[ad_1]

Polkadot (DOT), the native token of the Polkadot blockchain, looks poised to turn higher, having put in an inverted bullish hammer candle last week.

The inverted hammer comprises a small real body, an extended upper wick, and little or no lower wick. The extended upper wick results from bulls trying to push prices higher. For instance, DOT opened last week at $17.92 and rose as high as $26 in a sign of bargain hunters stepping in following a sharp sell-off from $49 to nearly $13 in the preceding two weeks, according to data provided by TradingView.

The cryptocurrency, however, ended the week with 14% gains at $20.47, forming an inverted hammer with a long upper wick and small body. The pattern has appeared after a notable sell-off and signals a potential bullish reversal.

However, confirmation of the reversal higher requires a move above the Asian session high of $21.05. Therefore, seasoned traders are likely to wait on the sidelines for the time being, waiting for a move above $21.05 to materialize before entering a long position.

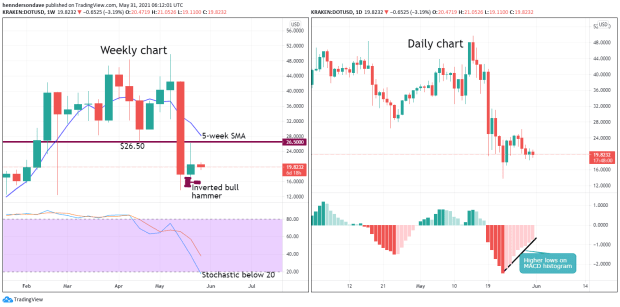

Price chart: Weekly and daily

Technical indicators support the case for a price bounce. The weekly stochastic has entered oversold territory below 20, meaning the market is over-extended to the downside. Meanwhile, the daily chart MACD histogram is printing higher lows below the zero line, a sign of weakening of the downward momentum.

The immediate resistance is $26.50 (April low), followed by $28.14, marked by the downward trending 5-week SMA (simple moving average). Support is seen at $17.10 (last week’s low). A break lower would expose the May 23 low of $13.81.

This is a guest post. Investing in cryptocurrencies is speculative and investors should carefully conduct all research and diligence before making trades.

[ad_2]