[ad_1]

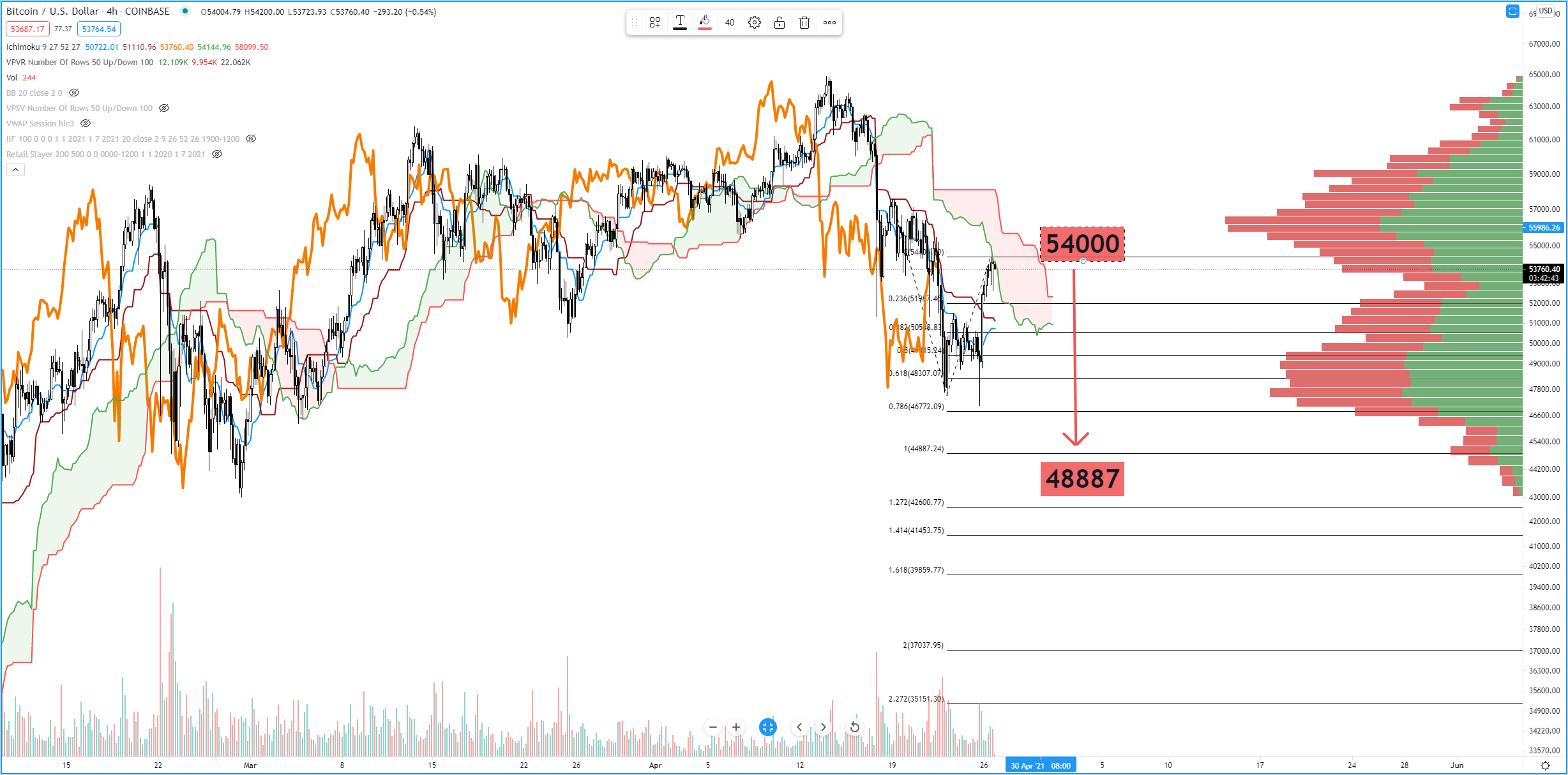

Bitcoin (BTCUSD)

Above: Bitcoin (BTCUSD) 4-hour Chart

The chart above is Bitcoin’s 4-hour chart. The rally that Bitcoin experienced on it’s Monday sessions was phenomenal – but on lower volume. If we don’t see any follow through higher during Tuesday’s trading session, then we’re likely to see Bitcoin trade lower. I like an aggressive short entry between 56,000 and 5300. One could argue that Bitcoin completed a corrective wave at 54000. This would mean Bitcoin could return to test the 44500 value area. How did I get that number? Easy – it’s the 100% Fibonacci extension from the 57620 swing high, the most recent swing low at 47044 and the Monday swing high of 54400. However, if Bitcoin were to trade above 57,000 then the short idea would be invalidated. Additionally, the market is still overwhelmingly bullish for cryptocurrencies so I’d watch for any strong buying at the key Ichimoku levels at 51110 and 50700.

