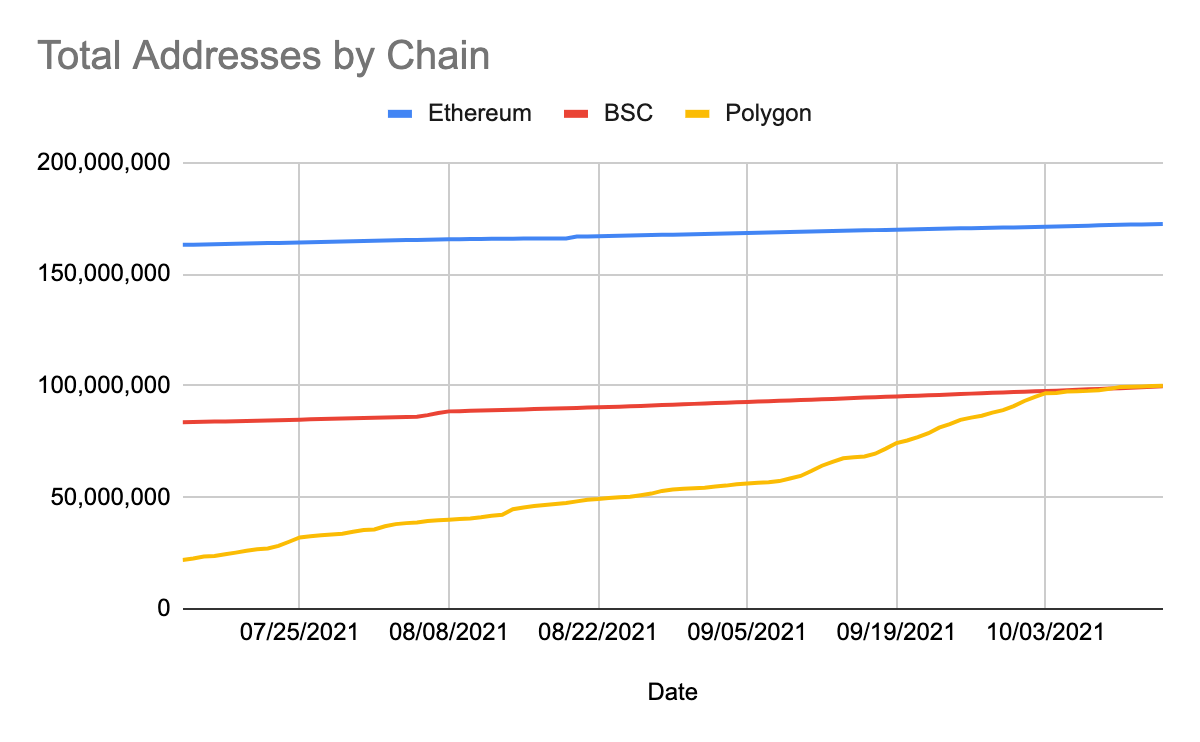

Additionally, statistics recorded by Coin98 Analytics weekly defi report indicates that the number of BSC active addresses reached an all-time high. However, the Polygon (MATIC) network surpassed BSC as far as the quantity of wallets created onchain.

“It also reached the ATH of 100 million wallets,” Coin98 Analytics said in its report. “The number of Ethereum wallets has remained unchanged from last week.”

The weekly report also discusses defi’s liquidity by protocol, dex platform weekly trading volume, and the daily active dex users as well. The report highlights that while dex trade volume has not grown much, it maintained $20 to $22 billion each month. Coin98 Analytics detailed, however, that Sushiswap volume “increased sharply, reaching $2.7 billion.”

What do you think about the defi tokens outperforming bitcoin and the TVL increase during the last two weeks? What do you think about the NFT sales volumes increasing and the address increase on Polygon and Binance Smart Chain? Let us know what you think about these subjects in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coin98 Analytics, Nonfungible.com, Defillama.com,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

[ad_2]