[ad_1]

Polkadot (DOT)

Above: Polkadot (DOTUSD)

Polkadot has had one heck of a run over the past week. As a leader in the DeFi space, its important that an instrument like DOT maintain a bullish presence and price action. The chart above is the $0.25/3-box reversal Point and Figure chart. Currently, there is a double top – but because of the wide price action that has traded, I’m not comfortable taking a long on a breakout above that double top. Instead, I’ve drawn the kind of setup I need to see in order to consider taking a long. I want to see a new O-column print (it can go below the drawn in red circles) and then a follow-up column of Xs. In a nutshell, I want to see a triple-top. Then the long entry looks good at $15.50. I’d more than likely limit my profit target the prior peak at $17.50.

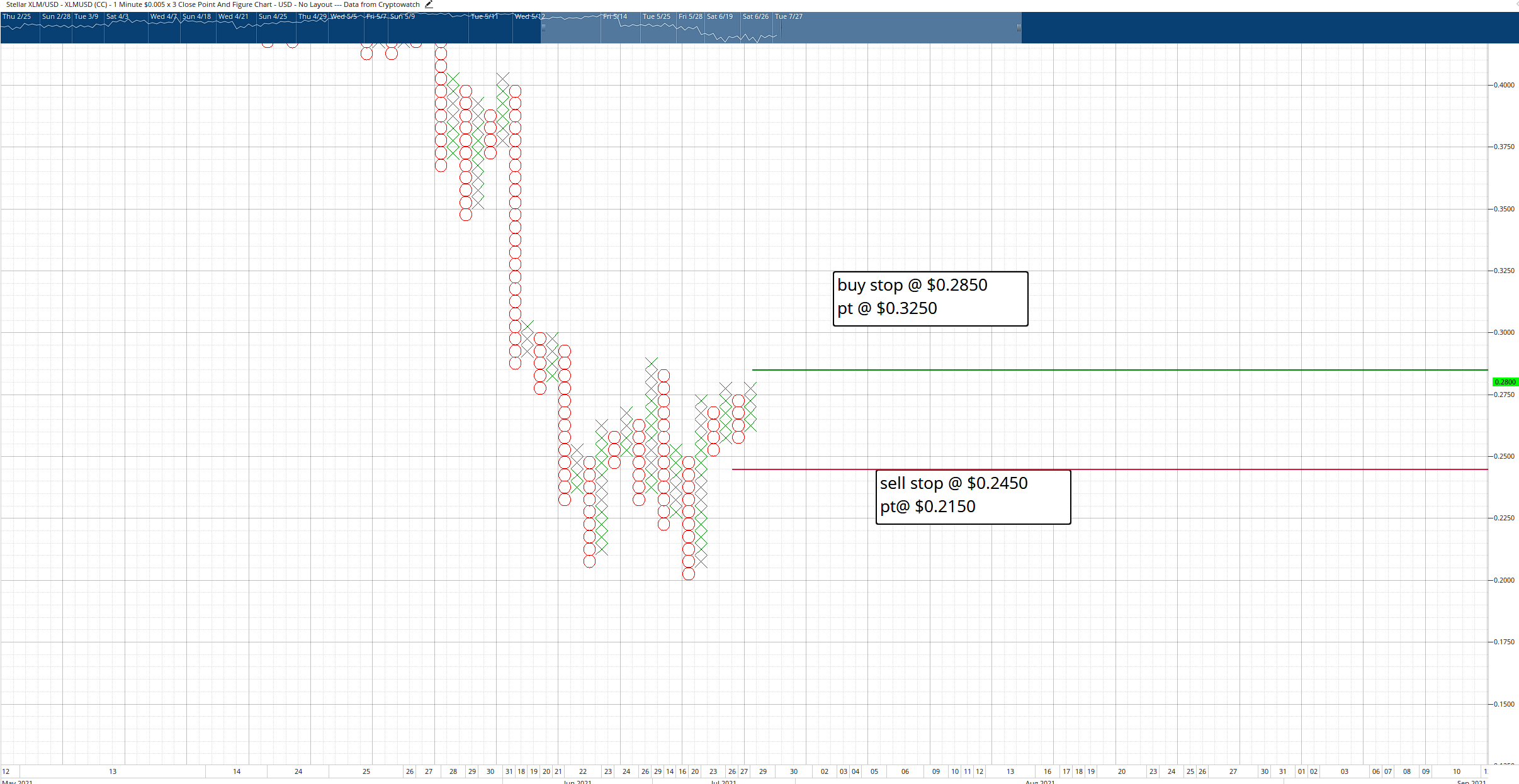

Stellar (XLM)

Above: Stellar (XLMUSD)

Stellar’s candlestick chart (not shown) is one of the few cryptocurrency charts that I analyse with clear bullish momentum and a probable bullish breakout coming. But the price action has been congested and continues to whipsaw on smaller time frames. Point and Figure charts really help eliminate the noise and make it easier to see what is happening. For Stellar, I see two possible entries for both the long and short side of the market. First, is a buy stop at $.2850. The buy stop entry would be at the break of a triple-top and the profit target would be at the $0.3250 value area. On the short side of the trade, I see a sell stop at $0.2450 with a profit target at $0.2150.