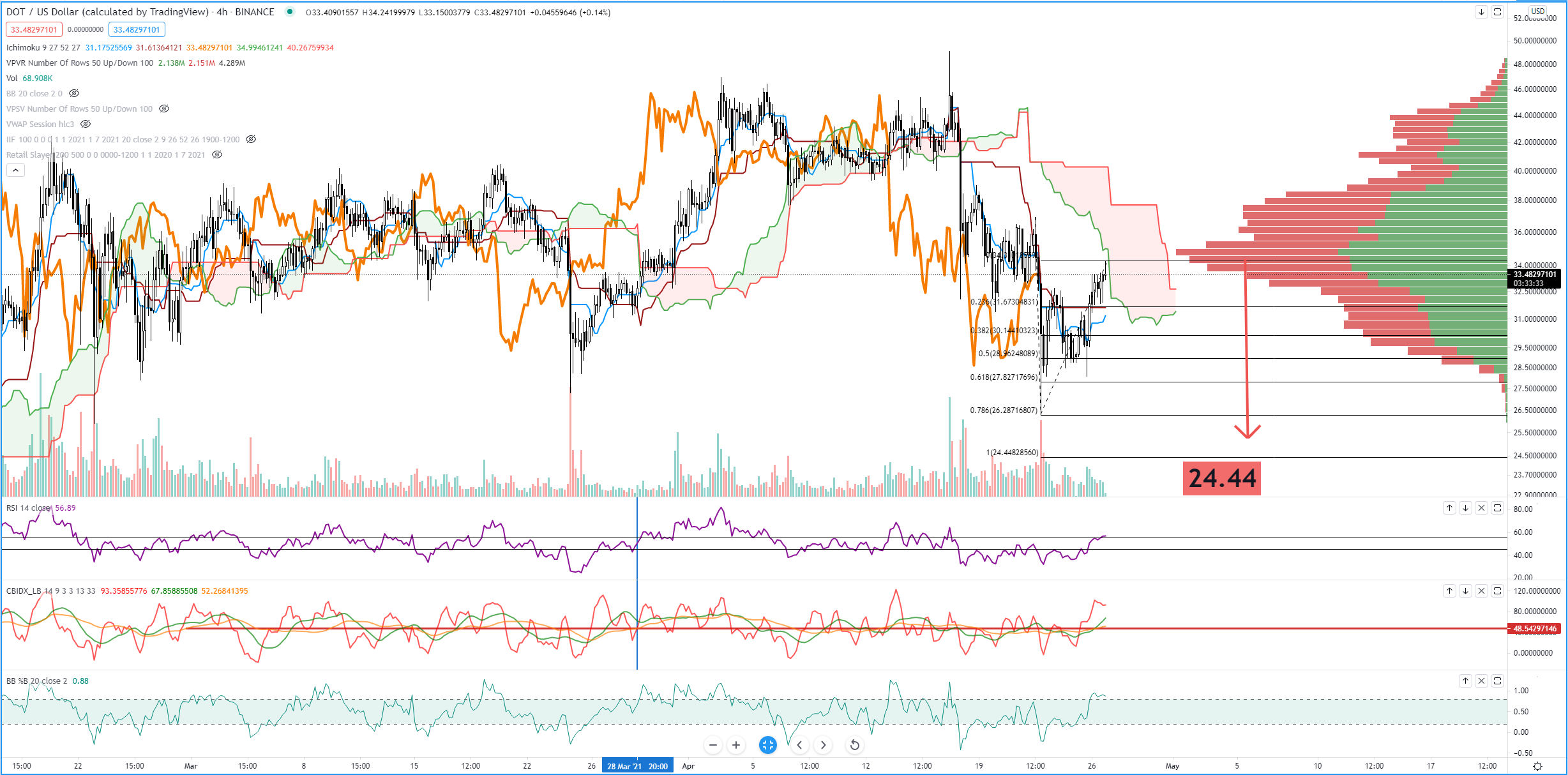

Polkadot (DOTUSD)

Above: Polkadot (DOT) 4-hour Chart

Polkadot has a very similar setup to Bitcoin. Using the 4-hour chart, we can see the same Elliot Wave structure that exists on Bitcoin’s (although a sloppy version of Elliot Wave). The 100% Fibonacci Extension on Polkadot’s chart put’s price at 24.44 – a sizeable drop from the current traded level at 33.50. One of the primary reasons why the short here at 33.50 looks like a good setup is the condition of the RSI. The RSI is at 55, which is the overbought level when an instrument is in a downtrend. We can also observe the %B to be poised for a cross below the 0.8 level. There is some clear bearish divergence between price action and the Composite Index. I’m getting some very strong signals to look at the short side of Polkadot’s price action this week.

