[ad_1]

Data from proof-of-stake research platform Staking Rewards shows Cardano is the most staked chain, by value, in the cryptocurrency space.

The Cardano network currently hosts $29.7 billion of ADA staked. While the next nearest token, Ethereum, comes in at a significantly lower $12.3 billion.

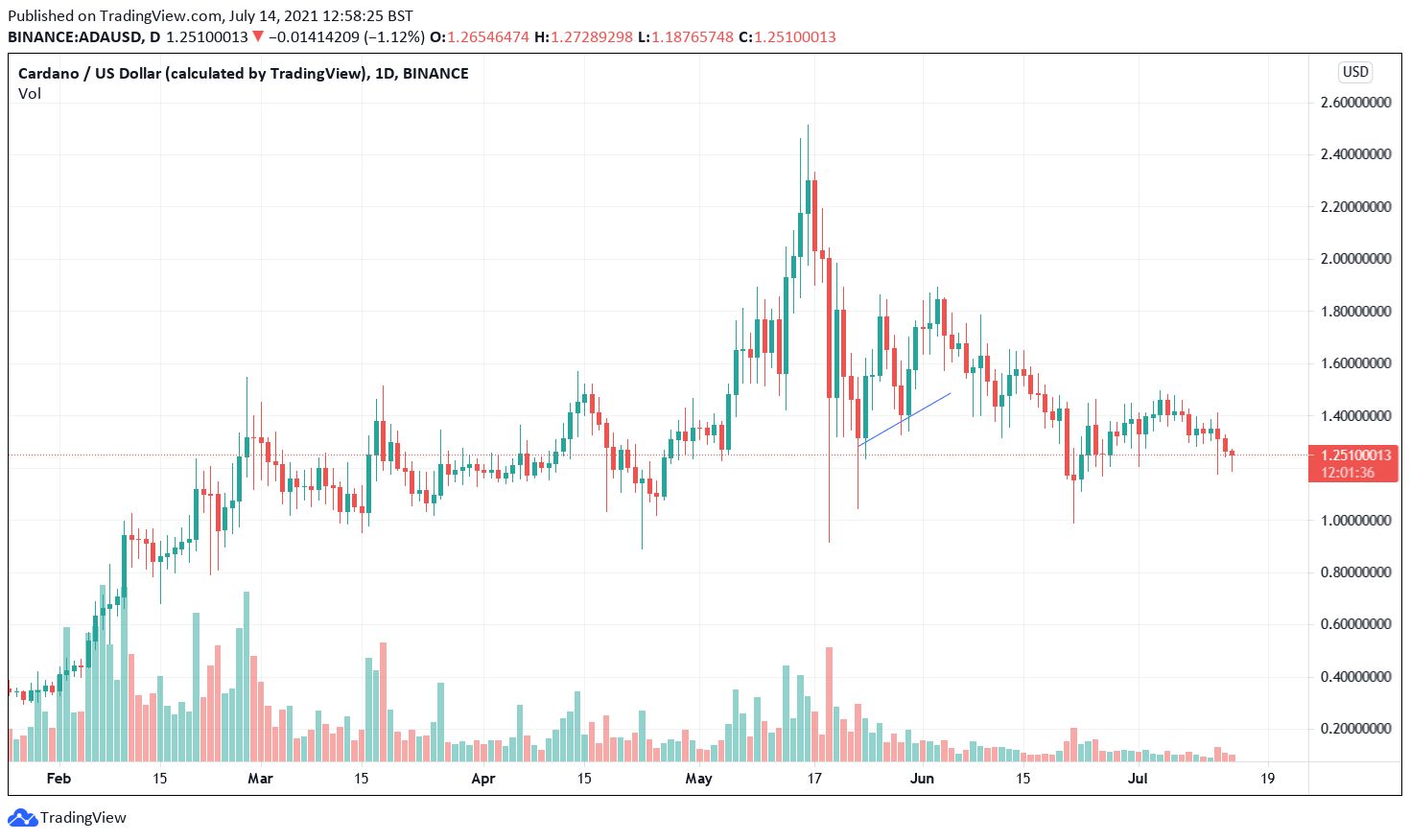

However, staked value is a somewhat one-dimension metric without consideration of price. Cardano’s price consistency has enabled it to stay top of the pile.

Cardano has fared well during the downturn

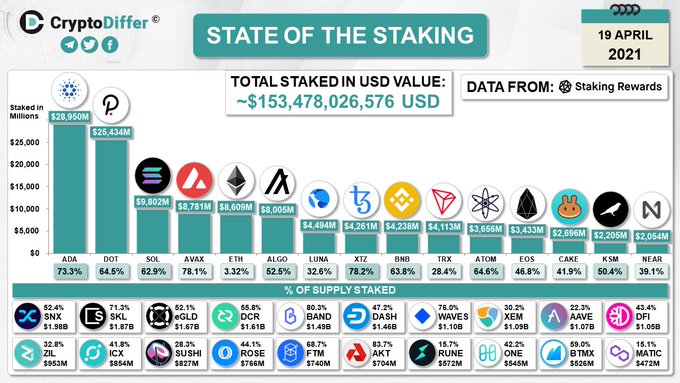

In April, as the crypto markets approached the local top, data from analytics firm CryptoDiffer showed a similar story.

Back then, Cardano also topped the list of staking chains, with a staked value of $29.85 billion. This was closely followed by Polkadot coming in at $25.43 billion. Whereas Ethereum was way down the pecking order in fifth place at $8.61 billion.

But now, according to Staking Rewards, Polkadot and Ethereum have switched fortunes.

Comparing the two data sets, the value of Polkadot staked has seen a 60% drop between now and mid-April, leading to a fall in its standing as the second most staked chain.

Analysis of price, or more accurately price resistance to the downturn, could explain this shift in rankings. Value staked is calculated by token price multiplied by the number of staked tokens.

DOT closed on April 19 priced at just under $35. But DOT has fared badly during the recent downturn, showing little fightback in terms of recapturing pre-downturn prices. Today, DOT is priced at around $14 – also a 60% drop.

DOT’s price capitulation would go some way in explaining Polkadot’s fall in staked value.

On the other hand, ADA closed April 19 priced at around $1.20. The downturn has been relatively kind, even seeing a brief uptrend of higher lows post-FUD. Today, ADA is priced slightly above where it was two or so months ago, at $1.25.

Ethereum is one to watch

Staking on Ethereum presents a number of issues. Firstly, under current criteria, there’s a minimum 32 ETH staking requirement, which at current prices excludes most users.

Then there’s the problem of time-locked deposits for an indefinite period. Developers Consensys says users can withdraw their staked ETH after Phase 2 of ETH 2.0 goes live. But when that will be is anyone’s guess.

Since staking became available on Ethereum, staking pools and exchanges started offering staking services that bypass the above objections. For example, on Binance, users can stake a minimum of 0.1 ETH, and they also offer a derivative token, BETH, which enables a degree of flexibility as far as exiting is concerned.

The threat to Cardano’s staking crown is two-fold. One, as more people utilize staking pools and exchanges for Ethereum staking. And two, as ETH 2.0 Phase 2 approaches.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Like what you see? Subscribe for updates.

[ad_2]