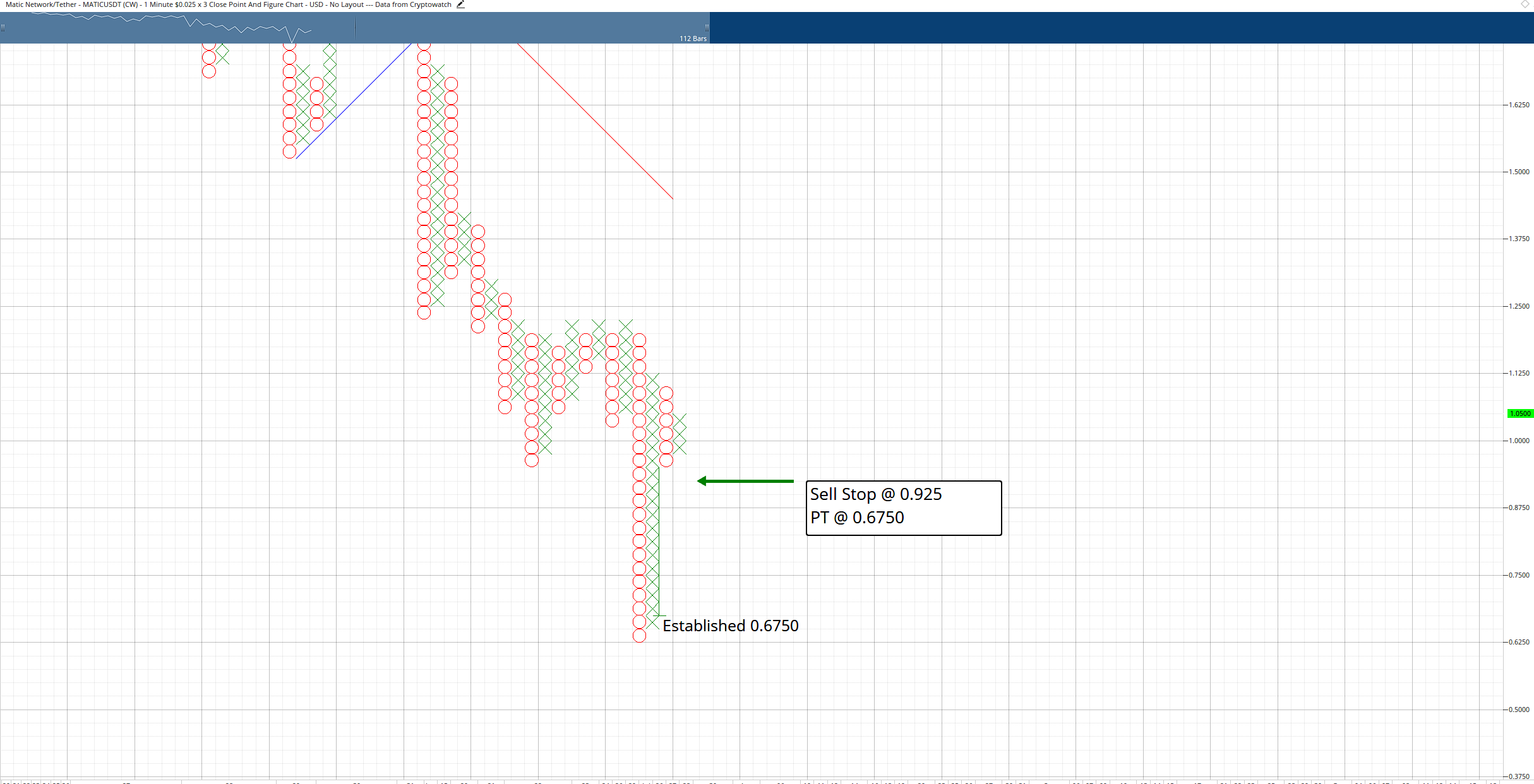

Polygon (MATIC)

Above: Polygon (MATICUSD)

Polygon will be a cryptocurrency we’ll be talking about and hearing about much more of in the future. However, in the short term I see the short side of the market (no pun intended) more likely than the long side of the market. There is a clear setup coming for buying opportunities, but price needs to setup for those conditions yet. I see a short opportunity with the break of a double bottom at $0.9250 with a profit target near the prior swing low at $0.6750.

Monero (XMR)

Above: Monero (XMRUSD)

Monero’s performance over the past eight trading days has also been fantastic for the bulls. It’s currently up against a strong series of resistance levels on the 3-week Ichimoku chart, the weekly Ichimoku chart, and the daily Ichimoku chart. While those charts are not shown here, they provide the kind of information needed to identify a trading opportunity on Monero’s $1/3-box reversal Point and Figure chart. A short entry at $238 would mean two bearish events occurred. First is the standard break of a double bottom, but most important is the pattern that would generate from that double bottom break. The pattern above is a form of a bull-trap known as a bullish washout. The theory is that many buyers will be trapped as Monero moves down to lower prices. The profit target zone here is in the $215 value area.

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016 – 2020. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone.

Find out more here.

[ad_2]