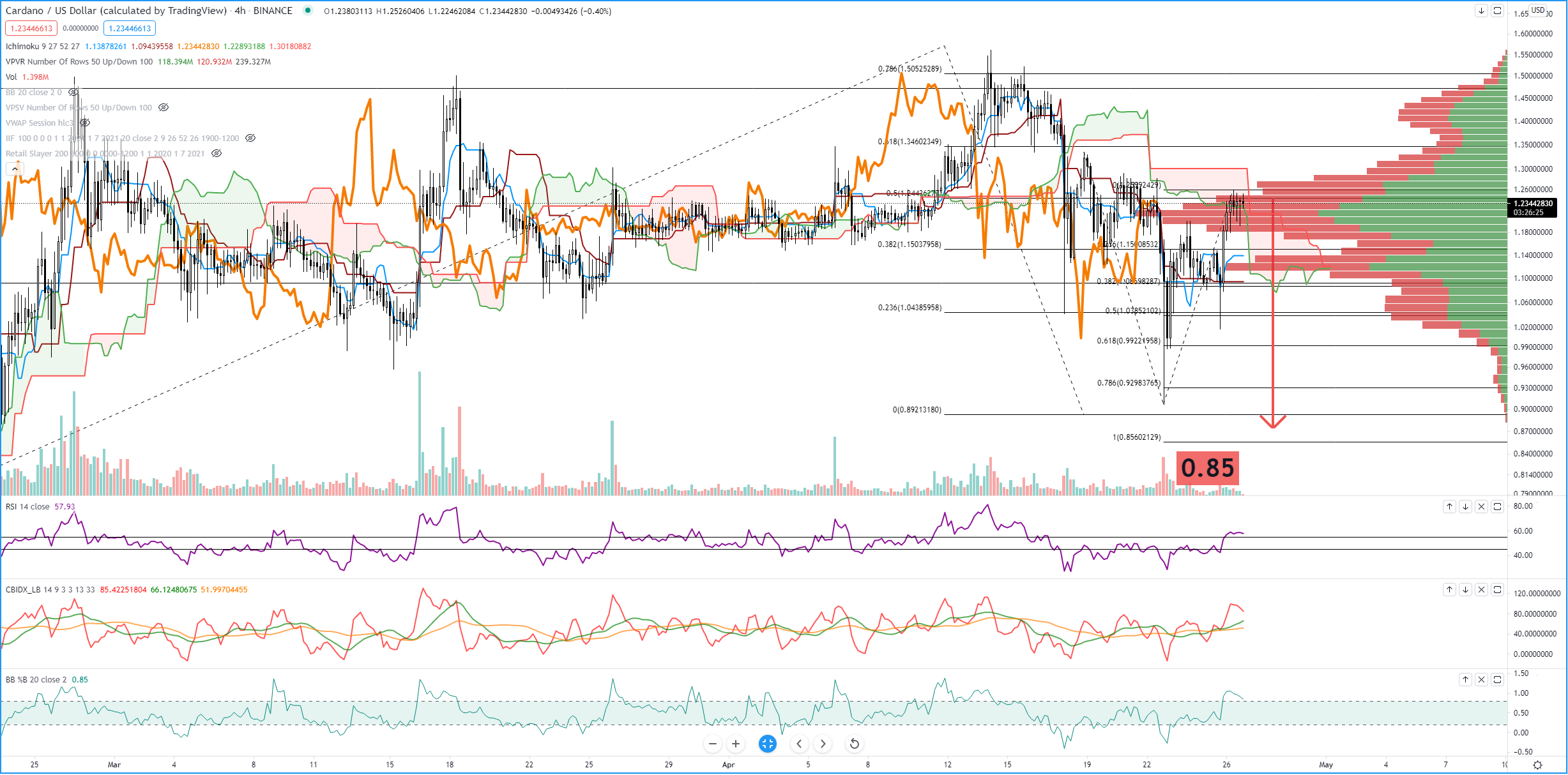

Cardano (ADA)

Above: Cardano 4-hour Chart

Cardano’s chart has the same near-term bearish setup as Bitcoin and Polkadot. For Cardano, the frustration for bulls has to be high. Cardano has spent almost 60-days inside a right consolidation range and looks like it will test lower – this is almost certainly likely if Bitcoin drops to test the 44500 levels. I like the short-term short trade for Cardano anywhere between 1.30 and 1.19 with a profit target near 0.85. The same swing structure I utilized in Bitcoin and Polkadot is used on Cardano’s chart – 0.85 is the 100% Fibonacci Extension of that swing structure. Consequently, 0.85 within the same support range that we’ve discussed over the past few weeks. I would expect a test of this level to be bought up as quickly as it was just a few days ago. Do watch for the oscillators though, because the short side of this market is likely in the cards, but the consolidation for Cardano has been extensive and any move higher could create a series of new all-time highs for Cardano.

Advertisement

Save money on your currency transfers with TorFX, voted International Money Transfer Provider of the Year 2016 – 2020. Their goal is to connect clients with ultra competitive exchange rates and a uniquely dedicated service whether they choose to trade online or over the telephone.

Find out more here.

[ad_2]