[ad_1]

Cryptocurrencies are back on the bull ahead of today’s Fed announcements. Currently, no policy moves are being anticipated and the FOMC is widely expected to maintain its dovish attitude. For cryptos, no policy news is good news. With about an hour to go until the FOMC Statement is released to the public, values are up across the board. One of the big winners has been Polkadot (+5.02%) which is once again closing in on the $15.00 handle.

The past several weeks have been tumultuous for Polkadot. Values have been all over the board as investors mulled the future of crypto. However, a devalued USD is certainly good for business. As of this writing, the USD Index is flat, having fallen back beneath 93.00. Given that the CME FedWatch Index is assigning a 100% probability to interest rates being held at 0.0-0.25% this afternoon, it’s little wonder that cryptos are showing a bit of short-term strength.

Late July has been a solid period for Polkadot and the DOT/USD. Prices have risen in seven of the past eight sessions and are now on the cusp of retesting the $15.00 psyche level.

Polkadot Rallies Ahead Of The Fed

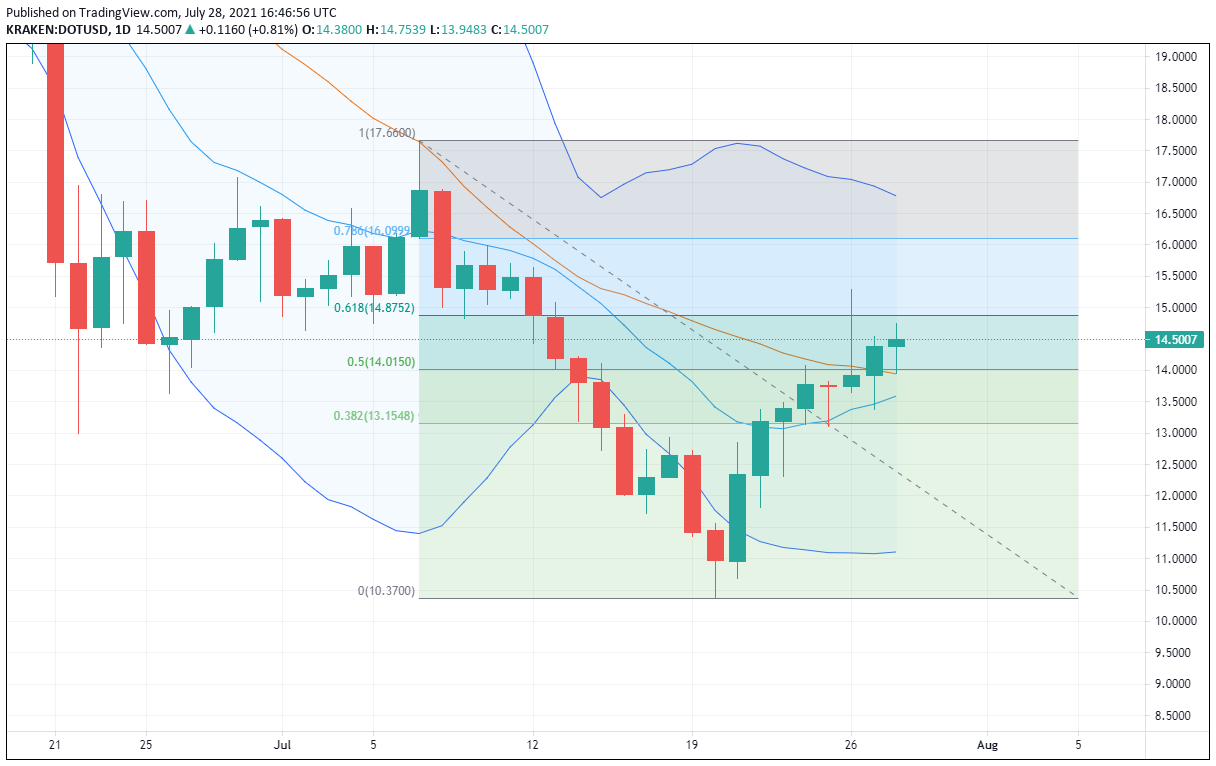

The DOT/USD daily chart below gives us a good look at the recent bullish action in Polkadot. Consistent bidding has prices closing in on the 62% Fibonacci retracement of July 2021’s range ($14.87).

Bottom Line: For the time being, a short-term bullish bias is warranted for Polkadot. However, the long-term bearish trend remains very much alive as values are off nearly 70% from 2021’s high ($49.75). Until elected, I’ll be looking to follow the macro trend and sell the DOT/USD from $14.85. With an initial stop loss at $15.75, this short scalp yields $0.90 (6%) on a 1:1 risk vs reward ratio.

[ad_2]