[ad_1]

The cost to purchase one Ethereum might exceed its previous record high this week.

That is, according to Josh Rager. On Monday, the independent market analyst said that he sees ETH/USD making a run towards the $1,250-1,350 area as resistance. Meanwhile, a clear breakout move above the said range would have the pair test its January 2018 high of $1,419.96.

“The final target is $5k for me in the next year,” added Mr. Rager. “But now – the target to hit is $1,250 to $1,350 is resistance.”

What Pumped Ethereum?

Mr. Rager’s statements surfaced in the wake of Ethereum’s volatile price rally over the weekend and Monday. It surged by almost 60 percent, hitting $1,168.99 before turning lower towards $1,000 in its opening week move. Meanwhile, its market capitalization climbed to near $119 billion, making 13.68 percent of the overall cryptocurrency market valuation.

Ethereum breaks above key Fib resistance areas. Source: ETHUSD on TradingView.com

It is not clear what specifically caused the Ethereum bull run, but many analysts agreed that its gains emerged as a part of a so-called altcoin season.

ETH/USD’s upside moves matched sentiments across other top assets (except Bitcoin). For instance, Litecoin’s LTC climbed 11.50 percent on a 24-hour adjusted timeframe. Chainlink’s LINK surged 15 percent, while Cardano’s ADA and Bitcoin Cash’s BCH jumped 21 percent and 15 percent, respectively.

Meanwhile, leading cryptocurrency Bitcoin corrected by approx 9 percent after hitting its all-time high near $34,500 on Sunday. Its market capitalization also slipped from 72 percent to 68.89 percent, signaling that traders decided to sell its top to seek opportunities in the altcoin market. It benefited Ethereum.

Long-term Speculation

Ethereum also drew its bullish cues also from the anticipation of higher demand as its active supply runs dry.

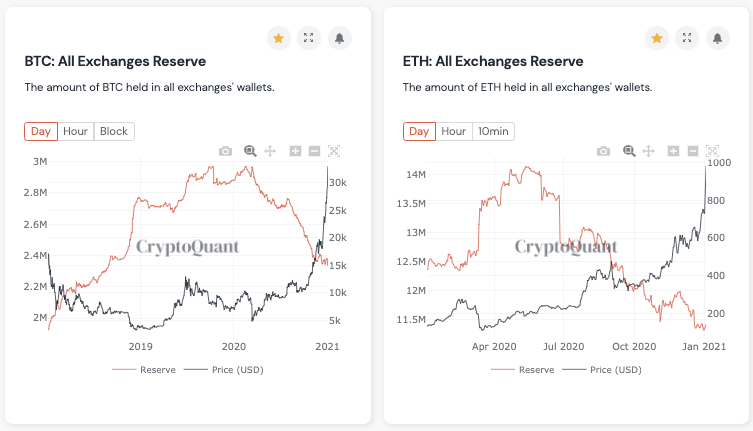

Ki-Young Ju, CEO of South Korea-based blockchain analytics platform CryptoQuant, stated that the ETH reserves across all the cryptocurrency exchanges have decreased by 20 percent since May 2020. He noted that the supply might be going into decentralized exchanges, staking contracts, and self or third-party custodial wallets.

“It seems the sell-side liquidity crunch started to hit ETH just like the BTC market,” Mr. Ju tweeted.

Ethereum All Exchanges Reserves. Source: CryptoQuant

Data fetched from EtherScan shows that Ethereum’s very-own smart contract that powers its recent upgrade to proof-of-stake has locked about 2.2 million ETH out of supply. It is equivalent to $2.33 billion at the press time.

“Almost 2 percent of ETH supply is staked on the ETH2 deposit contract. I think this illiquidity makes the ETH price goes higher in the long-term,” stated Mr. Ju.

Meanwhile, ETH locked inside DeFi pools is about 6.97 million, according to separate data provided by DeFi Pulse.

[ad_2]