[ad_1]

Over the past 24 hours, Polkadot (DOT) has entered a tight consolidation pattern just above the $40.00 handle. The muted action comes on the heels of a swift $6 selloff on Wednesday, which sent shockwaves through the DOT market. Now, it appears that the DOT/USD has stabilized, down a modest 0.61% on the session.

During the U.S. overnight, PayPal co-founder Peter Theil decided to weigh in on Bitcoin BTC, China, and the global crypto landscape. While Theil’s words aren’t typically primary market drivers, he does put forth an interesting point of view. As a key player in PayPal, Thiel is all-too-familiar with internet-based monetary transactions. Here are his key China/crypto-oriented statements from a Thursday talk at the Nixon Seminar on Conservative Realism:

- “From China’s point of view, they want to get ― they don’t like the U.S. having this reserve currency because it gives us [the U.S.] a lot of leverage over Iranian oil supply chains and all sorts of things like that.”

- “Even though I’m sort of a pro-crypto, pro-Bitcoin maximalist person, I do wonder whether at this point Bitcoin should also be thought of as a Chinese financial weapon against the U.S.”

In short, Thiel took an ominous tone toward China’s relationship with crypto and the U.S. monetary system. So is China using BTC as a financial weapon against the U.S.? From a mining standpoint, it’s certainly possible. Experts project that about 60% of the world’s existing BTC supply came from Chinese miners with rates as high as 85% in 2018. Even though parts of China have banned crypto mining, the miners remain at work. If China was to suddenly eliminate all crypto mining, it’s difficult to forecast how the blockchain would evolve. At least for asset prices, everything from Bitcoin to Polkadot would likely be impacted.

Polkadot (DOT) Back Above $40.00

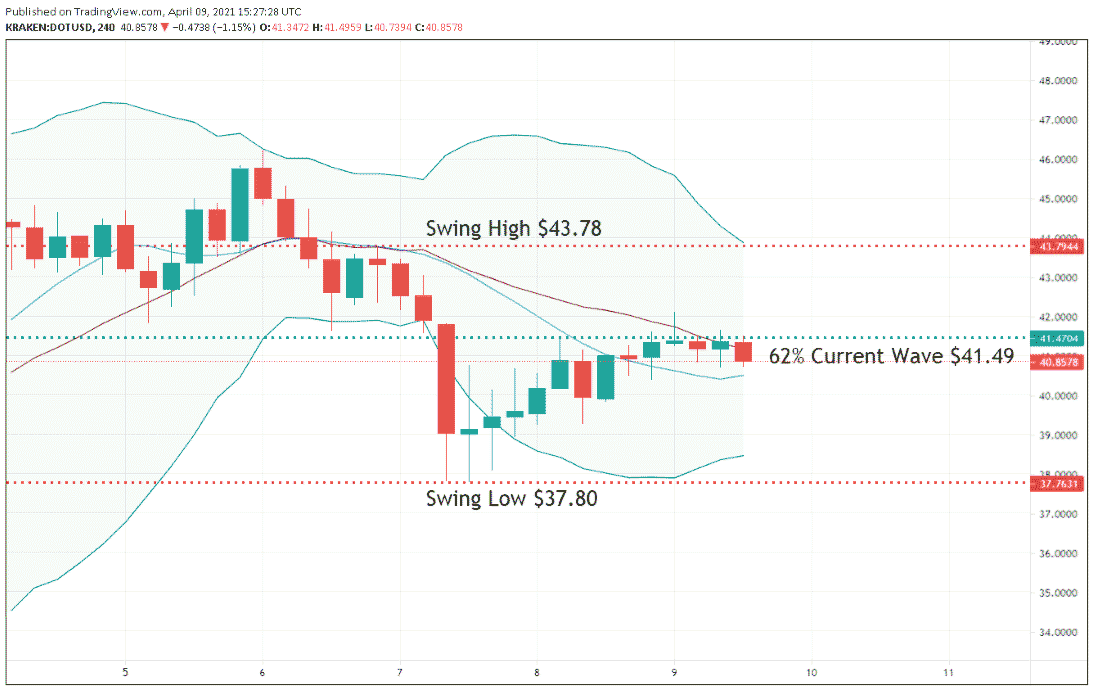

It has been an interesting week for Polkadot. Bidders and sellers have created significant 2-way action, with $40.00 becoming an area of fair value. Now, it appears that price is headed for another test of this level.

Here are the levels worth watching as we roll into next week:

- Resistance(1): 62% Current Wave, $41.49

- Support(1): Psychological Barrier, $40.00

- Support(2): Swing Low, $37.80

Bottom Line: If we see Polkadot open next week on the bear, I’ll have buy orders ready to go from $38.15. With an initial stop loss at $34.15, this trade produces $4.00 (10.5%) on a standard 1:1 risk vs reward ratio.

[ad_2]