[ad_1]

- LocalBitcoins has added Chainlink as a payment method

- Chainlink was added alongside Tether, Polkadot, Cardano, BCH, USDC, Dogecoin

- LocalBitcoin has also added support for several traditional payment methods such as Uphold, PaySera, Airtel Money and More

- Chainlink is currently having a hard time breaking past the 100-day moving average at the $30 – $32 price area

The global peer-to-peer Bitcoin trading platform of LocalBitcoins has added Chainlink (LINK) as a payment method. The team at LocalBitcoin’s made the announcement back in late May and also pointed out the inclusion of additional popular digital assets as listed in the following statement.

It is now possible to create advertisements and accept Tether (USDT), Polkadot (DOT), Cardano (ADA), Bitcoin Cash (BCH), USD Coin (USDC), Chainlink (LINK) and Dogecoin (DOGE) as payment methods.

LocalBitcoins Adds Other Traditional Payment Methods

The announcement by LocalBitcoins also included the addition of the following global payment methods depending on the jurisdiction of its users.

PAYSEND, AirTM, Uphold, PaySera, Remitly, EcoPayz, Vodafone Cash, Monese, Airtel Money, Orange Money, MTN Mobile Money, Eversend, Sendwave, OneMoney, Mukuru, Zipit, Bunq, N26, Bizum, MBWay, MercadoPago, PagoFacil, RapiPago, Boleto Bancário, PIX instant payment, PicPay, Mach, Baloto, Efecty, MOVII, Nequi, PSE, YAPE, Bhim, Freecharge, PhonePe, Easypaisa, JazzCash, GCash, MonCash, Chime, N26, ERIP, GEO Pay

Chainlink Battles to Break the 100-day Moving Average

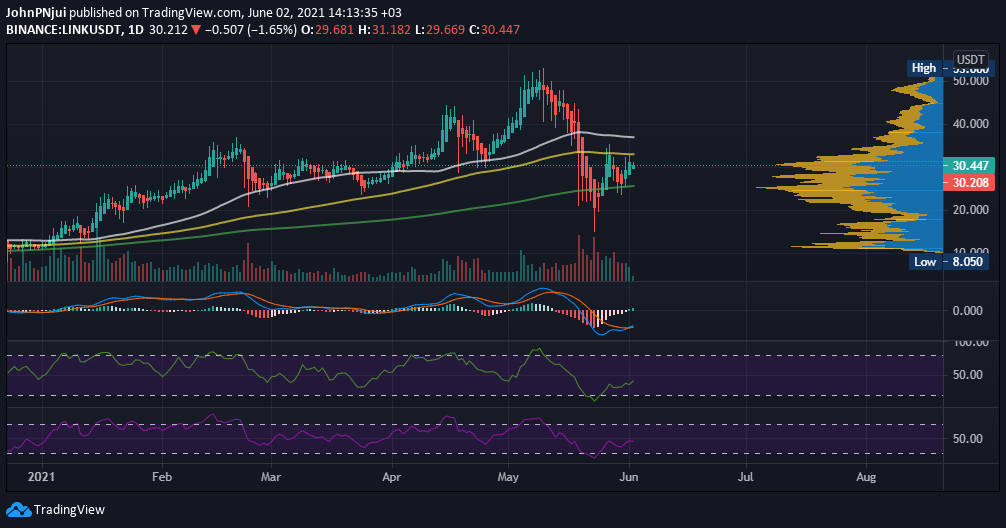

With respect to price action, Chainlink is currently trading above the crucial 200-day (green) moving average as seen in the chart below. However, the digital asset has met tough resistance at the $30 to $32 price range that also converges with the 100-day (yellow) moving average.

Also from the chart, it can be observed that the three daily indicators – MACD, RSI and MFI – are pointing towards an ongoing trend reversal for Chainlink from the bearish environment experienced in late May. Although, the daily trade volume is yet to provide the much-needed confidence to conclusively state that Chainlink will retest levels past the 50-day moving average at the $37 price area.

To note is that the value of LINK in the crypto markets is tied to its function calls on the Ethereum network. As a result, LINK’s price is hinged upon increased DeFi activity on Ethereum in addition to Bitcoin being the overall compass for the market direction in the crypto markets.

Therefore, DeFi on Ethereum needs to thrive once again and Bitcoin has to be stable for Chainlink to keep rising above $30.

[ad_2]